Interest rates are rising, and bond investors are worried about the potential impact on their portfolios. But they’re not entirely at the mercy of the markets. Below are three strategies that can help investors take control and mitigate their portfolios’ interest-rate risk.

1. Shorten your portfolio’s duration—but not too much. When facing a rising-rate environment, investors who can’t stomach too much risk should limit—but not eliminate—duration, or sensitivity to interest-rate changes. Shortening duration can help mitigate volatility and losses as interest rates rise.

But don’t exit the market, shift to cash or drastically shorten your duration exposure. A cash strategy could soon have you lagging both income-generating bonds and inflation. In fact, even though rising bond yields can be painful in the short term as prices fall, rising yields are good for bond investors in the long run. Here’s why: the income bonds generate in the form of coupon payments gets reinvested at new and higher rates.

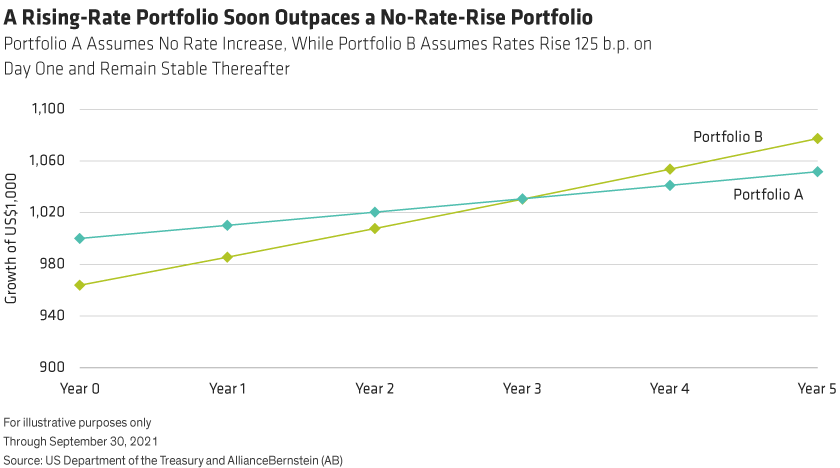

Let’s walk through an example to show what the actual impact of rising rates might be on a bond portfolio. We’ve modeled a simple portfolio of Treasury bonds and “shocked” it by assuming a sudden 125-basis-point rise in rates. What would its immediate performance look like? And then, how would the following years unfold (Display)?

At first, the portfolio sees an initial price loss—an undeniably painful experience. Even so, the portfolio generates income, and investors who stay the course can reinvest that income at a higher yield. This helps to make up for the price loss and eventually offsets it altogether; in two years, our portfolio is back in the black. And in year three, the portfolio has not only caught up to where it would have been had rates never risen, but thereafter it’s worth more and is growing faster. At that point, you’re better off.

Here’s our rule of thumb: as long as the duration of your portfolio is shorter than the investment horizon, rising rates will benefit you—no matter how large the rate increase.

2. Add higher-yielding bonds. Investors shouldn’t just shorten their portfolio’s duration; they should get a chunk of it from a source other than government bonds.

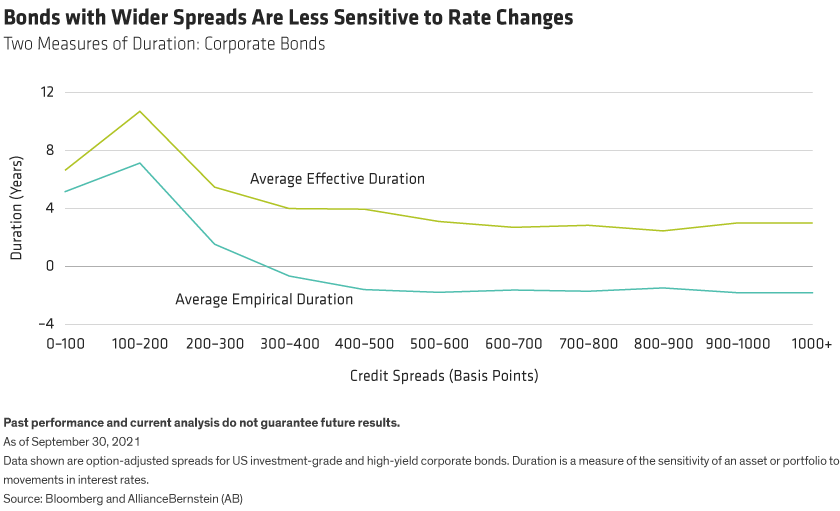

Bonds that offer a yield spread above government debt—corporates, for example—are less sensitive to changes in interest-rate levels. We can see this when we compare a credit’s stated effective duration to its empirical duration (Display). While the effective duration is meant to predict a bond’s price behavior for a given change in rates, the empirical duration describes the bond’s experienced behavior when rates move.

Effective duration is reasonably accurate for measuring the price sensitivity of Treasuries and high-grade corporates. But the lower the credit rating—and the bigger the credit’s spread above Treasuries—the less sensitive the credit is to interest rates. In fact, the prices of two bonds with the same effective duration—one a government bond and one a high-yield bond—often move in opposite directions when interest rates rise.

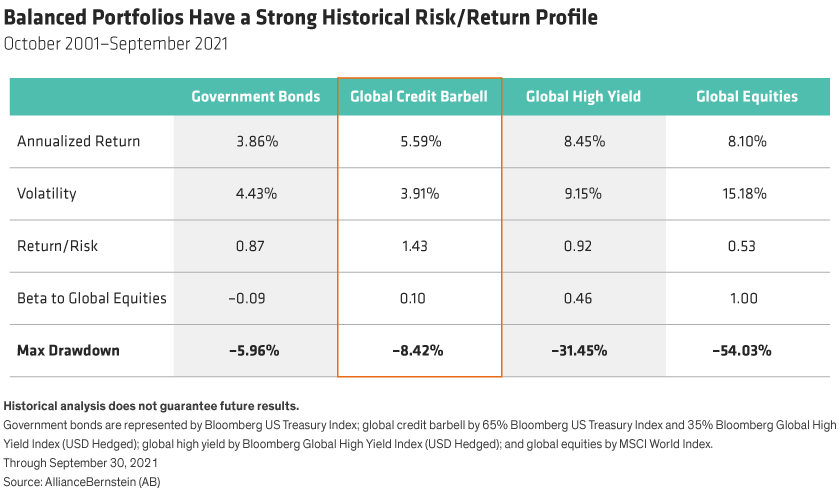

This negative correlation between high-grade and high-yield bonds argues for holding credit assets during periods of rising rates. Indeed, among the most effective active strategies for investors with a moderate risk tolerance are those that combine government bonds and other interest-rate-sensitive assets with growth-oriented credit assets in a single, dynamically managed strategy. The ability to rebalance negatively correlated assets helps generate income while limiting the scope of drawdowns (Display).

3. Broaden your horizons. Take your allocation to credit and stretch it, both globally and across a variety of higher-yielding sectors. A global multi-sector credit approach can deliver more than just diversification. A diversified global multi-sector credit allocation can provide bigger yield, more robust total returns and greater income efficiency. Here’s how.

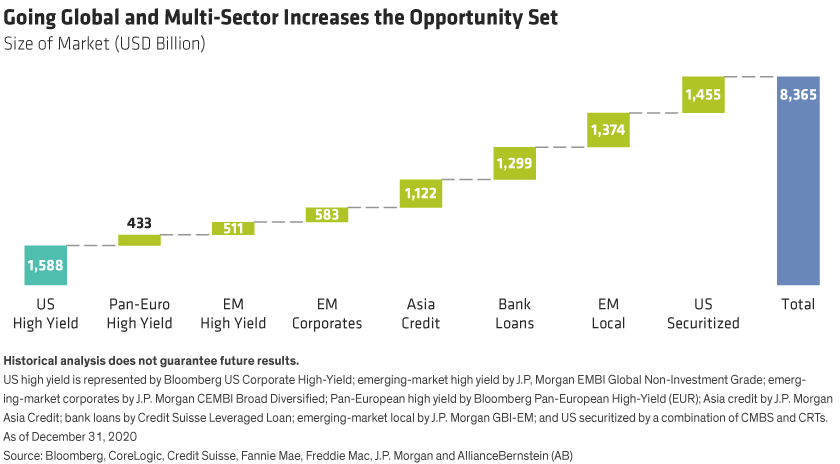

This approach taps a broad spectrum of assets, from US and European high-yield bonds to emerging-market debt to securitized debt, Asian credit, and bank loans. That’s a huge opportunity set. For example, the US high-yield index is almost $1.6 trillion, but it pales in comparison to a broader global multi-sector universe that tops $8 trillion (Display).

With such an extensive universe, bond managers can target areas that provide the best income and value at any given time. Constantly changing global economic and market conditions mean every sector has the chance to lead or trail the pack in any period. It makes sense, therefore, for investors to spread their money around while actively adjusting a portfolio’s exposures to focus on the most attractive opportunities.

Lastly, by spreading exposure across multiple regions and sectors, investors can reduce the potential damage that a large drawdown might have in any single sector. In this way, a global, multi-sector strategy maximizes opportunities at the same time that it minimizes concentration risk.

In short, we believe that investors who are willing to limit (but not eliminate) portfolio duration, lean into credit, and expand their horizons stand a much better chance of meeting their investment goals.

Joseph Haag, CFA, is Director of Product Management, and Brian Resnick, CFA, is a Senior Investment Strategist for Alternatives and Multi-Asset at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.