In a back-to-the-future world where diminished return potential and downside risk can derail carefully laid investment plans, it’s imperative for investors to adapt. As we see it, designing solutions that can deliver a better return path can be an effective approach to pursuing long-term goals, including stable growth, purpose and efficient income.

Generating Efficient Income…Not Chasing Yield

The intensity of the income need only grows as investors move closer to—and enter—their retirement years. The basic income formula used to be straightforward: simply buy a portfolio of US core bonds, clip relatively safe coupons and benefit from a tailwind of secular interest-rate declines on the way to a secure retirement.

Things have definitely changed a lot since then.

Shrinking bond yields have driven many investors to pour capital into higher-income sources, often bank loans, high-yield bonds and dividend-yielding stocks. But stretching for yield, especially in a low-yield environment, can magnify risk. For example, since 2001, core bonds have had a beta of near zero to the S&P 500 and a maximum drawdown of about 4%; for high-yield bonds, the beta is 0.41 and the maximum drawdown is –33%; for high-dividend equities, it’s 0.84 and –51%.

We think investors would be better served by pursuing efficient income through investments that seek the highest level of income per unit of principal risk they take on. And in budgeting between active and passive sources, we believe the active portion of that budget should lean into alpha-rich segments, such as credit, that require deep fundamental research and nimble positioning.

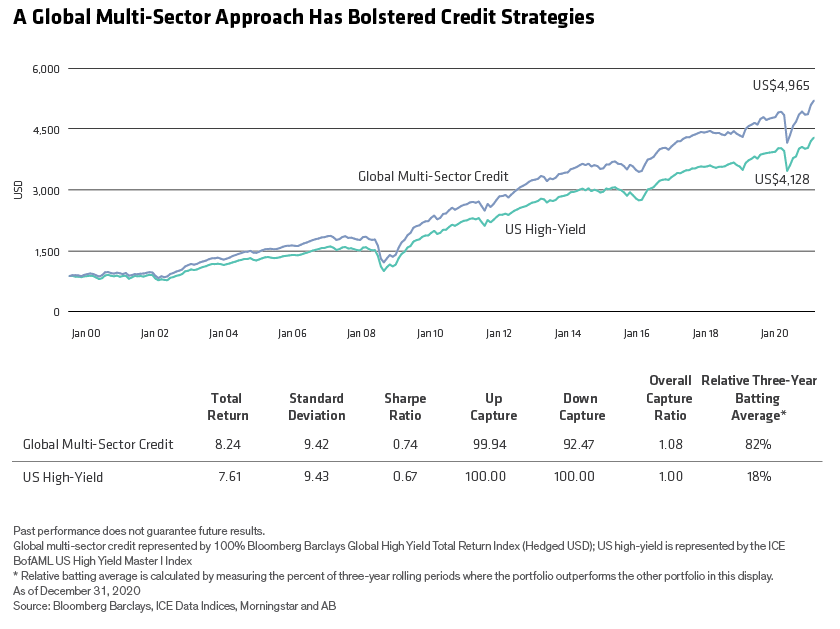

An important principle in generating efficient income is to globally diversify credit exposure. We’ve always maintained that a global multi-sector credit strategy is a better beta than US high-yield bonds alone, given its broader opportunity set, alpha potential and greater efficiency. Global multi-sector credit has outpaced US high-yield corporates over the long run (Display), winning in 82% of trailing three-year periods.

While diversified credit portfolios offer benefits, the potential drawdowns could be too much for some investors’ risk tolerances. One possible solution to this challenge is to consider the efficient structure of a barbell. Much like a classic 60/40 portfolio with high-quality bonds balancing the higher risk of stocks, high-quality bonds diversify income-enhancing credit exposure in the barbell strategy.

That balance is an especially important tool today, given the worries about rising rates leading many investors to focus on low-duration bonds—and even cash. These investments, however, have failed to deliver the type of countercyclical behavior necessary to cushion portfolios against sell-offs. From our perspective, an efficient income portfolio involves blending risks—not avoiding them.

An efficient barbell structure, with duration and credit exposures carefully blended, has the potential to produce a yield and return similar to high-yield bonds, with about half the risk. It may also check all three boxes in the recipe for effective up/down capture: better beta, efficient structure and exposure to targeted alpha potential in multi-sector credit. As an added benefit, shallower drawdowns can leave portfolios with more dry powder to redeploy into segments made attractive by market fluctuations.

For tax-sensitive investors, the barbell’s efficient structure can be deployed in the municipal bond market too. On one end of the barbell are high-quality municipal bonds with returns bolstered through active yield-curve strategies to take advantage of “roll,” which is the change in a bond’s value as it moves closer to maturity (independent of other factors). On the other end of the barbell is income-generating credit exposure from high-yield municipal bonds—another alpha-rich market.

In fast-moving and fragmented bond markets, technology can be a force multiplier for active fixed-income investing, helping investors identify opportunities and avoid risks. Innovation can even create new sources of alpha through more efficient, connected trading (trading alpha) and streamlined portfolio building that puts money to work faster (speed alpha).

The Big Picture on Income

Investors have many formulas at their disposal to build a better path to efficient income, and the specific mix doesn’t have to be one size fits all. Designing such an income portfolio isn’t simple—indeed, there are many facets to consider in matching portfolio design to individual needs.

For example, diversifying globally across income generators is a sensible approach, and it can help to consider the importance of inflation protection in the mix. Investors should also consider other beta exposures, such as dividend equities, REITs and emerging market stocks, which offer income and potential for growth. And it’s critical to balance income-generating potential with downside protection in the overall portfolio. As we see it, investors who strike the right balance will be better equipped as they pursue income goals.

Want to learn more about post-pandemic portfolio construction? Download a copy of AB’s white paper, A Guide to Investing in the Time of COVID-19…and Beyond.

Richard Brink is a Market Strategist in the Client Group at AB, Walt Czaicki is a Senior Investment Strategist for Equities at AB, and Brian Resnick, CFA, is a Director and Senior Investment Strategist for Alternatives and Multi-Asset at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.