Forget about rising interest rates for a minute. The question bond investors should be asking themselves is this: “Where are we in the credit cycle?” Knowing the answer—and it varies somewhat by sector and region—is critical for today’s investment decisions.

Bond investors tend to embrace the glass-half-empty view of the world, so they’re always on the lookout for what could go wrong. But lately, we think they’ve been asking the wrong questions and worrying about the wrong things.

In 2012, investors were bracing for an emerging-market debt crisis. A year later, it was fear that a bubble had formed in high yield. Last year, the question on everyone’s lips was “when will the US Federal Reserve raise interest rates?”

Chances are the Fed will raise rates at some point this year. And there’s not much that individual investors can do to influence that decision. But by knowing where we are in the credit cycle, investors can put themselves in position to make smarter choices—and to capitalize on opportunities that can be hard to see if you’re too busy trying to time the Fed’s next move.

Different Sectors, Different Stages

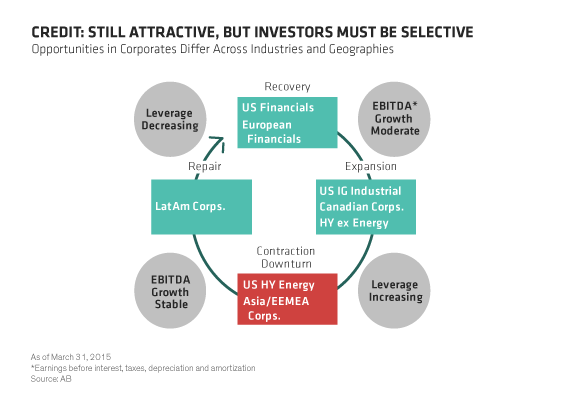

Credit cycles have distinct stages. During the expansionary period, easy access to credit helps boost earnings and prompts companies take on debt. As those debt levels rise, so does credit risk. Asset values start to decline, causing lenders to get stingier. A rise in interest rates then usually leads to a period of contraction and balance-sheet repair and, eventually, a recovery phase.

So where are we now? The answer depends on where you look. In developed markets, we are moving into the later stages of the cycle—somewhere between expansion and contraction. Telltale signs abound:

-

Companies are taking on more debt to finance mergers, buyouts and stock buybacks—all of which benefit shareholders more than creditors

-

Loans increasingly lack traditional lender protections such as limits on how much debt a borrower can issue. (In today’s low-interest-rate environment, many investors are willing to trade these protections, known as covenant agreements, for higher returns.)

-

Bond markets are taking more time to recover from sell-offs as credit fundamentals weaken

But in different parts of the world and in different sectors, we’re at different stages of the cycle.

US high-yield and investment-grade industrial companies are firmly in expansion mode. But high-yield energy companies and emerging-market firms from countries that rely on commodities (Russia, Brazil) are already in contraction. Other Latin American companies have moved on and are repairing their balance sheets, while US and European financials are already in the recovery phase (Display).

Be Selective and Diversify

With different markets and sectors at different stages, one of the most important things investors can do is diversify. Exposure to various regions and sectors expands the opportunity set and varies credit risk.

Diversification also helps investors avoid crowded trades, which can be hard to get out of should everyone decide to sell at the same time. And the challenge we’ve been seeing lately isn’t overconcentration in a single security. It’s frequent stampedes into and out of entire sectors—emerging markets, European high yield and so on.

It’s also important to be selective. For one thing, there aren’t many parts of the market that are uniformly cheap today, so investors should avoid reaching for the riskiest securities. Over the years, the hunt for higher yields has inflated the prices on these securities, and we doubt investors are being adequately compensated for the risk of default.

Active Approach May Increase Opportunities

It follows, then, that investors should be careful when it comes to passive bond index funds that might have large exposures to sectors that struggle in the late stages of the cycle. As we’ve pointed out before, investors who overlooked this ran into trouble last year when oil prices collapsed and the large high-yield energy sector dragged down the rest of the market.

In our view, a more active approach that allows investors to underweight or overweight a particular sector gives investors the potential to capitalize on bonds that have been bid up or down for the wrong reason. For instance, active managers could have reduced exposure to high-yield energy bonds last year and increased it to securities from companies that stood to benefit from lower oil prices.

If the credit cycle teaches us anything, it’s that we can’t avoid higher interest rates and credit contraction. Sooner or later, credit expansion ends. But knowing our credit cycle coordinates lets us make better decisions about which assets to avoid—and which to pursue.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.