“Don’t put all your eggs in one basket,” a mantra that can apply to so many aspects of our lives. Investing is no exception. Most investors try to diversify their investments—by allocating money to several asset classes like stocks and bonds, in various geographies—the US or foreign markets, for example—or by choosing stocks in many industries. Another way is to seek investments outside the public markets. Private equity is one such place.

Investors in private equity take a stake in a company, just like public stocks. But unlike securities in the public market, private investments do not trade on an exchange, and the money invested is generally tied up for many years—it is illiquid. For some investors, the inability to exit an investment at will may not be feasible or meet their risk tolerance. For others, illiquidity can be tolerated, but only for a certain portion of their assets. How can you decide if private equity is right for you, and how much makes sense?

Seeking a Smoother Ride

To answer these questions, you may first need to answer another: Do daily gyrations of the stock market worry you? When considering this question, start with the logic of equity investing. Equities provide appealing long-term return, but investing in public equity markets requires a tolerance for volatility. Stock prices, and markets overall, tend to respond precipitously to news, whether it’s on individual company performance, or, more broadly, on macroeconomic influences. On some days, quarters, or even years, macroeconomic forces may be the only cause of market movements and have nothing to do with a company’s fundamental strengths. Geopolitical headlines, changing interest rate regimes, rising or falling inflation readings, and currency movements can mask the blemishes or the brilliance of any public company. Private investments do not react immediately to such short-term market turbulence.

A Different Way

Investing in public stocks means you own a (very) small share of a company, and for the most part, it is a passive, indirect ownership—there is very little a small investor can do to influence the operations of the company. Private equity, on the other hand, is direct ownership in a company, typically by taking a controlling position, or a significant, active minority ownership interest. Private equity owners seek to create value over time by increasing cash flow, generally from internal growth initiatives, exploring potential mergers or acquisitions, and/or through cost rationalization. They often add value to businesses by improving corporate governance, upgrading management, and assisting with strategic and operational initiatives.

The Nut and Bolts

Investors in private equity serve as active shareholders in businesses over a long-term investment horizon. This long-term focus is required because private investments have much less liquidity than a publicly listed equity or mutual fund. Progress and results are evaluated over the span of multiple years, affording business owners time to make necessary improvements to the business without being forced to meet the quarterly earnings goals that the public markets often focus on.

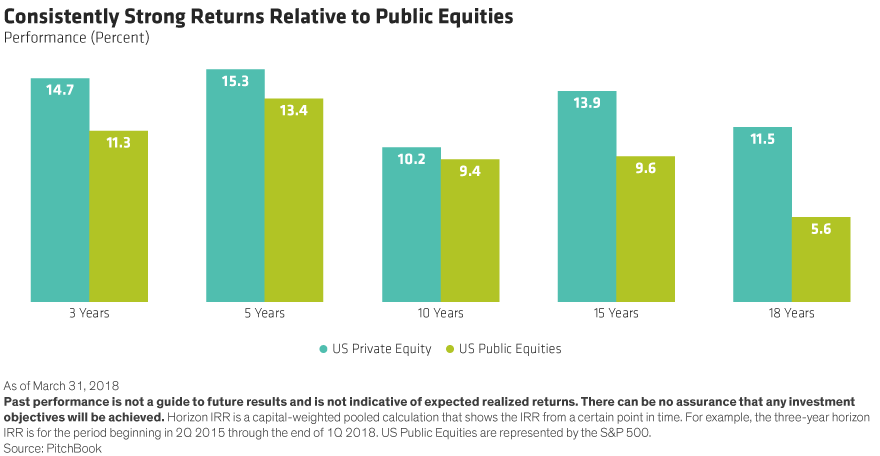

Due to these actions of owners, private equity has historically performed better than most public equity markets over the long term (Display). And there is another benefit: the pattern of returns tends to differ from that of public equities, actively diversifying public-equity performance. Further, while the number of publicly traded stocks is shrinking, a trend that started in the last few years, the number of private companies is growing.* Part of the reason for the decline is that public stocks are subject to higher and more costly compliance and regulatory scrutiny, an environment that is only getting more stringent, so many company owners prefer to manage their companies in the private markets.

What’s the End Game?

Because many companies prefer to remain outside of the public realm, some investors wonder how they make money on a private investment. The perceptions that the only way to be a successful private investor is to bring the company public, or to sell the company for more than what was originally paid, are false. The growth and maturity of the private equity market offer owners multiple options: initial public offering, sale to strategic or financial buyer, or do nothing and benefit from the growth and cash return of the company.

The Right Fit for You?

Private equity is attractive on many fronts: It offers a non-correlated return stream from public stocks, and robust long-term performance with minimal, if any, daily price fluctuations. In other words, when public equity markets rise or fall, private investments tend to continue on their path, generally unaffected by market moves. But since these investments are less liquid, generally requiring an investment horizon of 10 years, most investors can only hold a portion of their assets in private equity. That’s why an allocation typically complements a public equity allocation.

Constructing an appropriate asset allocation to achieve long-term goals depends upon each investors’ unique investment criteria—time horizon, capacity for illiquid investments given spending needs, pre-existing liquidity bias, and risk tolerance. An asset allocation that includes private equity, among other alternative investments, must account for their unique risks—illiquidity in particular—that are less relevant in public markets, with consideration for two factors. First, the allocation must never imperil the ability to spend from a portfolio, meaning the overall portfolio must have sufficient liquidity, even in the most difficult markets, to support spending, without any shortfall. Second, the target allocations must have flexibility regarding the weight of illiquid positions; drift from the initial target allocation should be expected as rebalancing a portfolio that includes illiquid investments is difficult, if not impossible.

The bottom line is that private equity is an appropriate asset class for investors looking to achieve strong returns and mitigate short-term market fluctuations, but because of its illiquid nature, any allocation to private equity should be made after consideration of the risks, and importantly, as part of a broader equity allocation, which includes public securities, to reach the investor’s long-term goals.

To understand what allocation to private investments may be right for you, stay tuned for our upcoming blog, “A Framework for Allocating to Private Equity” due on March 20.

* Source: Hoovers; US-based companies with revenues of $10M or more.

To understand what allocation to private investments may be right for you, stay tuned for our upcoming blog, “A Framework for Allocating to Illiquid Investments” due on March 20.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.