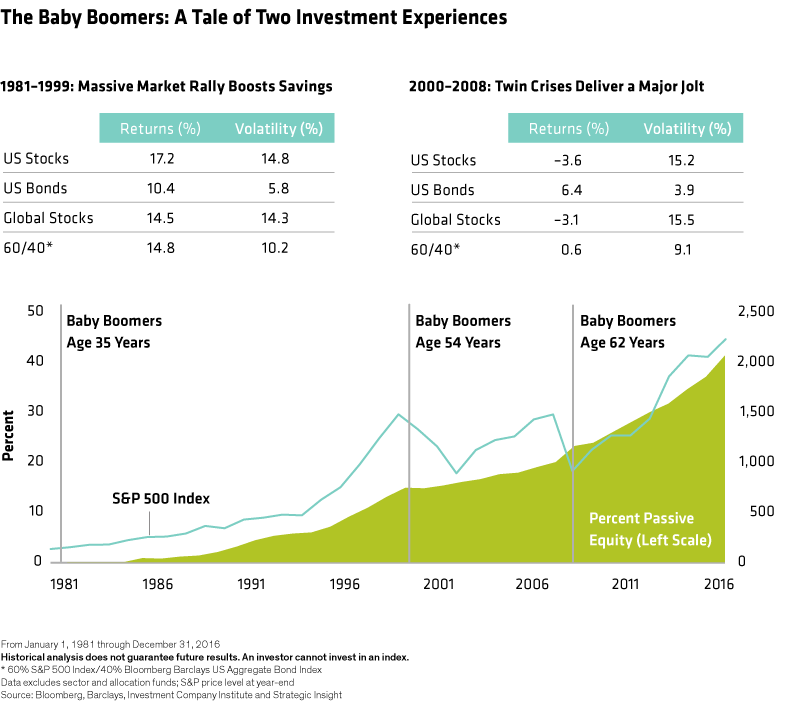

This challenging period from 2000 through 2008—almost a lost decade—left investors reeling. Their wealth was eroding just as they saw retirement approaching. The shock from this reversal of fortune caused many baby boomers to reexamine the way they thought about investing.

One of the prevailing thoughts? “Active management didn’t help me defend in the downturns.”

This line of thinking sparked a broader assessment of active management’s struggles. With that in mind, investors sent a wave of money into passive strategies after the global financial crisis. It was a sea change in investing preference: From 1988 through 2006, roughly $1 trillion flowed into active equity strategies. Since 2007, about the same amount has flowed out of active and into passive—aided by a changing regulatory environment.

We see two structural themes behind active management’s slump.

Why Active Management Failed... And Didn't

It’s true that active managers—as a group—underperformed over time; there’s really no debate on that point. But it’s also true that the success of active managers varies a lot based on important factors such as the specific time period, the equity category, and how active a manager really is.

We see two structural themes behind active’s slump.

First, both actively managed assets and asset managers’ staff saw explosive growth in the 1990s. That growing number of alpha seekers made it harder to add value by being active. Second, many active managers that had raised large amounts of assets became less active, managing closer to the benchmark—perhaps to avoid underperforming and losing client assets in a strong beta market.