It’s often said that a home is life’s biggest investment, along with a college education and cars. But our retirement nest egg is often overlooked, perhaps because it’s intangible, even though it usually involves an even bigger financial stake.

With so many competing priorities, plan participants are increasingly detached from their retirement accounts—they’re either too busy or not interested. Persistently low confidence and financial literacy don’t help matters.

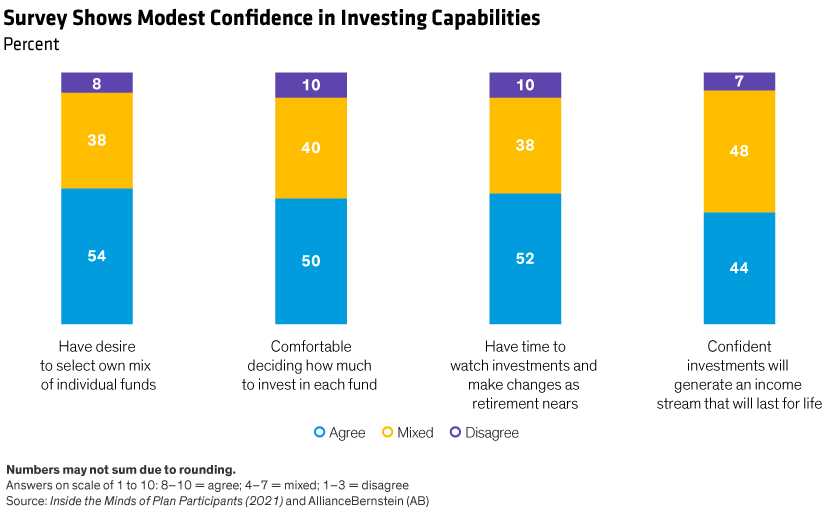

According to an AllianceBernstein (AB) survey, Inside the Minds of Plan Participants, only about half of respondents expressed the desire, comfort level or time to make decisions about how their retirement savings are invested. Only 44% felt confident that their retirement investments will generate income for life, which means well over half don’t think it will (Display).

Engagement Is Fragmented, Leaving Gaps for Sponsors to Fill

Encouraging plan participants to pay more attention to their retirement accounts is a constant challenge for sponsors. Understandably, participants are busy tending to more immediate priorities, like paying mortgages, raising kids and caring for parents; retirement may seem too far off to devote much time to it now.

It’s also easy for participants to keep themselves at arm’s length when plan features like auto enrollment and qualified default investment alternatives do the heavy lifting. But retirement is too important not to take an active interest in it.

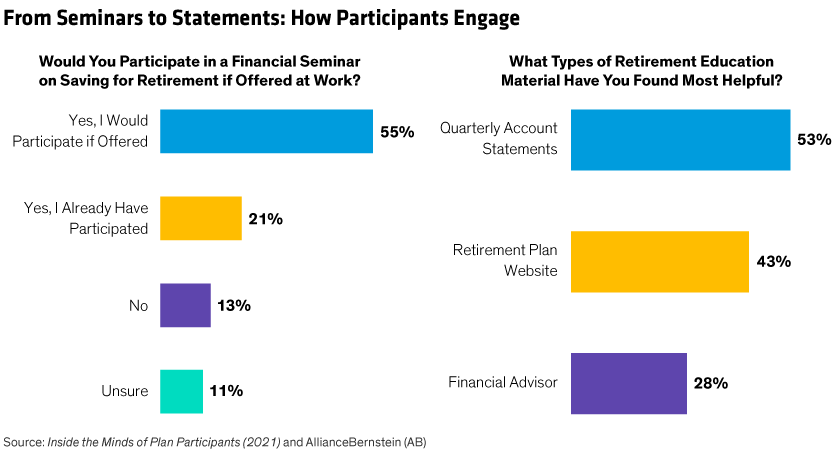

Not all participants are completely tuned out. About 43% find their plan’s web portal helpful, and over half of them at least view their account statements. But more outreach is needed and in demand. For example, about 55% of survey respondents said they’d attend a financial seminar if offered, and about one in five said they already have (Display).

Some participants look beyond their employer for help. Only about one-quarter turn to financial advisers, and many mistakenly believe they don’t have enough account value to warrant one. Meanwhile, 83% said they frequently discuss investment choices with spouses or domestic partners—a large number, but not very revealing of whether those conversations lead to good decisions.

All this leaves some large gaps, where sponsors remain the most logical source of financial guidance—and it doesn’t have to be exclusively related to retirement. In fact, we think widening the range of topics can pique more interest and improve engagement levels over time.

Cover Broad and Timely Topics to Encourage Wider Involvement

In our view, it’s a good idea to offer topics that participants are most interested in, like responsible investing, or that they’re currently worried about, such as the economy or market volatility.

Most recently, for example, inflation has been a growing concern. Participants and retirees alike may appreciate ideas on how rising prices may be affecting their savings or income strategies, along with possible action steps in this kind of environment.

Market volatility is another timely topic that needs perspective. In this case, there’s nothing sponsors can do to change market conditions, but a lot can be done to remind participants of the benefits of thinking long term, staying engaged and remaining diversified.

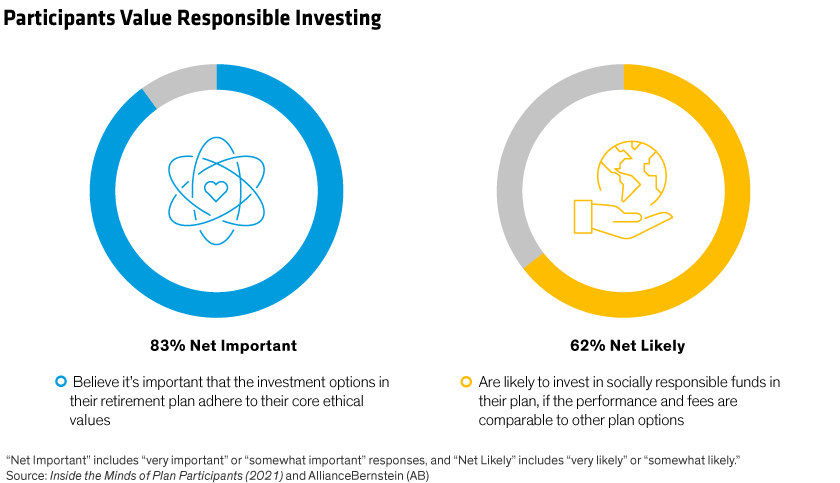

Responsible investing, which takes different forms, is another area sparking greater participant interest. A resounding 83% of survey respondents said it’s important that investment options adhere to their core ethical values, albeit with some consideration of returns and costs. Overall, two-thirds were somewhat or very likely to invest in such funds (Display).

Why not relate to this growing passion? For instance, participants could use guidance around the distinct types of responsible investing—from ESG integration to stand-alone solutions that include ESG goals—whether they’re available in the plan, via brokerage windows or both.

Driving engagement can seem like a daunting task, but sponsors don’t have to go it alone. Plan partners, recordkeepers and money managers, among others, are equipped and ready to provide timely content and insights into what participants want to know. And with a steady flow of diverse ideas, sponsors can more frequently weigh in on topics participants see in the mainstream media and are more likely to relate to.

Even a little engagement is good, but more is best. It helps participants gain more confidence and control over their savings, which in turn can improve the overall health of the plan.

Jennifer DeLong is Managing Director, Head—Defined Contribution at AB.

Heather Balley is Director of Participant Communications—Defined Contribution at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.