Global stocks advanced in the third quarter, but investor sentiment wobbled amid puzzling signals on macroeconomic growth and monetary policy. Political uncertainty and a cloudier outlook point to more volatility, which should compel investors to intensify their focus on stock fundamentals.

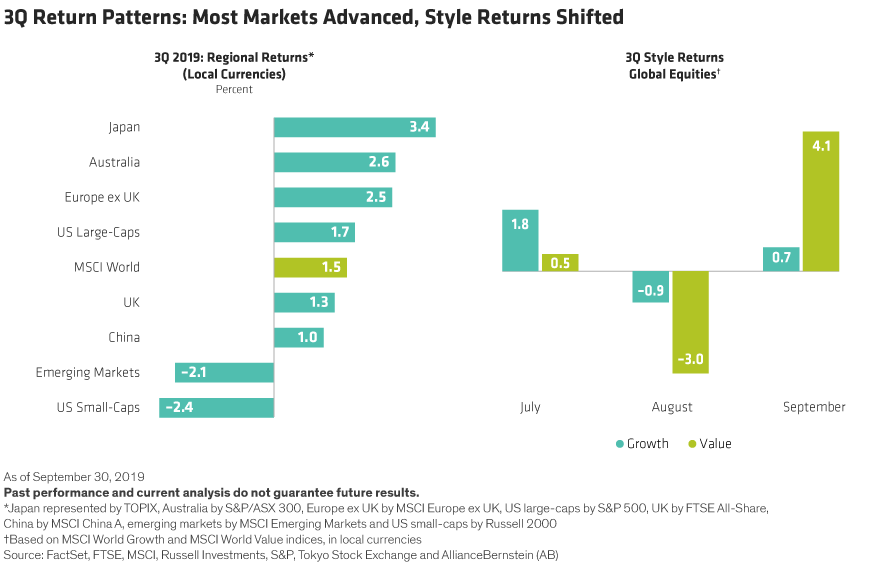

Developed market stocks were led by Japan, while Chinese stocks advanced despite the weaker trend in emerging markets. The MSCI World Index increased by 1.5% in the quarter and was up 18.5% for the first nine months of the year, in local currency terms. But the real drama unfolded beneath the headline numbers. In September, style return patterns took an abrupt turn, with value stocks outperforming growth in a rising market for the first time since late 2016, particularly in US and European large-caps. While growth stocks still slightly outperformed value stocks over the entire quarter, the move showed just how sharply sentiment can shift, and why style diversification is important.

Style Shift: Short-Term or Sustainable?

What can explain the sudden appeal of value in September? The rotation could have been triggered by many things, including relative valuations and technical factors. But macroeconomic expectations certainly played a big part, in our view. Bearish sentiment appeared to peak in August and gave way to small doses of good economic news. Global manufacturing showed signs of life, as the PMI for August increased after 15 straight months of decline.

Bond yields reflected some of this optimism. The 10-year US Treasury yield bottomed out at 1.43% in early September, then clawed its way back to 1.90% by mid-month, before falling back to 1.68% at quarter-end. US and global economic surprise indicators improved. The possibility that growth expectations may have become too pessimistic helped fuel returns for stocks that are more sensitive to the economic cycle, which are typically among the most attractively valued cohort in the market.

Economic Outlook: Which Way Is Up?

Still, it’s tough to draw a conclusion from such a short-term move, and the global economic outlook faces many challenges. Uncertainty driven by the US-China trade war remains a big obstacle to sustainable growth, especially in regions that are driven by manufacturing, such as Europe and Japan. Consumer and capital spending have held up so far, but could be vulnerable if manufacturing weakness persists. Volatile oil prices and Brexit disarray add more confusion to the outlook.

This tug-of-war for investor sentiment will probably continue, in our view. Since expectations for the global economy are so low, any nugget of good economic news could spark a risk rally. Major central banks are widely expected to keep monetary policy loose for the near future. At the same time, since multiple geopolitical and macroeconomic risks remain unresolved, investors are quickly spooked and easily revert to defensive postures.

Equity Valuations Look More Reasonable

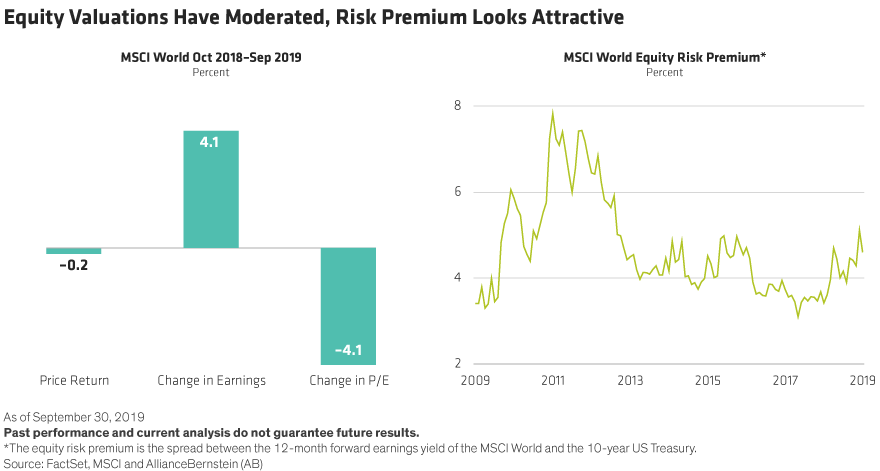

Where does this complicated situation leave equity markets? After all the ups and downs, global stocks haven’t really budged much over the last year. At the same time, earnings have risen by more than 4%. As a result, price/earnings ratios for global stocks have slipped by about 4% over the last 12 months, making them more reasonably priced than a year earlier (Display, left).

Meanwhile, the 10-year US Treasury rate fell by about 140 basis points over the same period. As a result, the equity risk premium—or the excess return investors can expect from investing in stocks over the risk-free rate of government bonds—increased to its highest level in three years (Display, right). If interest rates rise substantially over a sustained period, this premium would be threatened. But in current conditions, we believe that the potential reward for owning equities is attractive.

Volatility Will Be a Menace

For many investors, the attractiveness of equities is offset by concerns about volatility. In today’s environment, these fears are understandable—and volatility is unavoidable. Yet while it’s impossible to forecast short-term fluctuations in outlook and sentiment, it doesn’t mean that there is nothing you can do about it.

In particular, investors should make sure that their allocation is properly matched to risk tolerance. In many cases, that means making sure that an investor can withstand the type of swings we have experienced over the past year or so, which are likely to continue.

It’s especially important to avoid overreacting to seemingly daily shifts in market leadership. Often, this type of tactical reaction can be a recipe for disaster and may undermine long-term investing objectives.

Strategic Diversification Is Essential

Instead, it’s important to ensure that effective, strategic diversification is in place—not just in individual portfolios, but across your asset allocation. Different styles or factor exposures are primed to succeed in different environments. With proper diversification, an investor is likely to benefit from some winners even if other parts of a portfolio are more challenged. It’s impractical to shift too much of an allocation during episodic style shifts. However, the recent quarter illustrated why it’s important to have exposure to multiple styles that are likely to generate long-term outperformance, albeit at different times.

Active managers can take advantage of today’s volatility by building positions in stocks or sectors that may be temporarily mispriced when emotions overwhelm fundamentals. Given all the short-term noise, we believe that long-term investors have an opportunity to see through the uncertainty by focusing on company business models and fundamentals.

Sharon Fay is Co-Head—Equities at AllianceBernstein (AB).

Christopher Hogbin is Co-Head—Equities at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.