Target-date funds have always promoted the mantra of diversification (“don’t put all your eggs in one basket”). Now it’s time to preach—and practice—an even wider diversification strategy.

Large US defined contribution (DC) plans have been structuring target-date glide paths that are customized to their specific company’s needs. Why have they done this? The two most often cited reasons among plan sponsors were gaining control over the underlying investment managers and having a more diverse mix of asset classes.

That greater diversification will likely prove increasingly beneficial over the next decade or so, since the investment environment shows signs of becoming much more challenging for most target-date funds, which rely almost exclusively on traditional stocks and bonds.

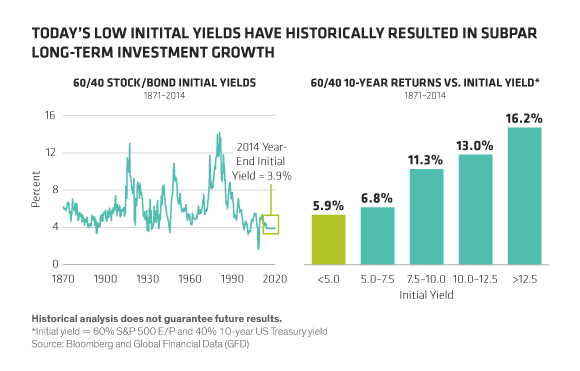

If we look at a hypothetical portfolio of 60% stocks (as represented by the S&P 500 Index) and 40% bonds (the 10-year US Treasury yield) over roughly the past 150 years, initial portfolio yields of 3.9% (as of December 31, 2014) are about as low as they’ve ever been (Display 1, left side). That’s not a good sign, because those current yields may paint a dismal picture for returns ahead. Historically, when the initial yield has been under 5% for that 60/40 stock-bond portfolio, the forward 10-year return has been well below historical averages (Display 1, right side).

What’s a target-date fund to do?

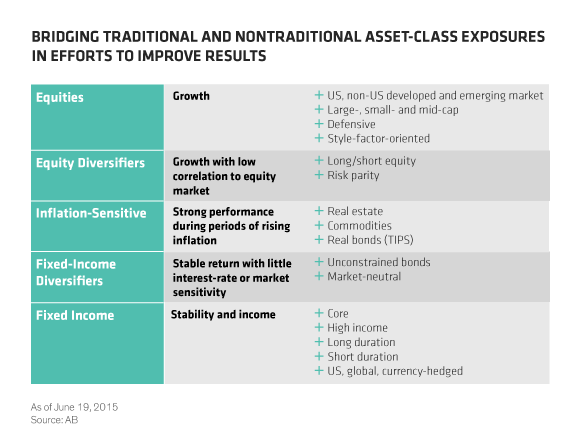

Call in diversification reinforcements—in the form of nontraditional asset classes. A few years ago, that would have been a pipe dream for anything but the largest of DC plans. But the investment world has changed rapidly, and many seemingly esoteric investments have been time-tested and are now widely available. These include such strategies as long/short and market-neutral equities, long/short credit and unconstrained bonds, risk parity, and real assets (such as commodities and real estate).

It’s worth noting that real assets have already gained a sliver of representation in some glide path designs, so the process of evolution and integration isn’t completely new to target-date design. In fact, Treasury Inflation-Protected Securities (TIPS) were a somewhat provocative asset class when they were included in target-date funds 10 years ago, partly because TIPS appeared only in the late 1990s.

New or old, nontraditional diversifying asset classes can help lift the return potential and bolster the risk reduction for a glide path (Display 2).

Equity diversifiers have come a long way from the traditional geography, capitalization and style categories. Long/short equity strategies, for example, reduce equity exposure by taking long positions in stocks that may rise and hedging the portfolio with short positions in stocks that appear set to underperform. They’re designed to profit as much from a manager’s security-selection skill as from broad market performance.

Real assets have historically generated strong growth in periods of rising inflation, and participants need that as they near and enter retirement. But inflation has been quite tame for the past two decades, so these strategies are underused in most target-date offerings today.

Also in the later years, defensive, lower-volatility equity strategies and fixed-income diversifiers help combat steep market losses. And for senior retirees, today’s new breed of target-date funds even contain ways to hedge against outliving one’s assets. But the critical issue is first to make sure that the glide path manages the portfolio’s growth risk through retirement, not simply to retirement.

We looked at how our evolved target-date glide path performed versus a traditional (mostly stocks and bonds) glide path. There’s a lack of historical index data prior to 1990 for all the asset classes we included, so we used similar 10-year periods from 1990 to 2014 to calculate glide path performance for participants who were 55 at the start of the 10-year period. The new glide path would have done better than the traditional glide path about 80% of the time. So we believe that this type of broad asset-class diversification could deliver a major improvement in retirement savings results.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.