With the global economy moving into its late-cycle stages, we think it’s a good time to bolster portfolio inflation protection by embracing several recently unloved investments—including natural resources and commodities.

The thought of adding inflation protection in this way may seem a bit controversial. After all, real assets have struggled mightily over the past several years, as commodities and the stocks of natural-resource producers have suffered from overinvestment and persistent oversupply. But today, the winds may be shifting, and commodity and commodity-linked investments seem poised for a rebound.

In our view, the decision to add commodities and other real assets to a portfolio’s inflation protection should be made with a nine- to 12-month investment horizon. Of course, no one can predict the perfect entry point, so you could end up being early. However, given the potential for higher inflation ahead, we think being a little early is better than being late and missing out on much of the benefit.

The decision also isn’t as simple as flipping a switch. There a number of key considerations: Where are we in the economic cycle? Have real assets historically been effective in these times? How attractive are valuations? And what’s the potential for diversification?

Here are four reasons we think it’s time to make the move:

1) The global economy is moving later into the cycle. The world’s economy seems likely to transition into late-cycle mode during the second half of 2018 and into 2019. Global economic growth has stabilized at a relatively high level—our forecast is 3.2% for 2018. Structural and cyclical factors support the case for a gradual increase in underlying inflation, especially in developed markets.

So far in 2018, we’re only seeing limited evidence of higher inflation, giving ammunition to skeptics of adding protection. But in our view the inflation risks are tilted to the upside, so it seems sensible to add protection before the need becomes more obvious—and inflation protection more expensive.

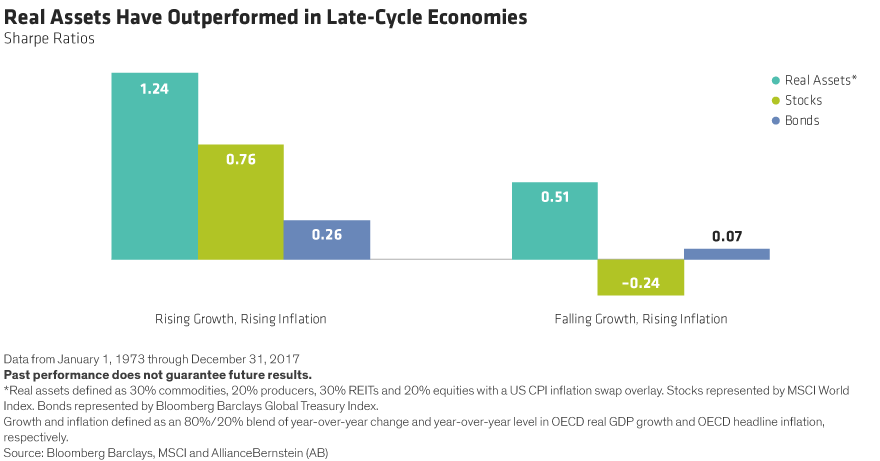

2) Inflation-sensitive assets have flourished late in the cycle. Real assets in particular have responded to rising inflation—and they don’t need unusually high inflation to outperform. In the late-cycle periods from 1973 through 2017, when growth and inflation were rising, real assets1 delivered a Sharpe ratio of 1.24. That’s much better than the 0.76 Sharpe ratio for stocks or 0.26 for bonds (Display). And the real-asset Sharpe ratio was positive in 85% of those periods.

As the economic cycle progresses, growth tends to slow and inflation continues to rise. In this challenging environment, the Sharpe ratio for real assets is lower but still substantial. So, as with many types of investments, the key to adding inflation protection is to get in before a good amount of the potential has already played out. In other words, it’s better to be too early than too late.

3) Valuations look pretty appealing right now. It’s no secret that years of low inflation haven’t been kind to real assets. Over the past three years, a 60/40 stock bond portfolio delivered an annualized return of 6.7%, while a blend of 60% real assets and 40% TIPS returned 2.5%. That’s a bigger return deficit than in 70% of the rolling three-year periods since 1980. Based on five-year periods, the most recent deficit is bigger than in 86% of the historical periods. This long period of underperformance has left commodities and commodity-producer stocks particularly attractive.

4) The diversification potential is particularly helpful today. Interest rates are still at relatively low levels and likely to rise further; equity valuations are higher than normal; and the world is moving slowly toward a normalization of monetary policy. Under these conditions, we expect correlations between stocks and bonds to continue to narrow. With the traditional stock/bond relationship less complementary than normal, inflation-sensitive assets can help enhance portfolio diversification.

Among inflation protectors, commodities, industrial metals and oil producers look particularly compelling at this point. As we see it, this portfolio shift should be sourced from equity exposure. Stocks are still a good play, but they aren’t particularly cheap right now; real assets offer a similar risk/return profile but more attractive compensation.

1. Defined as 30% commodities, 20% commodity producers, 30% real estate investment trusts and 20% equities

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.