The Tax Cuts and Jobs Act of 2017 (TCJA) doubled the basic exclusion to $10 million, so after adjusting for inflation, only estates greater than $11.58 million will be subject to estate taxes in 2020. As a result, the number of taxable estate tax returns filed each year is expected to drop from about 5,200 in 2017* to just 1,900 † through 2025 when the law sunsets. This also means that less than one-tenth of 1% of decedents will be subject to federal estate tax while the law is in effect.† The $39.7 billion‡ question is: How will the significant drop in the number of taxable estates affect charitable bequests?

Will Charitable Bequests Fall to the Wayside?

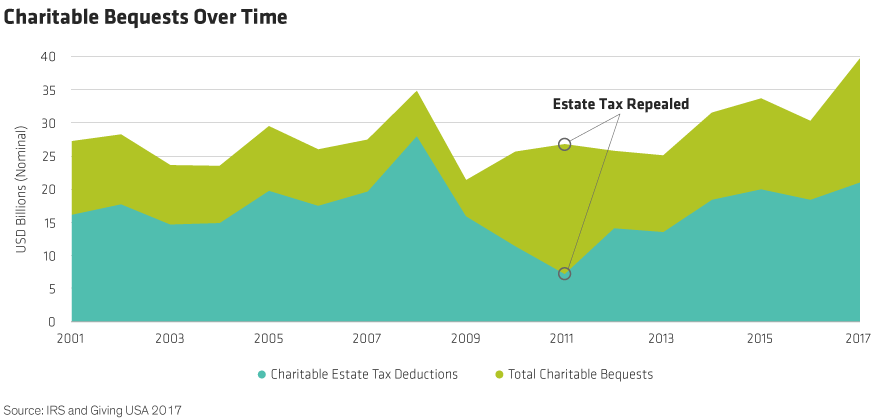

The estate tax has long encouraged charitable giving, with a dollar-for-dollar deduction that matches any amount of wealth left to charity after death. The concern for many charities is that bequests will significantly decrease as fewer estates benefit from a charitable tax deduction. However, history doesn’t necessarily support this conclusion. The estate tax has been phasing out for most Americans—in 2017, just 5,200 taxable estate tax return§ were filed, down from nearly 51,700 in 2001. Interestingly, during this same period, charitable bequests remained relatively stable. In fact, the estate tax was even briefly repealed in 2010, and despite the significant decrease in estate tax charitable deductions claimed during this period, there was no corresponding reduction in total charitable bequests (Display). In other words, donors continued to leave wealth to charity even though there was no tax incentive. Since the repeal was extremely short-lived, it’s possible there just wasn’t enough time for estate plans to be amended prior to death, but the overall historical data trend is certainly encouraging for nonprofits. However, given how few estates will likely benefit from an estate tax charitable deduction, is there a way to structure bequests to provide a tax advantage?

Three Ways to Restructure Bequests

For estates that are no longer taxable, there are three avenues donors can explore to maximize their charitable impact: Accelerate bequests into lifetime gifts, restructure bequests to consists primarily of income in respect of a decedent (IRD) such as retirement accounts, and restructure bequests to be income-based (Display). We discuss each below.

Accelerate into a lifetime gift: Gifts made during life can provide a charitable income-tax deduction whereas a traditional charitable bequest provides none. For example, if a donor decides to give a cash gift of $100,000 during his/her life instead of leaving a traditional bequest, the effective cost of that lifetime gift could be reduced to just $63,000 after the federal income-tax deduction||. And if instead of cash, the gift was made in the form of appreciated stock, the effective cost would be even lower as capital gains tax would also be avoided.

However, this only works if the donor itemizes deductions. One way to overcome not qualifying for itemization is to “bunch” gifts. Instead of making small gifts each year, the donor combines a few years’ worth of giving into one single year. This strategy can lower the effective cost of gifts by maximizing tax savings from the charitable income-tax deduction.

Additionally, donors can that are 70½ or older, can transfer up to $100,000, tax free, each year from an IRA to qualified charities. This Qualified Charitable Distribution (QCD) must go directly from the custodian of the IRA to the charitable organization to be tax-free transaction. In other words, the donor cannot take a distribution, then turn around and make a gift to charity. The QCD also counts towards the required minimum distribution.

Restructure bequests to consist primarily of income in respect of a decedent (IRD): Income in respect of a decedent, such as qualified retirement accounts and appreciation in non-qualified annuities, is untaxed income a decedent had earned or had a right to receive during his or her lifetime. When an estate or beneficiary receives IRD, it is taxed as ordinary income. Additionally, IRD assets do not receive a cost basis adjustment or “step-up” like most other assets received from a decedent. These two features make retirement plans and appreciated non-qualified annuities some of the most desirable assets to leave to charity. This is because IRD is taxed to the person who is legally entitled to receive it. So, if a charity is named as the beneficiary of a retirement plan account or a nonqualified annuity, then it can receive the entire value of the account unreduced by income taxes. This can be accomplished by naming a charity on a beneficiary designation form or leaving instructions in a will or trust document to distribute assets in-kind and require charitable bequests be made first with IRD assets.

Restructure from traditional to income-based bequests: Charitable bequests are traditionally viewed as providing an estate tax deduction and not an income-tax deduction. In reality, a traditional bequest represents a lost income tax savings opportunity. This is because bequests are traditionally made from corpus instead of income. But in order to receive a charitable income-tax deduction for a trust or estate, the distribution must be traceable to income, so a bequest from the corpus will not qualify. To overcome this problem, traditional charitable bequests could be structured as income-based by moving it to the income section of the governing document of the trust or estate. For example, the governing document could be drafted to require all income up to a specified amount be distributed to charity.

Maximizing Impact

Philanthropic plans for estates that are no longer taxable need to be restructured to maximize charitable impact. The most effective strategy for many will be to accelerate philanthropy into lifetime gifts. But for some, lifetime gifts may not be practical or fully satisfy one’s philanthropic objective. In these cases, consider restructuring to an income-based bequest and requiring it come first from IRD.

*Source: IRS, Statistics of Income Division, Estate Tax Returns Study, October 2018.

†Source: Tax Policy Center Briefing Book.

‡Giving by bequest totaled an estimated $39.71 billion in 2018, remaining flat with a 0.0% increase from 2017 (a 2.3% decline, adjusted for inflation). Source: Giving USA 2019

§Source: IRS, Statistics of Income Division, October 2007

||State income taxes may lower the effective cost further.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.