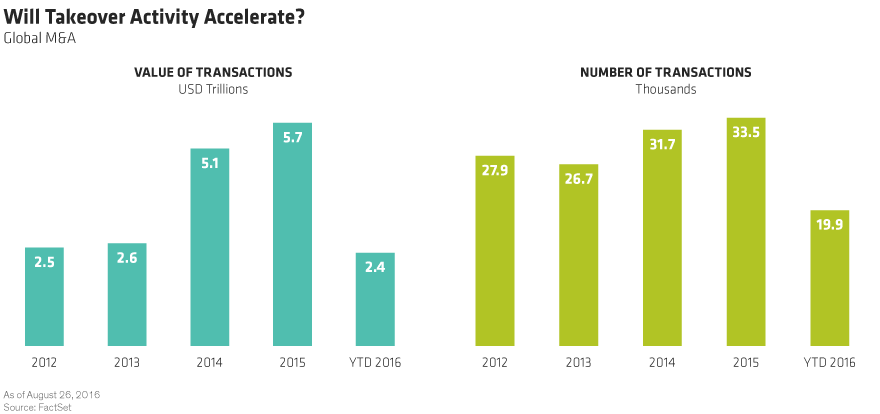

It’s been a relatively quiet year for global M&A so far, despite a couple of mega deals. But we think several trends are unfolding that could spark an increase in dealmaking during the coming months.

There have been a few eye-watering takeovers this year, such as Anheuser Busch InBev’s £79 billion bid for SABMiller. This year, the volume of M&A deals globally has reached US$2.4 trillion, according to FactSet data. At this pace, the annual scale of takeovers will most likely fall short of the last two years.

Unfolding Trends

However, we believe that many CEOs across regions and industries are compelled to consider deals today amid shifting currency dynamics and challenges to boosting earnings. In our view, investors hunting for returns should keep an eye on the following five trends, which could support a pickup in activity:

-

Cheap finance—with interest rates at record lows, companies can easily find leverage to launch a takeover. We think European groups are particularly well placed because they can issue paper in the market with confidence that the European Central Bank will buy it.

-

Low growth—moderate economic growth globally and sluggish earnings growth in many regions could provide an impetus for acquisitions. Companies realize that if they can’t build revenue growth, they just might be able to buy it instead.

-

UK on sale—the slumping pound is more than an export booster. After the Brexit vote, acquirers are well aware that they can find quality British businesses at bargain prices. In July, the volume of UK takeovers accounted for 27% of global deals, according to FactSet. Less than a month after the Brexit vote, SoftBank of Japan agreed to buy ARM Holdings of the UK for £24.3 billion.

-

Japan is buying—the SoftBank bid also illustrates the influence of relative currency movements on M&A. With the yen having risen this year by about 17% versus the US dollar and about 14% versus the euro, target companies are relatively cheap for Japanese buyers. And as the Japanese economy remains stuck, companies are compelled to purchase growth abroad.

-

Chinese champions—Chinese buyers are everywhere, looking to expand abroad and build world-class businesses as domestic economic growth remains stagnant and sources of finance are abundant. Prominent deals include China National Chemical’s US$43 billion pending acquisition of Syngenta of Switzerland, and Dalian Wanda Group’s proposed £921 million bid for Odeon & UCI Cinemas of the UK.

Equity Return Bonus

For equity investors, the usual caveats apply. When assessing a pending deal, it’s important to make sure the buyer really understands how M&A works and is committed to investing in the business to grow. Execution is critical, as countless deals end up destroying value because integration proves much more complicated than expected.

In selecting stocks for an equity portfolio, we would be wary of building an investment case just on a potential acquisition. However, if a company has a dominant franchise in an industry with high barriers to entry, strong management and clear drivers of volume growth, gauging the likelihood of a takeover can help underpin conviction in its stock—and provide a potential bonus to returns.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.