Central banks in the developed world have raised interest rates higher and faster than at any time in recent memory. But until labor markets start to slow, policymakers are unlikely to take their feet off the brakes. That may mean more rate hikes or, perhaps more importantly, rates that stay higher for longer.

To understand why, let’s take a closer look at the recent performance of the global economy. Regional banking turbulence in the US and the failure of Credit Suisse in March did not put an end to the economic expansion, nor did it signal the beginning of a systemic crisis. Likewise, the global economy didn’t shrink when confronted with Russia’s invasion of Ukraine, China’s prolonged adherence to its zero-COVID policy, or the rapid rise in policy rates across the US and Europe.

This isn’t to say the economic outlook is especially bright. The risk of a hard landing is lower today than it was three months ago, but we still expect growth to slow as time passes. Rate hikes are already weighing on activity in many sectors, and households have begun to deplete savings that accumulated during the pandemic.

Whether or not this leads to a recession remains a close call. But the evidence in hand suggests that if a downturn occurs, it’s likely to be mild by recent historical standards. Rather than a sharp contraction, our forecasts reflect a long period of below-trend growth lasting through 2024.

Cooling a Hot Labor Market

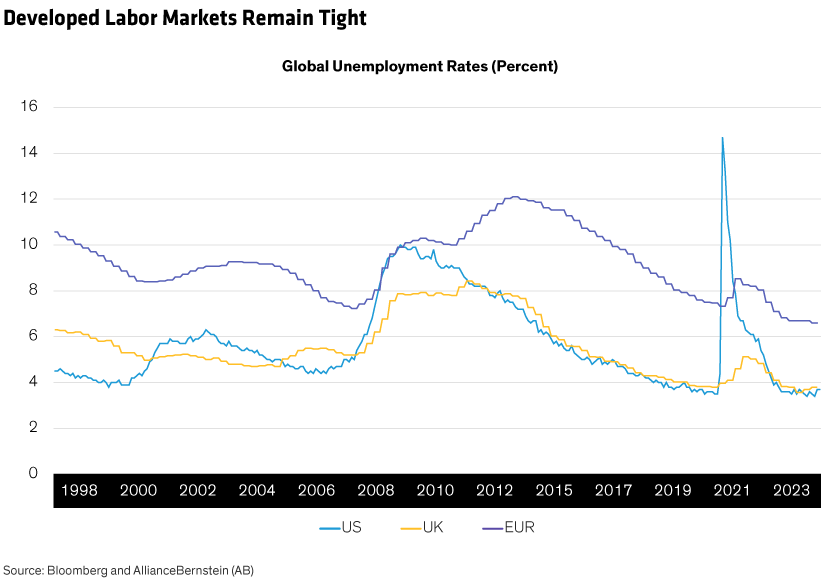

Why has the system proven so resilient? The key variable in developed economies is the labor market. Employment growth remains strong, unemployment remains low (Display) and wage growth has kept pace with inflation in most major economies. This has allowed households to manage their way through challenging times and smoothed out the bumps in the business cycle.

But resilient economic growth and, more importantly, labor markets mean that global inflation is likely to remain sticky. We expect central bankers to react by keeping policy rates in restrictive territory for some time.

We’ve seen evidence of that orientation recently. Central banks in the eurozone, Switzerland, Norway and the UK have pressed ahead with rate hikes—the UK surprised markets with a 50 basis-point move. The Reserve Bank of Australia and the Bank of Canada resumed tightening after previously taking a breather.

Similarly, the Federal Reserve held rates steady in June after 10 consecutive hikes but signaled more increases to come, dashing the market’s hopes for rate cuts in 2023. Both the Fed and the European Central Bank have indicated that the terminal rate for their economies is likely to be higher than previously expected. The message has been clear: interest rates will be higher for longer.

Learning to Live with High Rates

We think how long high rates will last is more important than their terminal level. Given the resilience of labor markets and the economy, we take seriously the possibility that rates could stay high for several quarters to come.

If labor markets weaken in a particular country, it may be enough to convince policymakers to stop raising rates. But it will take time for inflation to converge with central banks’ targeted rate and provide the all-clear to start cutting them. We believe that we’re still a long way from reaching that point.

The impact of persistently tight monetary policy is likely to be persistently soft growth. In other words, the consequence of a soft economic landing will be a sluggish rebound. As a result, we think growth will remain slow for some time to come.

Risks to that base-case scenario may be tilted to the downside. The global tightening cycle has yet to cause significant disorder in financial markets, but history suggests we should be ready for that to change. Without more policy stimulus, the risk of a hard landing in China remains acute. There’s also a risk that even our estimates of what “higher for longer” means won’t be enough to bring inflation down over an acceptable time horizon. If that proves to be the case, interest rates could climb higher still.

Even so, from a market perspective, sustained periods of below-trend growth typically call for caution—not panic. Absent a hard landing, markets may struggle to sustain momentum in either direction, rewarding those who can be patient amid the inevitable bumps in the road.