European banks are up against it. Profits are under pressure, and disruptive technology is a huge challenge. But for banks’ bondholders it’s still summer—and will be for a while, we think.

Since the global financial crisis (GFC), European banks have addressed one big challenge by rebuilding their balance sheets and reducing their bad debts. Now they face an even tougher struggle as they strive to lift profitability in the face of low rates, a weak euro-area economy and a flat yield curve. Despite this wintry background, skilful equity investors can still find winners, but we believe that bond investors can enjoy the best balance between risk and reward—particularly in selected subordinated bonds.

A Tangled Profitability Problem

Traditionally, banks have been able to offset profitability pressures by trimming costs, but this time that’s not so easy. Most banks are under pressure to continue spending heavily—particularly on digitalization. That’s because harnessing digital technology is key to both reducing costs and enhancing the customer experience.

Banks also need to raise their game to address another related problem—the threat from new tech entrants and challenger banks. To make life even tougher, European Union regulation has created the second Payment Services Directive (PDS2) which requires banks to open their payments infrastructure and customer data to competitors. That’s a chilling prospect for the banks, as their potential rivals include Google, Apple, Facebook and Amazon. So cost management, revenue growth and technology have become intricately interrelated issues for bank profitability.

The Sun Is Still Shining for Bondholders

But not to worry. In our view this doom and gloom is more an equity market story, at least in the short to medium term, where investors are more focused on profitability, or lack thereof. For bond investors, this is less of an issue. In their case, so long as the Profit & Loss numbers remain in the black and are sufficient to cover muted volume growth, then the all-important equity capital base of a bank shouldn’t be depleted (much).

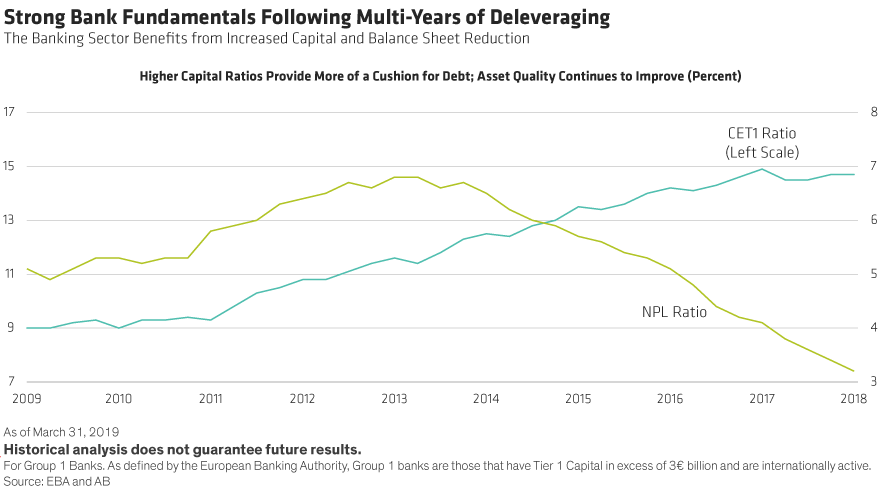

Equity capital is one of the key considerations for bond investors in banks. When all is said and done, it is the equity capital that provides a buffer between them and a potential loss. European banks have spent the best part of a decade since the GFC building these equity bases, and at the same time de-risking balance sheets. In fact, aggressive stress testing by regulators shows that most would be able to absorb significant stress and survive intact.

Threats to Bondholders Overestimated

With low rates and low unemployment, and barring any significant shock to the system, we expect asset quality to remain benign in the short to medium term. Many banks are coming under pressure from shareholders to return what they deem to be “excess” capital above minimum requirements. But we expect regulators to keep well on top of this trend and insist that banks run with decent buffers above these minimum requirements.

There are also concerns about the potential “Japanification” of the system, with its prospect of potentially chronic low growth and weak profits. But from a bondholders’ point of view this isn’t necessarily a bad thing; yes, revenue growth remains subdued, but if banks maintain strong balance sheets and don’t overstretch risk appetite, they could trundle on for years.

Can Management Deal-Making Screw Up?

Still, in this environment, banks’ management may be tempted by merger and acquisition (M&A) activity as a short cut to lower costs and higher profits. But for all the management consultancy hype around potential revenue growth, initial favourable projections often come to nothing once implementation costs and structural impediments are considered. (A case in point is the recent breakdown in M&A talks between Deutsche Bank and Commerzbank.) There will undoubtedly be some M&A as strong banks snap up smaller foreign fry, but a large-scale cross-border deal remains a pipe dream, in our view.

Sorting Winners from Losers

For both equity and bond investors, the key to earning robust income returns from this sector is to focus on banks with strong domestic retail/commercial banking franchises, a record of good risk management, leading digitalization and/or geographical diversification. But in terms of the balance of risk and reward, bondholders have the advantage, in our view. In particular, selected investments in AT1s look attractive, as they may provide equity-like returns with lower volatility. Despite the wintry forecasts for the sector, we could see a prolonged Indian summer for bondholders in the current bank credit cycle.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.