Today’s fixed-income landscape features a dizzying array of securities—from US Treasury bills to corporate bonds, and from asset-backed securities to catastrophe-linked bonds. On the surface, high-yield bonds seem a lot like their fixed-income relatives: they represent loans from investors to the issuer, make regular coupon payments and commit to repay investors in full on a specific maturity date.

So, it’s not surprising that investors tend to think of high yield as part of their bond allocations. Because high yield is one of the riskiest fixed-income sectors, many investors adjust their high-yield allocations to raise or lower the overall risk in the fixed-income component of their portfolios.

But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds, which has important implications for how investors consider high-yield bonds in an overall portfolio context.

LOOKS ARE DECEIVING

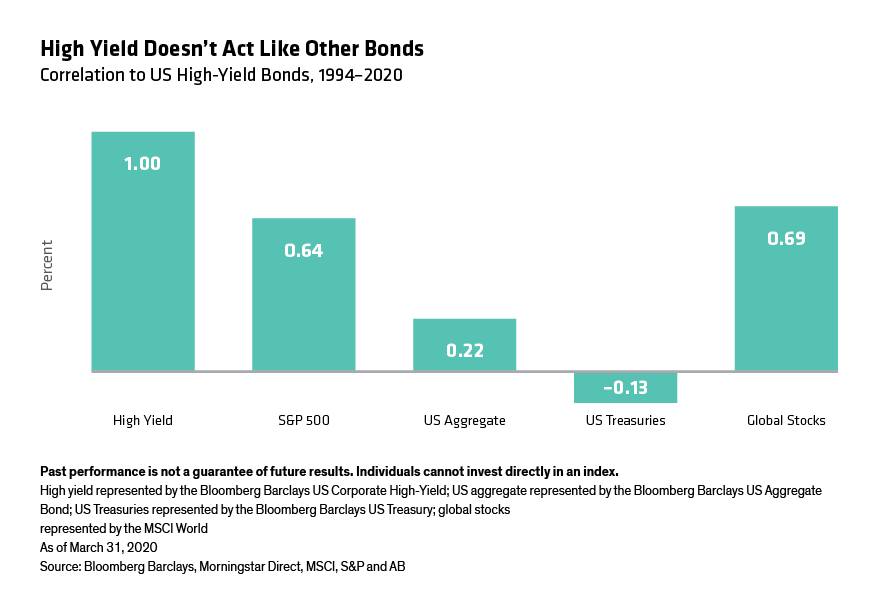

High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Over roughly the past 25 years, US high-yield bonds have exhibited a correlation of only 0.22 to a broad universe of investment-grade bonds and a correlation of –0.13 to US Treasury bonds, the traditional bellwethers of the US bond market. Of course, correlations aren’t constant—they fluctuate quite a bit over time.

Based on a rolling three-year average, high yield’s correlation to US Treasuries has ranged from as low as –0.52 to as high as 0.73. High yield’s long-term correlation to US stocks, as measured by the S&P 500, has been 0.64; its correlation to global stocks, as measured by the MSCI World Index, has been about the same: 0.69.

So it’s important to ask this question: Why do high-yield returns have more in common with stocks than with other bonds?

Like equities, high-yield bonds are strongly linked to the fundamentals of the companies that issue them. And credit spreads, the extra yield high-yield bonds offer versus similar government bonds, tend to move in the opposite direction from interest rates. So high-yield bonds are generally insensitive to interest rates—the dominant risk for many investment-grade bond sectors.

STACKING UP AGAINST EQUITY RETURNS OVER TIME

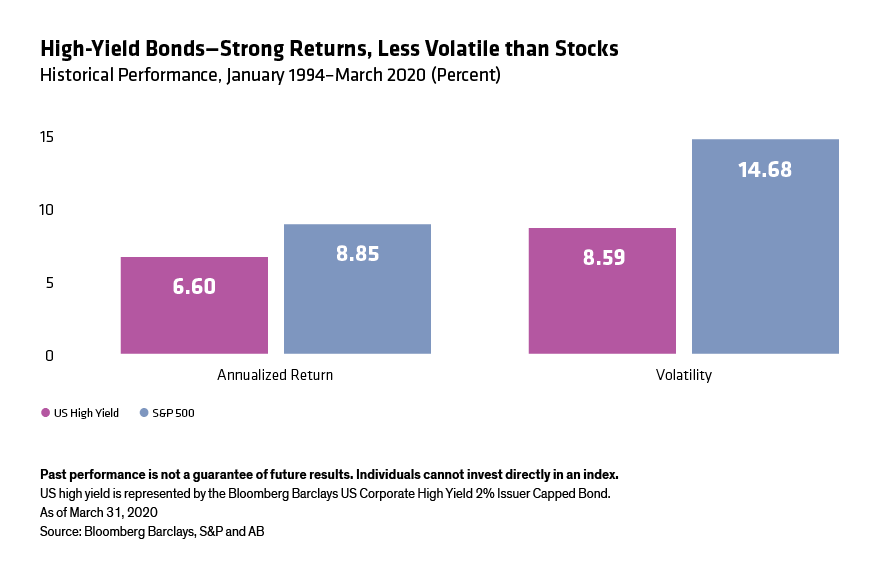

In more than two decades of capital-market history, high-yield bonds have stacked up fairly well against equity performance—but with much lower volatility.

Since January 1994, stocks have delivered an annualized return of 8.85%. High-yield bonds returned 6.60% over that period. That’s lower than the return for equities, but still attractive, especially considering that this period spanned two full market cycles and countless rallies and sell-offs.

Of course, high-yield bonds haven’t always kept up with stocks—they’ve been outpaced by a good margin over certain time frames, like when the technology/media/telecom bubble was inflating in the second half of the 1990s. But over the long haul, high yield has produced equity-like returns—with slightly more than half the risk of stocks, as measured by standard deviation.