The euro area faces another challenging year, but we see a continuation of recent soft growth as much more likely than recession. The European Central Bank (ECB) is, nonetheless, now likely to delay its first rate hike to 2020, and could also implement fresh credit-easing measures.

Euro-area growth has slowed sharply in recent months, aggravated by one-off factors, which are now starting to fade. Nonetheless, survey data continue to deteriorate, hinting at more persistent weakness. In Germany, for instance, the expectations component of the Ifo Institute for Economic Research business-climate indicator fell by eight points between September and January. Since 1990, there have been only two faster declines: in 2008 (the global financial crisis) and in 1992 (the European Exchange Rate Mechanism crisis).

Why Has Growth Slowed So Abruptly?

At its January press conference, the ECB placed a heavy emphasis on rising uncertainty—trade tension and the threat of a no-deal Brexit. While the ECB’s points are certainly true, we identify three specific factors for the rapid deterioration in euro-area growth.

First, the region is more exposed to fluctuations in external demand than other large economies—its Achilles’ heel when export growth slows. Second, consumption has also slowed, from an average 1.7% in 2017 to just 1.0% in the third quarter of 2018, largely because of higher inflation and a higher savings rate. And third, rising populism has led indirectly to greater uncertainty (rising trade tension and Brexit) and directly to tighter credit conditions in Italy.

Five Factors that We Think Make Recession Unlikely

Although the outlook now is materially weaker than expected several months ago, it’s important to maintain a sense of perspective about how far growth could slow. When we look more closely at the underpinnings of the economy, we see five factors that make recession unlikely in 2019:

1) Aggressive China policy stimulus. The recent actions of Chinese policymakers have significantly reduced the country’s downside growth risks. There’s likely to be a lag between policy action and impact, but we expect this stimulus to show up in stronger support for global trade growth by the summer. And the euro area is particularly sensitive to the ups, as well as the downs, of the global trade cycle.

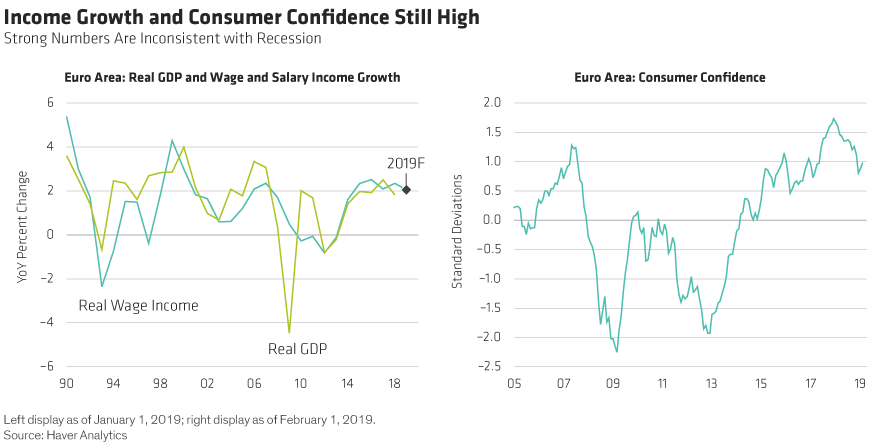

2) Strong gains in real income. Although consumption growth has slowed in recent quarters, real income growth remains strong, and that’s likely to continue over the coming year (Display, left). Moreover, consumer confidence remains relatively high and has actually risen slightly so far this year (Display, right). Barring a major shock, it would be highly unusual for the euro area to fall into recession under these circumstances.

3) Resilience in capital spending. Although there’s more uncertainty around now, capital spending has remained strong. And while the decline in the German Ifo survey warrants some caution, other forward-looking indicators—such as the demand for loans in the ECB’s bank lending survey and France’s industrial investment survey (Display)—are not at all consistent with a sharp slowdown in capital-spending growth.

4) Fiscal policy is likely to come to the rescue. Having been broadly neutral over the last year, fiscal policy is likely to turn expansionary this year in all of Germany, France, Italy and Spain. For the euro area as a whole, we estimate that the stimulus should be equal to roughly 0.5% of GDP this year: hardly a game-changer, but another factor that should help reduce the risk of recession.

5) Monetary policy is still very accommodative. The ECB’s quantitative easing program is now over, but monetary conditions remain highly favorable: both nominal bond yields and the euro have actually fallen slightly since December. Also, recent comments from ECB council members suggest that the central bank is ready to respond to the softer outlook by extending its forward guidance (to push the timing of the first rate hike back into 2020, thus anchoring the yield curve and borrowing costs for even longer). The chances of another targeted longer-term refinancing operation are also starting to rise.

In light of these supportive factors, we caution against extrapolating the recent weakness of euro-area data out to the scenario of a full-blown recession. That said, unless we see a sharp improvement in the global trade cycle, it’s difficult to see what could kick the euro area out of its current low-growth rut—the modest policy easing we’ve discussed certainly won’t do the trick. And until we can identify this catalyst, monetary tightening in the euro area is likely to be pushed further back on the horizon.

Darren Williams is Director of Global Economic Research

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.