Fundamentals and factors are two concepts that underpin equity portfolio construction. But they often get tangled unintentionally. So how can you ensure that a portfolio is really driven by stockpicking skill—and not factor exposures?

Skill is the cornerstone of active management. Investors pay stock pickers to generate alpha and beat the market over time, based on their talent at analyzing a company’s fundamental strengths and weaknesses, as well as the underlying business dynamics that drive earnings and cash-flow potential.

Yet company and industry fundamentals don’t always determine success. Even when a portfolio intends to generate returns from company-specific opportunities, it may get thrown off course by market trends that have little to do with the individual stocks held. Perhaps investors have turned against stocks with attractive valuations, or they suddenly adore or hate stocks with a lot of momentum. Value, momentum, lower volatility and high dividends are examples of stock characteristics known in industry parlance as factors. Simply put, factors are features of stocks that can have a profound impact on portfolios as they come in and out of favor. Style investors often create portfolios that rely on a factor or combination of factors—as well as stock-selection skill—to generate returns.

Factor Returns Are Volatile

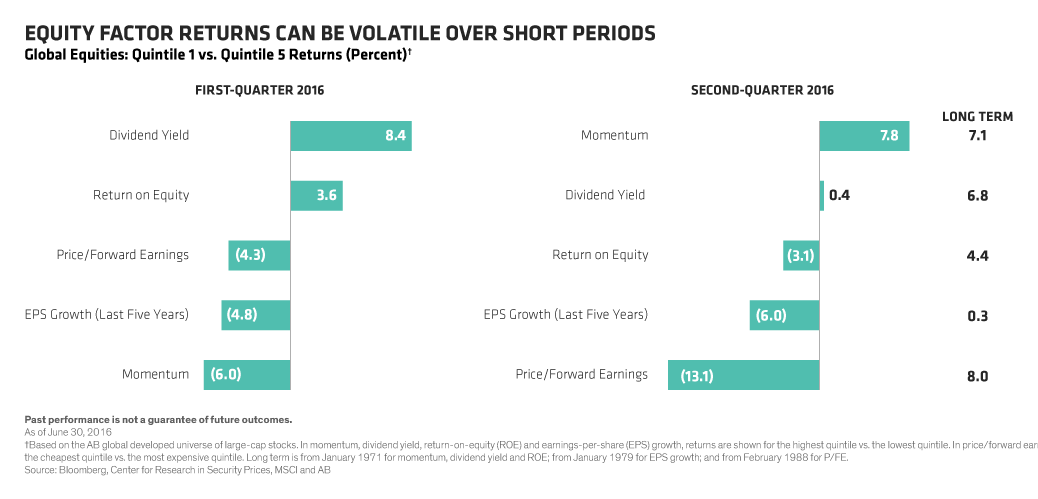

Systematically exposing a portfolio to certain return factors can be very effective over the long term. Extensive research shows that the cheapest stocks on the market, or stocks with strong momentum, outperform the broader market over time. But factors don’t always work. Over short periods of time, factor performance can be very volatile. For example, in the first quarter of this year, momentum stocks fell sharply while shares of quality companies with strong return on equity did well (Display). In the second quarter, these trends reversed.

And factor leadership can change dramatically year by year (Display). In 2012, investors loved growth stocks. This year they don’t. Minimum-volatility stocks have topped the charts since 2014, but ranked low during the previous two years. As a result, a portfolio that is skewed toward a specific factor can be heavily influenced by these volatile investor preferences.

Of course, some portfolios are designed to provide exposure to factors, for investors may wish to accept the inherent volatility in order to benefit from the long-term returns many factors offer. There are also portfolios that aim to dynamically adjust factor exposures to changing market conditions, which can be a powerful way to capture market returns.

These strategies aren’t for everyone. Investors who don’t want systematic exposure to the volatility associated with equity factors need to neutralize them. Yet sometimes—without even knowing it—a portfolio may have too much exposure to a factor. It can happen because of an inherent bias in the portfolio manager’s preferences, or even accidentally, if diverse stocks chosen for their merits coincidentally share similar characteristics.

Fads Can Be Misleading

Stock pickers who seek to build a portfolio of companies with diverse return drivers should be aware that faddish investor behavior can obscure opportunities. For example, in 2011, as growth stocks fell 5.5%, many investors shunned growth-oriented healthcare stocks. However, investors or analysts who focused on fundamentals could have concluded that Roche, the Swiss drugmaker, actually had a strong product pipeline and an effective new chief financial officer. Shares of Roche rallied 22% that year.

More recently, minimum volatility outperformed in 2014 and 2015, as investors sought safety amid market uncertainties. However, by following a factor-based approach, investors may have ended up with traditional safe-haven gold stocks in their portfolios, which underperformed during the two-year period. These stocks were exposed to another risk—the weakening gold price at the time.

In fact, thousands of factors influence the market, but they only get attention when they become very popular or very volatile. About a decade ago, quality didn’t even register on investors’ radar screens. Today, many active managers are overweight quality stocks, which could become risky if the trade reverses.

Value, growth and low-volatility portfolios can play an important role in equity allocations. These can be very effective ways to source returns when steered by fundamental research and stock selection.

But we believe that a core portfolio can best serve its purpose by defusing the impact of factors. By detaching factor risk, we believe investors can benefit from what we call prime alpha—a measure of portfolio-specific returns that is generally uncorrelated with other managers and asset classes. As an indicator of consistent market-beating returns that aren’t tethered to factor trends, prime alpha can help bolster investor confidence that a portfolio is truly driven by stockpicking skill over time.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.