With negative interest rates unlikely to ignite global growth, the debate will soon shift to expansionary fiscal policy. Investors should consider how a potential inflation recovery could impact their portfolios.

In the aftermath of the global financial crisis, central banks have boosted liquidity, which has helped markets return to normal and supported asset prices. But end demand hasn’t fully recovered yet, and nominal economic growth is still subdued. As a result, investors are losing confidence in monetary policy as a tool to stimulate growth. We see this as a key source of potential downside for risk assets.

A closer look at three key transmission mechanisms sheds light on why quantitative easing (QE) has become less effective over time:

QE encourages risk taking. By reducing the supply of financial assets, QE was expected to lower the risk premium investors demanded. But current estimates of the 10-year US Treasury term premium are now negative. That’s a 50-year low, and it suggests there’s limited potential for further declines.va

Meanwhile, equity valuations have risen above their historical averages and housing prices have regained their pre-crisis highs in most regions. Sure, valuations could expand further, but upside potential appears more limited, and further gains could trigger concerns about asset-price bubbles.

Wealth effects haven’t led to more spending. Higher asset valuations have helped reduce household leverage, but households have been reluctant to spend more—despite growing wages and cheap energy. One likely reason: rising asset prices mostly benefit higher-net-worth households, which tend to save more.

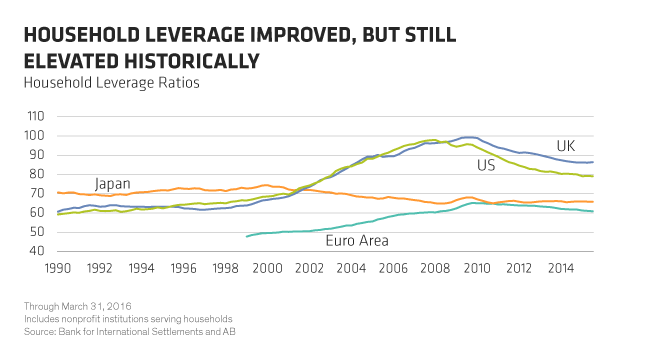

And even though households have reduced their leverage from post-crisis highs (Display 1), it’s still higher compared to history. Corporations have reacted to tepid end demand by returning cash to shareholders, instead of exploiting higher stock prices and low rates to fund investment.

Currency depreciation is less likely to continue. As currencies have weakened in response to lower interest rates, they’ve been very effective at driving corporate profit margins and equity returns across regions. But if QE becomes less effective at pushing down long-term interest rates, it will also likely be less effective at driving currencies.

Supportive Environment for Fiscal Stimulus

The deleveraging cycle appears likely to last if consumer and business sentiment don’t improve. We think governments can break this cycle, even though they’re highly leveraged, too. Central-bank asset-purchase programs are in place, so governments could finance spending initiatives by expanding the money supply. And given low rates, the interest-expense burden should be fairly small.

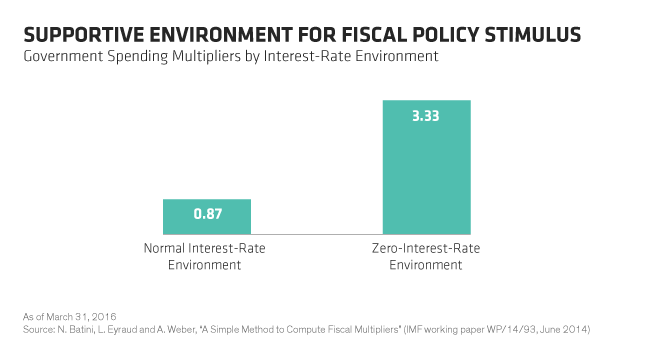

In general, it’s hard to gauge how effective fiscal stimulus can be. Academic studies estimate that fiscal spending multipliers on GDP average less than one in a normal interest-rate environment. In other words, for every fiscal dollar spent, GDP gets a boost of less than a dollar. But recent research suggests multipliers may be much higher today.

When growth is strong and there’s no slack in the economy, public spending raises inflation and interest rates, crowding out private spending. But when output is below potential, like today, and there’s spare economic capacity, increased public spending can have a more direct impact on real economic growth, with a much larger fiscal multiplier (Display 2).

Also, when monetary policy is constrained by zero interest rates, fiscal stimulus raises inflation expectations, causing real interest rates to decline. This decline raises overall demand substantially, which further heightens inflation expectations and depresses real interest rates. This process can help break the deflationary dynamics of zero interest rates.

US growth has been strengthening and core inflation has been accelerating, but the settings in Europe and Japan point to the potential for fiscal stimulus to be more effective than normal.

Underinvestment Has Created Fiscal Spending Targets

Infrastructure spending could be a prime target for that fiscal stimulus, because many developed economies have arguably underinvested in this area.

A McKinsey study estimates that in the US and some European countries, spending would need to increase by 0.5%–1% to meet infrastructure needs. Fiscal spending directed towards the right infrastructure projects may have a positive structural impact on growth in addition to cyclical benefits.

In Japan, given the country’s elevated infrastructure spending, measures to improve consumption (such as the postponement of the consumption tax), labor-force participation (such as elder care and child care), wages and capital spending (including corporate tax incentives) may be more appropriate.

Up Next: Helicopter Money?

We expect the risk-on, risk-off environment to last for a while—investors and policymakers still don’t have a coherent framework for stimulating economic growth. Monetary policy, including negative interest rates, has failed to bring sustainable growth.

We expect to see more discussion of the potential for helicopter money (central banks printing money and funneling it to consumers to stoke demand), or simply tighter integration of monetary and fiscal policy. If this is done in scale, it would likely recharge inflation.

But there are political hurdles in large-scale fiscal stimulus, so we expect these initiatives to be delayed until 2017–2018. And they’ll be implemented only if there’s more evidence that monetary policy is becoming less effective.

Long-Term Investors: Check Your Portfolio’s Inflation Sensitivity

Still, investors with long-term horizons (three to 10 years or longer) have some things to think about—if they’re willing and able to tolerate short-term volatility.

We think it makes sense to consider increasing portfolio tilts toward assets that would benefit from an environment of reflation—in other words, inflation recovering to normal trend levels. This means potentially increasing their portfolios’ inflation sensitivity—also known as the inflation beta. Some ideas would be allocating to real assets, such as commodities, and emerging-market-related assets in equity, credit and currency. Value equities in Europe and Japan would be other ideas to consider.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.