The United Nations Sustainable Development Goals (UN SDGs) offer a good guide for investing in companies making a positive impact on society. But where do you begin? Start by drilling deeply into the SDGs themselves to identify investible themes.

There are many ways to create a sustainable portfolio. Some investors choose to simply exclude shares of companies that do harm, from weapons producers to tobacco manufacturers. We prefer a proactive approach, targeting companies that do good for society and the environment while also offering strong return potential.

The UN SDGs can help investors pursue such an agenda. With 17 goals and 169 specific targets, the SDGs are an ambitious program—with a massive scope. They address areas of critical importance to humanity, including eliminating poverty and hunger, improving access to education and healthcare, and addressing the negative impact of climate change. Signed by 193 nations, the SDGs attempt to build on the earlier Millennium Development Goals by broadening the focus beyond developing markets and explicitly considering a role for the private sector. These important changes make the SDGs a more useful tool for equity investors.

It would be impractical for an investor to try to focus equally on all 17 goals, because the investing opportunities for the private sector aren’t spread equally across the SDGs. Instead, we believe the best way to use the SDGs is to identify those that offer the best investible opportunities and to target those specific areas. This thematic approach also allows an investor to develop expertise that can support effective allocation of capital.

Unlocking Investment Potential of UN SDGs

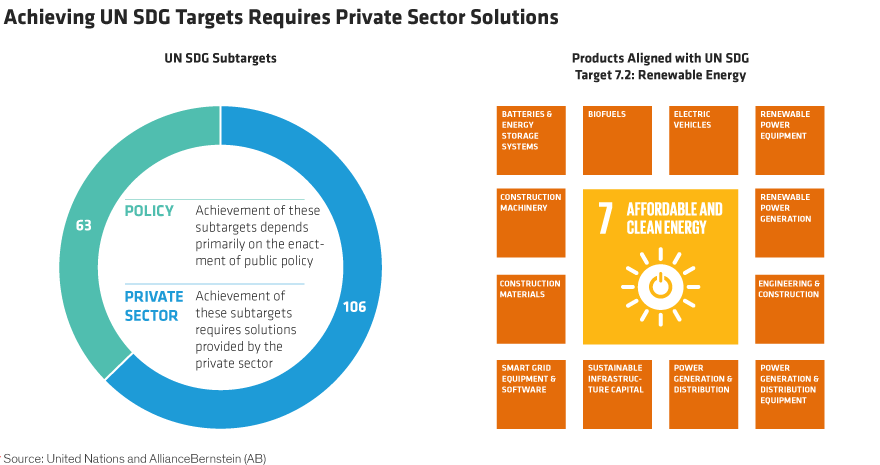

To map out a framework that connects the SDGs with the private sector, it’s important to dig deeper than the 17 SDGs themselves. While the SDGs offer simplicity, we think they aren’t detailed enough to serve as an investment foundation. Instead, we evaluated the 169 SDG subtargets that exist underneath the 17 SDGs. These subtargets are much more detailed and, in our view, are key to unlocking the investment potential of the SDGs.

After carefully evaluating each individual subtarget, the next step is to classify each into one of two categories: policy or private sector. Our research found that 106 of the targets presented opportunities for the private sector, with the remainder more purely in the domain of policymakers (Display below, left).

For those in the private sector group, we then identified the specific products and services that contribute to the achievement of these subtargets. This required thoughtful and rigorous analysis; yet it is critical to developing an investment strategy.

UN SDG target 7.2, for example, calls for increasing the use of renewable energy globally. We outlined 12 diverse groups of products, including batteries, construction materials and power generation equipment, that all contribute toward reaching this goal (Display above, right).

This step also facilitates another important plank of a sustainable investing plan: exclusions. It allows investors to identify products that aren’t aligned with the SDGs, in industries such as tobacco, weapons, pornography or gambling. Generally, such products will be automatically excluded from a sustainable portfolio.

From Products to Investment Themes

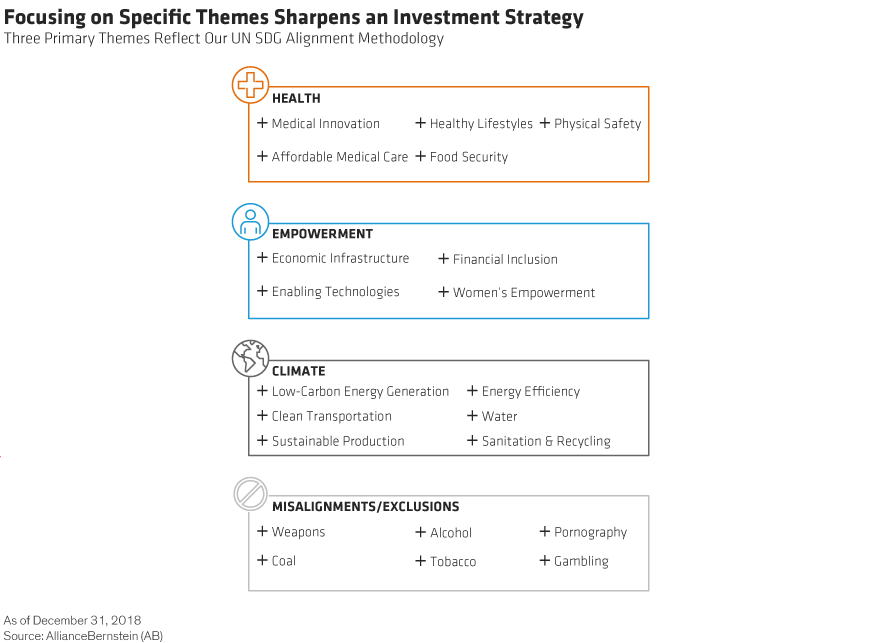

Once we establish which products are relevant to the achievement of the SDGs, we can then logically group those products into more understandable themes. Themes can form an organizing structure for conducting ongoing research, can be used in portfolio construction, and can also facilitate client communication.

To simplify the investment agenda, we developed three primary themes: health, empowerment and climate (Display). We also identified 15 subthemes within each of those categories to further clarify the investment opportunities represented by the UN SDGs. Subthemes within climate include, for example, low-carbon energy generation, energy efficiency and clean transportation.

After identifying products that are aligned with the SDGs, investors can look for publicly listed companies that generate revenue from these products. Of course, this is only half the battle. To generate positive investment returns, every SDG-aligned company must be assessed by fundamental analysis aimed at finding those with strong business models and selecting stocks with attractive risk/reward profiles.

This is the key link between the SDGs and equity investing. By connecting these dots, investors can sharpen their focus to those companies that support the SDGs and are key catalysts for positive real-world change.

This blog is based on a white paper that was published in April 2019 titled Responsible Returns: Better Stocks for a Better World.

Dan Roarty is Chief Investment Officer—Thematic and Sustainable Equities at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.