One of the big risks in retirement saving and spending is a problem most people would like to have: a long life. But funding an extended “happily ever after” isn’t easy.

Typically, defined contribution (DC) plans focus on accumulating assets, not translating them into income during retirement. As a result, very few plan participants are sure how much retirement income their accounts are likely to provide—or for how long. Many are also unaware of how much more they’d need to contribute to achieve the retirement income they want.

The only way to make income certain is to incorporate secure income through insurance products. This is a relatively new frontier for DC plans in general and for target-date funds in particular. Without income certainty, many retirees will either run out of money or be forced to spend less.

To have wide appeal among DC plan participants, a secure income solution should incorporate the following characteristics:

-

Income certainty: Most participants want a steady income stream in retirement. They also want a retirement withdrawal amount that will never go down—even if the market does.

-

Access to the retirement account: Participants rarely buy a traditional annuity at retirement because they’re afraid there’s no going back. They want access to their assets at any time for any reason, without penalty.

-

Ability to capture market upside: The focus is on a steady income, but retirement can last 30 years or more. The ability to capture the market’s upside could boost the account value and income.

-

Known fees and benefit rate: The benefit rate and any fees should be known ahead of time and not change with the market environment.

-

Bequest to beneficiaries: After the participant’s death, any remaining account assets should go to the participant’s beneficiaries without penalty—not to an insurance company.

-

Multiple insurers: Being backed by multiple top-rated life-insurance companies provides competition in obtaining the best rates and making the solution sustainable.

-

Personalization: Participants have diverse life goals. Their investment strategy should have some flexibility to accommodate those differences. The secure income feature should allow participants to choose when they want to retire and how much secure income they want.

This wish list of secure income features can be the template for a suitable solution. In our new survey of over 1,000 American workers, we asked how likely they’d be to invest in such a fund. Among those participating in a plan, over half (54%) say they’d be likely or very likely to invest in a guaranteed-income target-date fund. Surprisingly, more than three-fourths of nonparticipants (78%) agree. And they feel it would enhance their desire to join their company’s retirement plan.

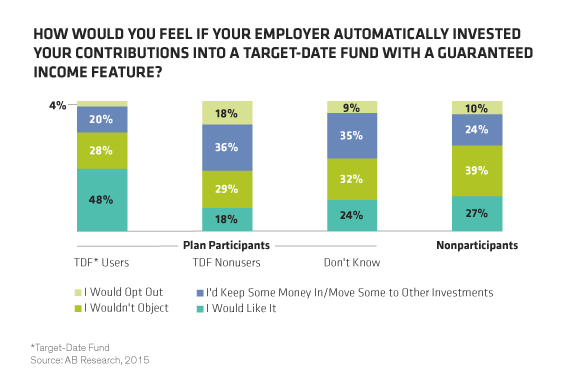

But to succeed in rolling out an option like this within a DC plan, sponsors would likely need to make it the plan’s qualified default investment alternative and combine it with automatic enrollment. So, we asked our respondents what they’d do if their employer automatically enrolled them in a target-date fund with a guaranteed income stream in retirement. The results are overwhelmingly positive (Display).

Nearly 90% of all employees would keep some or all of their contributions in a target-date fund that guaranteed an income stream for life. In fact, that’s been the top feature on their retirement plan wish list in each of the past seven years we’ve asked this question.

Some large DC plans have already adopted secure income target-date fund solutions. But there’s still a ways to go before they’re cost-effective enough to be scalable for midsize and smaller plans. Larger DC plans are typically in the lead on innovation, and we believe it’s only a matter of time before secure income target-date solutions are available to most plans.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.