If price stability is the legal mandate of the Bank of Japan (BOJ), and the central bank’s official target for price stability is 2%, as measured by the Consumer Price Index (CPI),* then why are fluctuations in prices the norm for Japan? The answer—and expectations for the BOJ’s next steps—lies in the exchange rate.

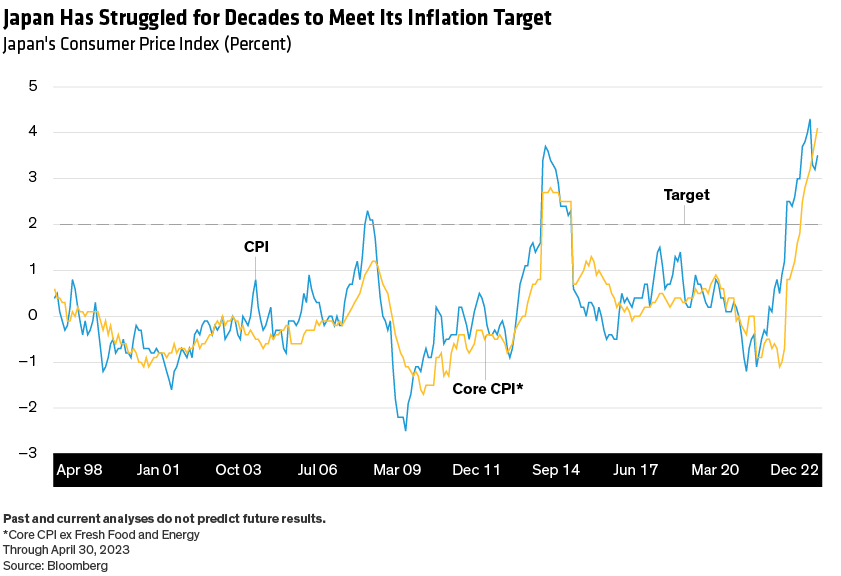

Hitting Japan’s Inflation Target Has Been Tough

At its policy meeting in April, the BOJ refrained from adjusting its negative interest-rate policy (NIRP) and yield curve control (YCC) policy in the face of CPI and core CPI (excluding fresh food and energy) at 3.2% and 3.8%, respectively. Citing weak real wages, the central bank judged the recent increase in inflation to be temporary.

Given Japan’s historical record (Display), the policy board was likely right, in our view. Japan has spent most of the past 25 years with inflation well below target, despite the central bank’s efforts.

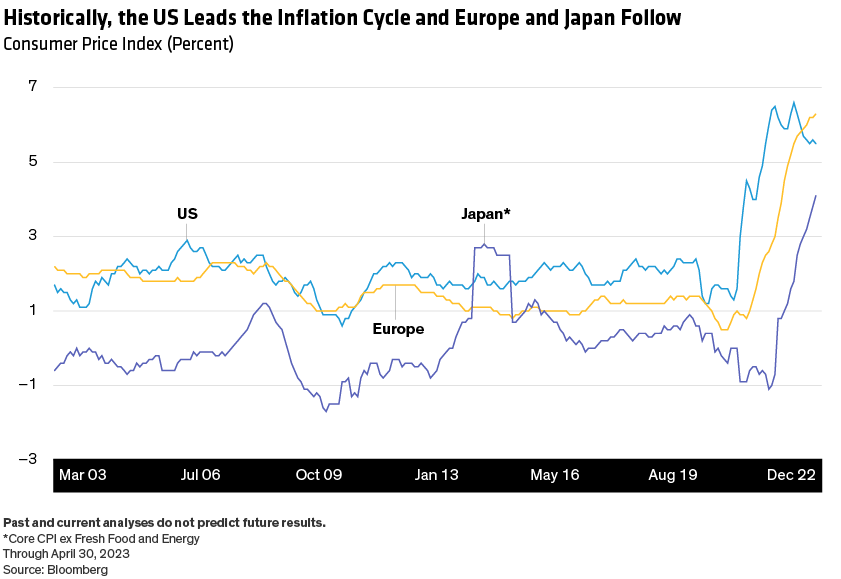

The latest comparatively hot inflation numbers may be short-lived, if other countries are a guide. Indeed, in past cycles of inflation, the US has led increases and decreases in CPI. With US inflation having already peaked in this cycle, it’s now widely expected that inflation will soon subside in Europe and Japan (Display).

At the Mercy of the USD/JPY Exchange Rate

Because Japan relies so heavily on imports of food and energy, even Japan’s CPI ex fresh food and energy is strongly influenced by the spillover effects of crude oil and other commodity prices. Consequently, yen-denominated commodity prices are the simplest leading indicator of inflation (Display), with yen-denominated commodity prices a function of the USD/JPY exchange rate and US dollar-denominated commodity prices.

As a result, Japan’s monetary policy is effectively at the mercy of its exchange rate, to which it pays extraordinarily close attention. For example, in October 2022, the USD/JPY rate reached 150, its highest level since 1990. In November, the government requested action from the BOJ. And at the BOJ’s December policy meeting, the board decided to expand the YCC band.

What’s more, Japan’s leaders must be mindful not to weaken the yen and impinge on the Japanese people’s cost of living, unleashing a political catastrophe. In other words, for the Bank of Japan, exchange-rate stability is necessary not only for price stability but for political stability.

So, what factors currently influence Japan’s exchange rate fluctuations? While a current account surplus helps maintain confidence in the yen, a sizable chunk of it tends to be directly invested overseas and so doesn’t contribute directly to yen buying. Structural trade deficits and increased carry trades because of interest-rate differentials lead to yen selling. And flows from purchase of Japanese stocks denominated in US dollars increase the correlation between stock prices and exchange rates.

Investors: Heed the Road Signs

Given these factors, we think the BOJ may explore the possibility of a policy change—most likely scrapping the YCC policy while keeping NIRP—should the yen head back toward the 150 level. Such a step would likely cap the yen at around 150 and increase the potential for it to rally back toward 130. It is currently hovering around 140.

An end to YCC would also likely result in a swift repricing in Japanese government bonds, with 10-year yields potentially doubling from current levels of roughly 0.4% to levels approaching 0.8%.

With the yen firmly in the driver’s seat of Japan’s monetary policy, the BOJ must navigate carefully to achieve its goals. Investors who heed the road signs may be best positioned to take advantage of opportunities as they arise.

*The Bank of Japan’s legal mandate, as originally defined in Articles 1 and 2 of the amended Bank of Japan Act (1997), is to ensure “price stability” and “financial system stability.” In 2013, the BOJ and the Japanese government issued a joint statement known as the Accord, which set the target for price stability at “a 2% year-on-year rate of increase in the consumer price index.”

Yusuke Hashimoto is Portfolio Manager—Japan Fixed Income and Brad Gibson is Head of Asia Pacific Fixed Income at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.