Millennials often say their biggest challenge is being lumped into one category, as if everyone’s needs and aspirations are identical. Plan participants have a similar problem of being bucketed too broadly. But just because they share the same retirement plan doesn’t mean their backgrounds—and investment savvy—are homogenous.

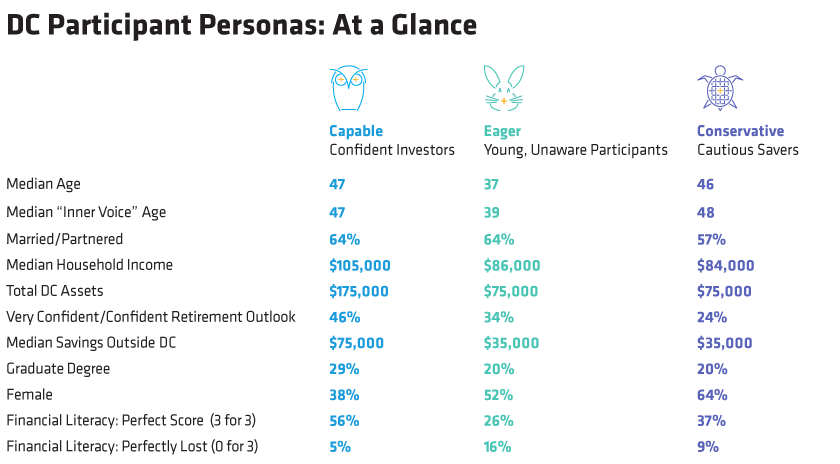

Every participant is different. But despite their differences, participants can still be grouped into three personas, according to our research, Inside the Minds of Plan Participants. In fact, based on responses to 14 investment-related statements, three groups have consistently emerged: Capable, Eager and Conservative. We think plan sponsors can boost engagement and confidence by engaging each persona on its distinctive terms (Display).

Defining Three Distinct Investor Personas

The three groups—roughly of equal proportions based on years of surveys—have specific characteristics beyond demographics. Each persona reflects an investment style, learning preference, engagement level, risk profile and other qualities:

-

Capable – Confident, knowledgeable investors who score high on our financial literacy test and have higher plan account balances

-

Eager – Younger participants with greater enthusiasm and confidence but lower literacy scores, and—likely because they skew younger—lower account balances

-

Conservative – Cautious, diligent savers with lower confidence and investing acumen, yet they may know (or need) more than they realize

Stronger Engagement Requires Targeted Outreach

Broad-reaching plan communications are a good start, especially if the messaging is straightforward, uses storytelling visuals and always includes a call to action. But the path to better retirement planning engagement, and outcomes, also requires hands-on messaging.

To engage more deeply with plan participants, connections need high-touch relevance, which is harder to achieve with a wider net. We believe that grouping participants by these distinct investor personas can help plan sponsors discover better ways to connect with participants—communicating and engaging with them on their own terms to foster better long-term results. The idea is to understand participants first to provide more of what they find useful.

Generating retirement confidence and investment knowledge, for example, has been an ongoing challenge for sponsors. The pandemic exacerbated the problem in recent years, but the trend began well beforehand. One reason: the growing use of default options and automated plan features. Although these features are incredibly helpful in many ways, they don’t require ongoing sponsor outreach or proactive participant engagement, which we are finding can lead to surprises down the road. This could explain why a growing number of participants eventually think they won’t hit their retirement income goals, or why retirees look back and wish they saved more.

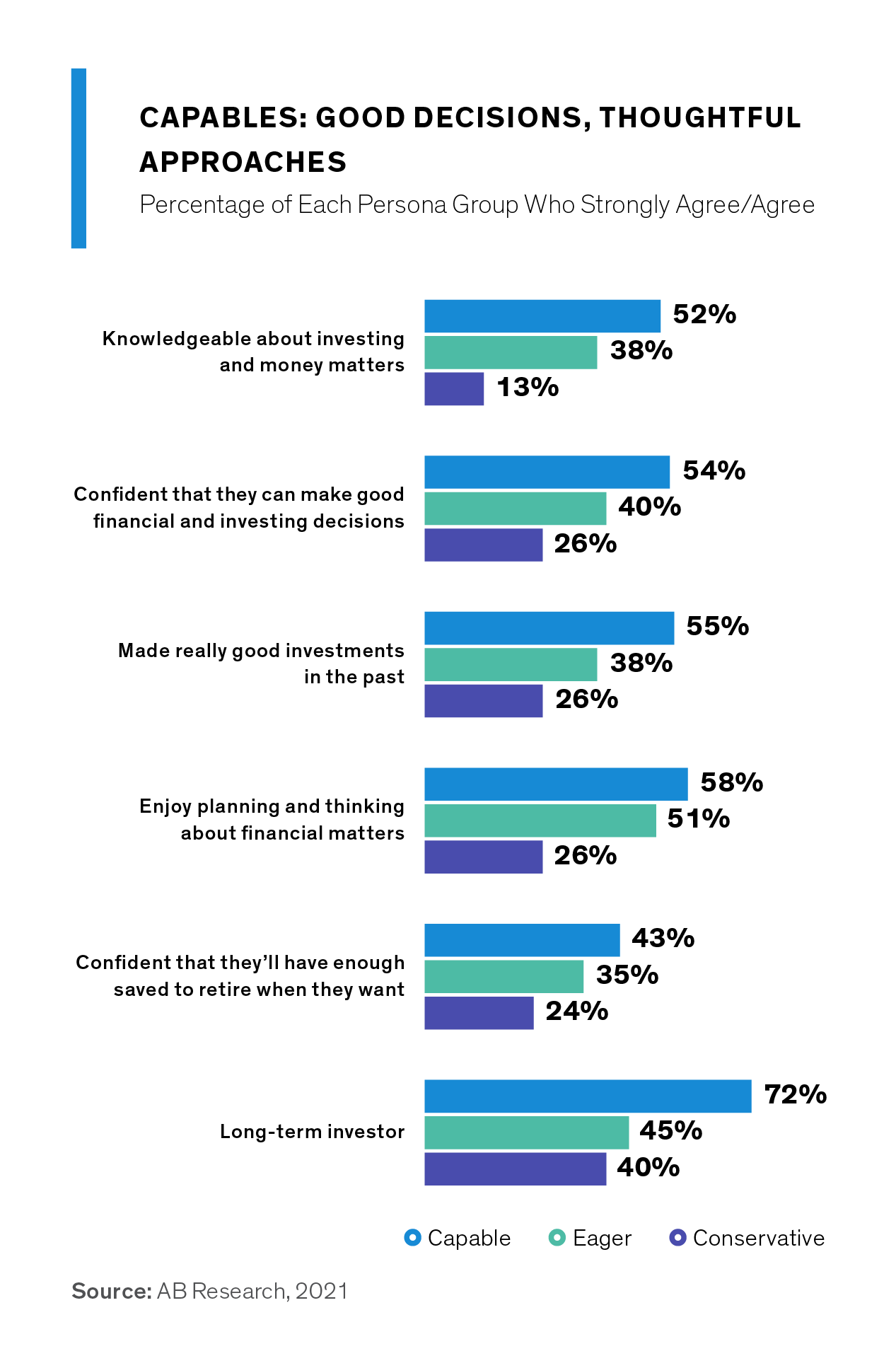

Even Capable Participants Need Help

Compared with other personas, Capable participants are long-term investors, financial planning enthusiasts and confident decision makers (Display). But even though they’re quite self-reliant, they can still use plan sponsor help.

For example, many Capables may be too aggressively postured in their investment mix and need timely reminders of the potential downside to taking too much risk. Thought-provoking content about the risks and rewards of different investment types or perspective on trending topics, like market volatility challenges or the long-term effects of inflation, can be helpful, too.

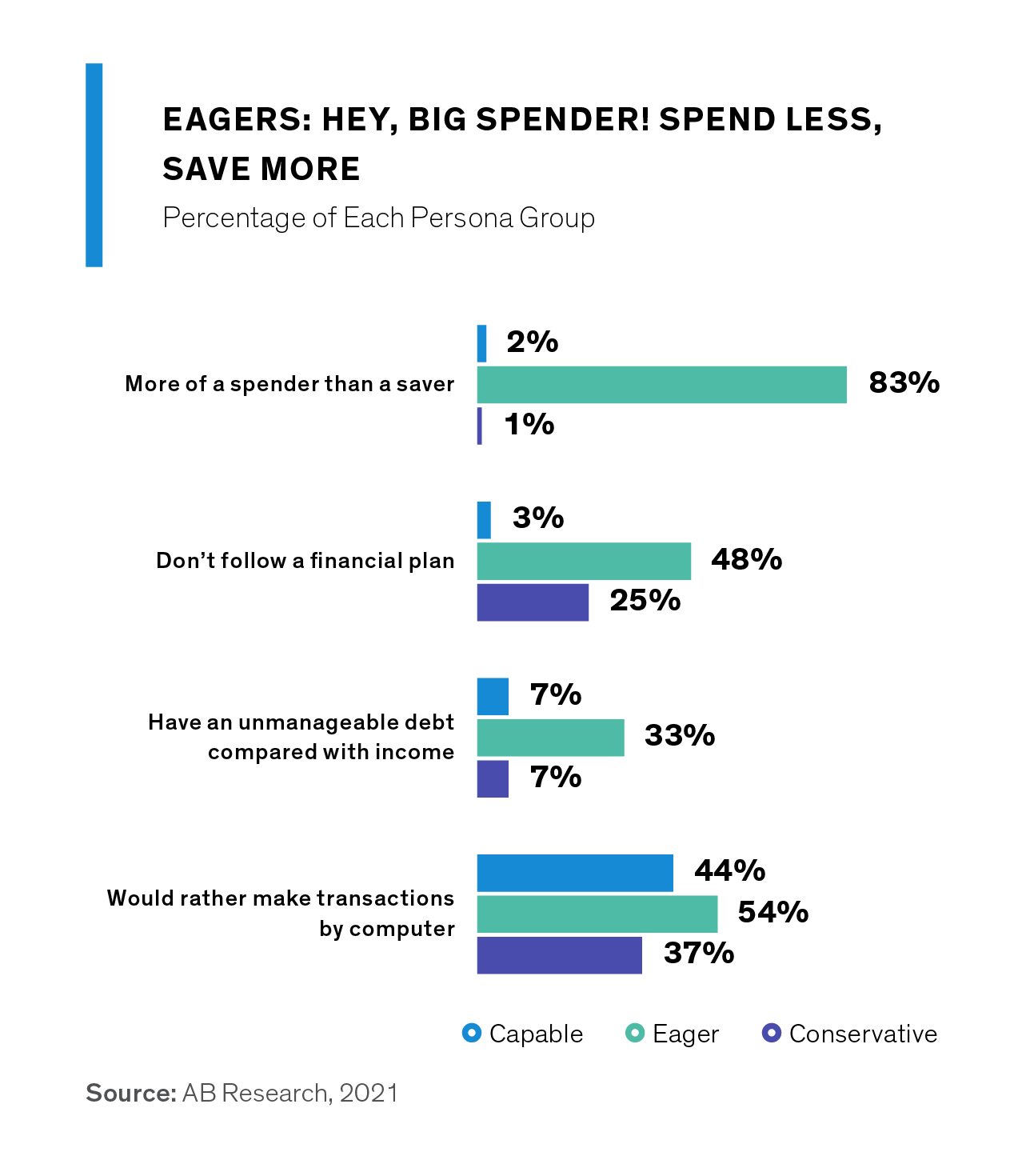

Encourage the Eager, But Reinforce Their Need to Plan

Eager participants need more guidance than encouragement. They typically spend more than they save, have the most debt and don’t follow a financial plan compared with other personas (Display). Their confidence tracks moderately high, but more importantly, they demonstrate a sponge-like thirst for financial knowledge. The key is to harness their enthusiasm and competitive drive by showing them ways to “win” at retirement.

Since they skew younger, eager participants probably see retirement as too far off to warrant action today. But they’re also highly malleable, and their tendency to wait can be turned into a positive by demonstrating the advantage of extra time when the right actions are taken today. For example, financial wellness programs focused on paying down debt or following a financial plan can be especially relevant.

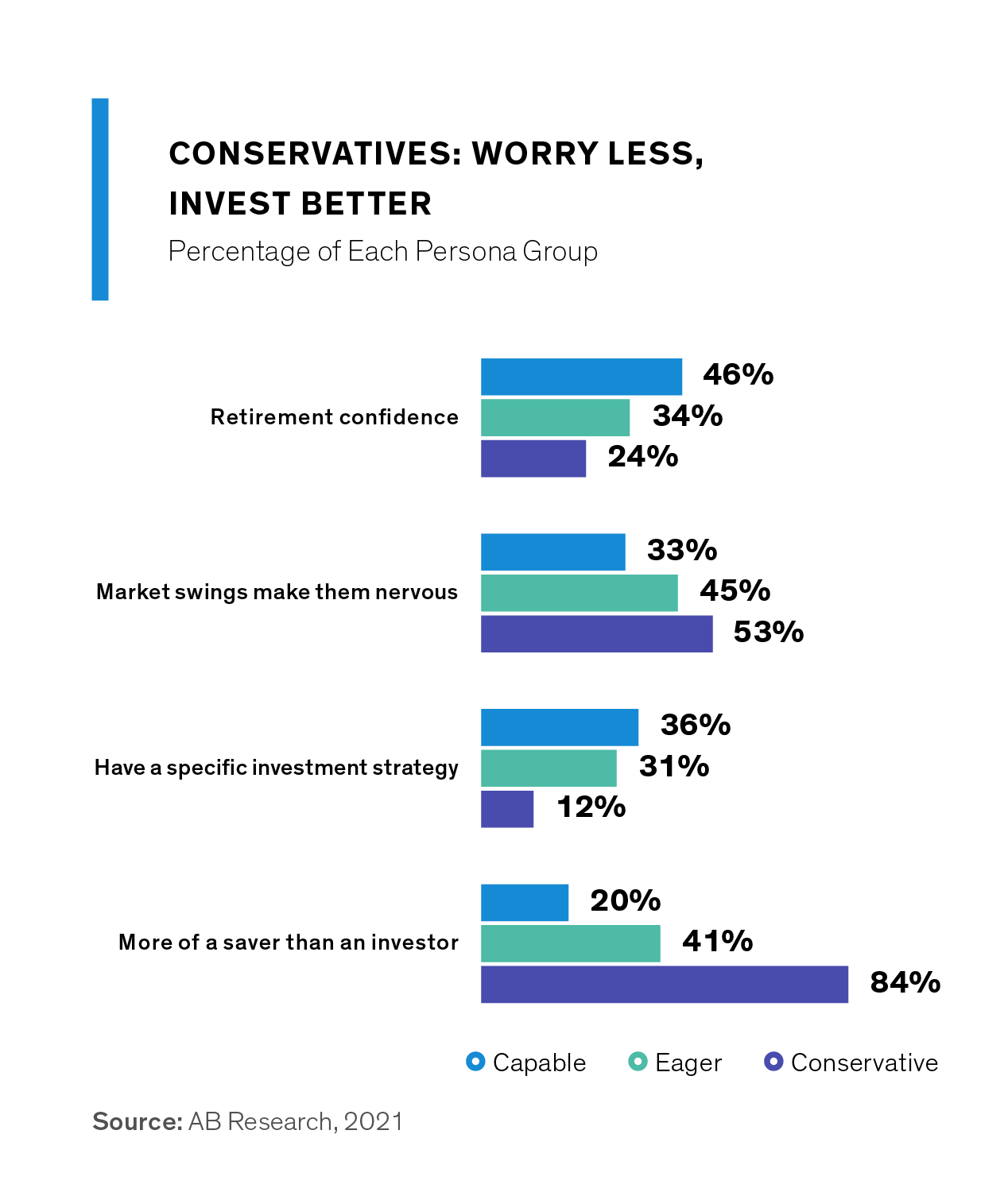

Conservative Savers Need a Nudge into More Growth-Friendly Waters

Conservative personas see themselves as savers more than investors. They’re the most averse to market volatility and least likely to lock in a specific investment strategy (Display). They typically stick to less risky, more defensive investments like money market funds to protect their plan balances. And they’re the least retirement confident of the three personas. Though they’re older than Eagers, they have the same average account balance, which is less than half the balance of Capables.

We think many conservative investors are too cautious for their own good, and their low retirement confidence may well stem from a sense that they haven’t saved enough. That’s why they need a nudge into more growth-friendly waters—but need to feel comfortable doing it. This means using relatable examples and tutorials about effective allocation across investment types—especially to those that add growth potential over time, which is still very much on their side.

We believe there is a striking correlation between strong participant engagement and improvements in their retirement confidence. Reaching a wide swath of participants through broad outreach efforts is an effective starting point. After all, some participant goals are commonly shared, such as generating retirement income, managing market volatility and staying ahead of inflation. But participants also have distinct differences—hopes, concerns, self-awareness, personal drive, etc.—that should be acknowledged too. For sponsors, understanding what makes their participants tick and building a thoughtful communication strategy around that is the key to unlocking greater participant engagement and, ultimately, outcomes.

Jennifer DeLong is Managing Director, Head—Defined Contribution at AB.

Heather Balley is Director of Participant Communications—Defined Contribution at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.