In a volatile world, it often feels like companies are subject to forces beyond their control. Finding companies that can steer their own course is a good way to capture resilient growth through changing market conditions.

Not all companies are equally vulnerable to unpredictable market forces. Some exercise a much greater degree of control over their fate by virtue of having fundamentally sounder businesses based on stronger people, better products, superior operating execution and more responsible financial behavior. Searching for companies that command their destinies is one of several ways that active investors can capture excess returns over long time horizons.

Balance Sheets Matter

Balance-sheet health—and low earnings volatility—is a great indicator of resilience. Investors should always scrutinize a company’s balance sheet, but in times of stress, this is even more important. Companies with less debt to service will pay less of a penalty in their financing costs when interest rates rise. Low debt ratios are also good indicators of a company’s flexibility to execute its strategy without relying on banks or credit markets. And businesses that can generate the cash they need to fund and invest in their operations are less beholden to the demands of externally sourced capital, and less vulnerable to a potential tightening of credit markets.

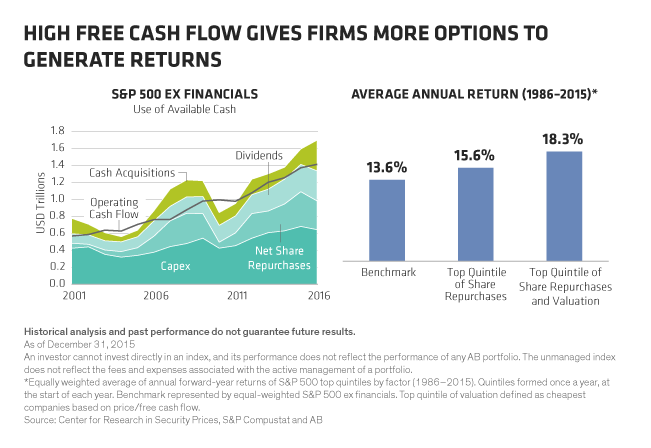

Solid balance sheets and sustainable sources of growth are a winning combination. Companies with both are much better equipped to reward shareholders by increasing their dividends or buying back shares—even in tough market conditions. Companies in the top quintile of share repurchases—especially those with attractive valuations—have outperformed the market historically (Display).

Focus on Pricing Power

Pricing power is another indicator of a company’s ability to deliver sustainable growth. With China and emerging markets slowing down, and with anemic recoveries in countries from the US to Europe, it’s difficult to find sources of new demand. And with inflation stuck at very low levels, it’s not easy for companies to raise prices. So companies that demonstrate pricing power in their industries are better positioned to improve their earnings than are their competitors that lack it.

We think there are three keys to pricing power: innovation, com¬petition, and cost and inflation dynamics. Innovative products and services are capable of commanding higher prices even in a tough economy and amid low inflation. For example, Apple commands premium prices for its smartphones because of its innovative features and an ecosystem that allows all the company’s devices to work together seamlessly.

A highly competitive environment makes it much more difficult for companies to raise prices. And in a low-inflation world, cost dynamics are crucial. Given this reality, we believe that companies with strong market positions and relatively fixed cost businesses are better placed to increase revenues while leveraging costs. For example, Visa and MasterCard are the two largest global card networks. As such, they have had the ability to modestly increase prices over time, while competitors have seen price erosion. And the nature of their networks means that additional transactions or volumes are highly profitable from an incremental margin perspective.

Understanding these dynamics can help underpin an investing plan for an unpredictable world. Investors in passive equity portfolios may be more exposed to capricious market forces because they will hold many benchmark stocks that are more vulnerable to instability. In contrast, in our view, active equity managers can target companies with clear advantages in confronting erratic headwinds—and controlling their destinies—which can lead to resilient long-term returns.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.