Fears of new threats to emerging markets have cooled stock returns after two years of hot performance. But the concerns may be overstated. The long-term risk profile of emerging markets is continuing to improve.

Growing risks to emerging markets are making headlines. Turkey’s currency crisis, expectations of US interest-rate hikes and a stronger US dollar are seen as big threats to developing markets. US–China trade tensions have added to the anxiety. The MSCI Emerging Markets Index has dropped by 1.2% in US-dollar terms through June 13 after surging by a cumulative 52.6% in 2016 and 2017. Investors withdrew $2.7 billion from US-domiciled emerging-market (EM) equity funds in May, reversing 17 consecutive months of positive flows, according to data from Morningstar.

The panic may be premature. When viewed through a long-term lens, we think macroeconomic and market fundamentals provide solid ground for EM companies to deliver results—and for investors to prosper.

EM Volatility Has Been Declining

Headlines about EM risks are unsettling, yet they tend to obscure declining volatility in EM stock markets. In the past, EM stocks were more volatile than developed-market stocks, as investors perceived them to be much riskier. But even though US market volatility spiked this year, EM volatility has been relatively subdued (Display).

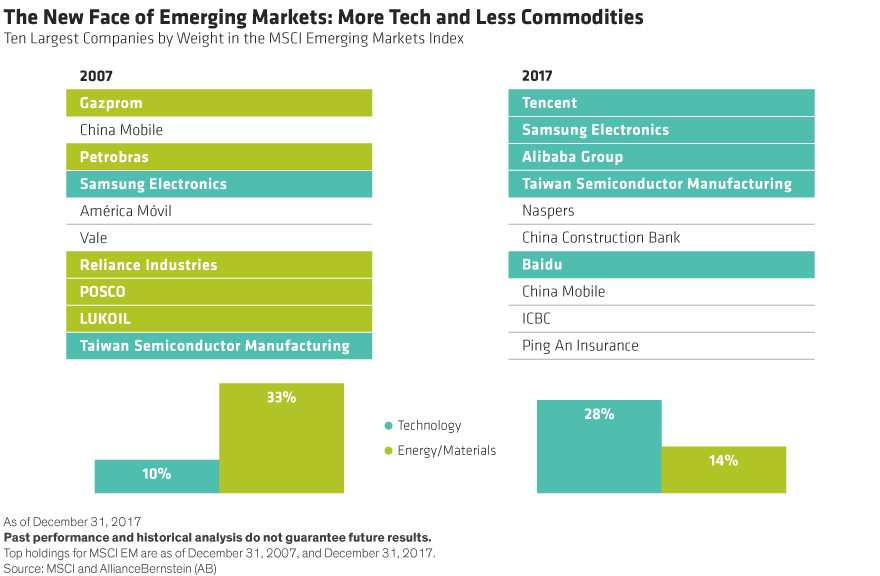

Why the change? Consider the composition of the benchmark. Over the last 10 years, the weight of highly cyclical sectors such as energy and materials in the MSCI Emerging Markets has dropped dramatically (Display). Meanwhile, technology stocks have become the largest sector weight. This change has reduced the economic sensitivity and risk profile of EM equities. Yet the MSCI Emerging Markets trades at a price/forward earnings ratio of 11.6x, a 25% discount to global developed stocks, suggesting that investors still believe developing stocks are significantly riskier.

Big Improvements to Deficits and Debt

That perception is rooted in historical experience that may be obsolete. In the past, rising US interest rates and a stronger US dollar were bad for EM assets. But we believe that emerging markets are less vulnerable to external shocks today.

Inflation is under control in many countries, which fosters low domestic interest rates. EM currencies are more competitive and external balances are much healthier (Display), with rising foreign investment and less dollar-denominated debt. As a result, rising US interest rates or a stronger dollar won’t have the same impact on EM countries and companies as in the past, in our view.

What about US–China trade tensions? Our research suggests that US tariffs on $50 billion worth of Chinese goods would affect China’s GDP growth by about 0.1%. While some export-oriented steel and industrial companies could suffer, we think the broader impact on China’s vast economy would be negligible.

China’s Banking Fears Dissipate

China’s banking system has long been seen as a tinderbox. Yet here, too, we think the risks have diminished. Over the last two years, regulators have reined in the growth of the shadow banking system and throttled credit growth toward nominal GDP growth. We believe that slower credit growth, along with government initiatives to reduce capacity in old economy sectors like steel to focus on the environment, should help improve credit quality for the industrial sector.

In addition, an increasing focus on profitable retail banking businesses could provide another boost to lenders’ return on equity. This would further buttress a sector that was seen as a potential destabilizing force for years.

Political Risk: It’s Not All About Turkey

China’s new focus on environmental issues reflects the government’s commitment to pursuing sustainability as a key component of stable long-term growth. These changes have been driven in part by President Xi Jinping’s moves to consolidate power and to marginalize factions of the communist party that may disagree with his policies. In our view, this shift indicates that political risk is declining in the world’s second-largest economy.

Beyond China, politics are a diminishing risk factor in other major EM countries such as India and Indonesia. Narendra Modi, who became India’s prime minister four years ago, has inspired investor confidence by tackling complex reforms, ranging from anticorruption moves to easing foreign investment restrictions. Indonesia’s pro-reform government is also attracting foreign investment and developing infrastructure, while maintaining flexibility to adjust near-term policies to new market challenges.

Still, political turmoil in Turkey, Argentina and Brazil has shaken confidence. We believe that these cases demonstrate that EM countries are not homogenous: Turkish stocks have tumbled 22% this year, while Chinese stocks advanced 2.2% through the end of May. Investors must be risk aware and selective by avoiding EM companies that could be adversely affected by heightened political risk in their home countries.

Lower Risk Differential, Stronger Growth Profile

Of course, there are real risks in emerging markets; it would be foolish to think otherwise. But the fact that a business is exposed to EM dynamics does not necessarily make it riskier. EM countries aren’t uniform and attractive opportunities can be found in diverse companies with business profiles that aren’t directly exposed to the risks.

What’s more, we think the risk differential between emerging and developed markets is much lower than in the past, while emerging markets still offer superior growth potential. To identify stocks with strong growth profiles and unappreciated return potential, focus on company fundamentals and block out some of the headline noise.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.