European bond-market performance was among the worst on record in 2022, as Europe ran the gamut of geopolitical, economic and market storms. While problems persist and we expect further periods of volatility, we believe the worst impact on markets is past and that investors will find opportunities in 2023—particularly in investment-grade and select high-yield credit.

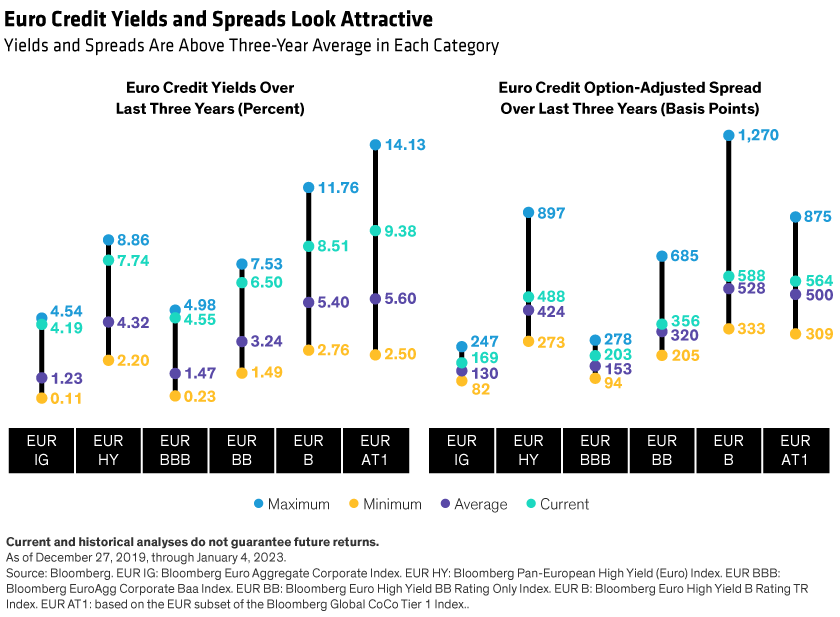

With a lot of bad news already priced into credit markets, yields look compelling to us at current levels. Starting yields have historically been reliable indicators of future credit returns over a three- to five-year horizon. On that basis, yields1 of 4.3% for euro-denominated investment-grade credit and 7.8% for high yield offer attractive risk-adjusted potential returns.

Outlook for European Corporates Brighter than Feared

European economies are entering a tough period in 2023. But we don’t think Europe faces an environment as bad as during the global financial crisis. Developments in recent months have been better than expected. An aggressive effort to rebuild natural gas stockpiles and a warm start to the winter season have limited the risk of energy rationing, reducing the probability of a severe economic downturn.

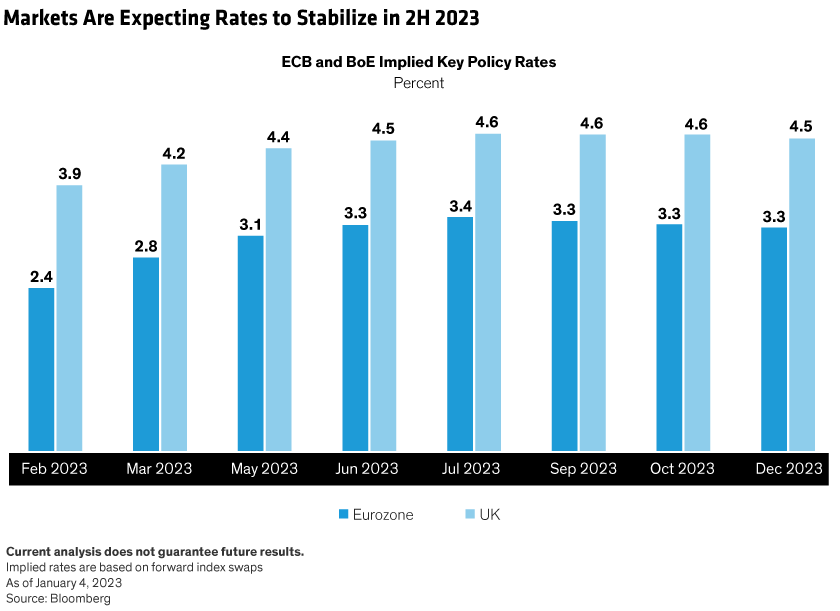

Accordingly, we anticipate a shallow recession with rates plateauing towards the end of the year. While that scenario may be somewhat challenging for equity investors, we think that debt issued by high quality companies should do well.

Euro-denominated credit has entered the current tough period in good fundamental shape, making it resilient to future storms. Corporate margins and leverage have recovered from the COVID emergency period and returned to long-term average levels, and earnings and cash flows should remain adequate to protect bondholder payouts.

Across both investment grade and high yield, credit spreads are above average and absolute total yields look attractive. We may see some further spread widening in credit markets as economies slow, but current yield levels provide a substantial buffer against near-term losses (Display, below).

Meanwhile, we prefer the higher quality segments of the euro credit markets, as these offer the best protection against business downturns. Specifically, we favor the BBB- and BB-rated parts of the markets, and we like select high-yield areas such as subordinated bank credit. European banks’ balance sheets are strong after a decade of tougher regulation, banks benefit from rising rates, and their subordinated debt (mostly Additional Tier 1 bonds, or AT1s) looks cheap. By contrast we look to avoid riskier corporate credits—particularly in cyclical industries, where spreads may widen most—and lower-rated securitized bonds. The latter held up well in 2022 and are exposed to the risk of a hard economic landing that could weaken the housing market and hurt consumer balance sheets.

Interest Rates to Peak in 2023

While both the European Central Bank (ECB) and Bank of England (BoE) are committed to further increases, we believe the period of aggressive interest-rate hikes and related shocks for investors is likely over and that rates will peak at around 3.0%–3.5% in the eurozone and 4.5%–5.0% in the UK (Display, below).

Slowing inflation and more stable monetary policy should reduce interest-rate volatility, and lower volatility typically favors higher-yielding assets. It is likely that the ride will remain bumpy at least for the first few months of the year, but the overall outlook for markets has improved significantly in the last few months, and we expect that trend to hold for 2023 as a whole.

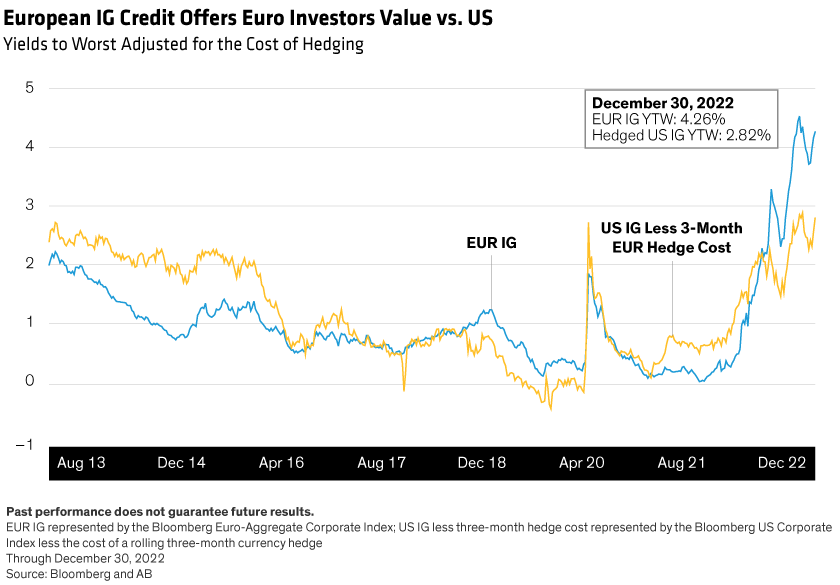

Cost of Hedging Is an Important Factor

The high cost of hedging US dollars into euros—now 2.5% versus just 0.8% at the beginning of last year—will probably again keep euro investors at home (Display, below).

Conversely, euro markets may offer attractive opportunities for US-dollar investors on a currency-hedged basis, since negative hedging costs for US investors will enhance euro yields. We think euro-denominated investment-grade credits have particularly strong fundamentals and offer a compelling diversification opportunity for US investors.

Balanced Portfolios May Make for Better Risk-Adjusted Returns

We have long advocated an approach that dynamically manages a portfolio’s exposure to interest-rate and credit risk. Such an approach can combine sovereign and other higher-rated debt with noninvestment-grade credits in a single, risk-managed portfolio with a view to improving risk-adjusted returns.

That combination looks particularly valuable as we enter a potentially choppy 2023. Both UK and euro-area government and investment-grade bonds are starting the year with significantly higher yields than in recent history, providing greater upside potential in future risk-off periods. And higher-yielding credit can contribute relatively high returns when markets are stable.

We think that this type of balanced portfolio approach can capture most of the potential return provided by high-yield markets, but typically with smaller drawdowns than a dedicated high-yield portfolio. It can also help provide liquidity in times of market stress. By adopting this risk-mitigating approach, investors can readily rebalance from higher-priced investment-grade securities into high-yield credits when attractive entry points arise.

We expect that the complexity and variety of European markets will provide further opportunities for active investors in 2023. The euro area remains at the forefront of environmental, social and governance investing, and we see further prospects to add value through skillful security selection based on rigorous analysis of green and other ESG-labeled bond issues.

A dynamic approach will remain key, as gains and setbacks may reverse quickly in a volatile environment. And the ability to invest tactically has the potential to add further value in a very diverse region. After the setbacks of 2022, we think investors—and yields—are starting 2023 in a more promising place, and we are optimistic that risk-aware positioning in European credit will be rewarded in the coming months.

Vivek Bommi is Head of European Fixed Income and Director of European Global Credit at AllianceBernstein (AB).

1 As measured by yield to worst. All data shown are as of December 30, 2022.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.