Against a backdrop of an economic reopening and abundant fiscal stimulus, investors can still wring some value out of the uncertainty premium surrounding the path back from COVID-19. But the dislocations won’t last for long, and at some point, investors will face a back-to-the-future scenario.

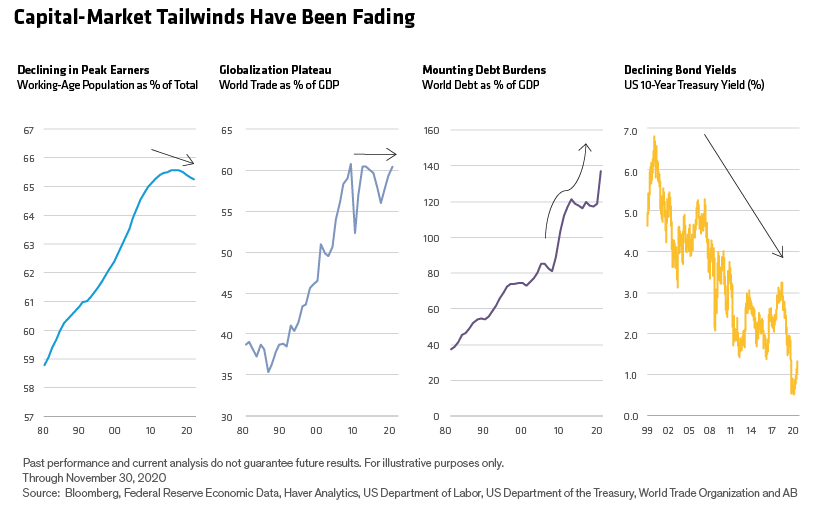

The same issues that existed before COVID-19 will remain (Display), only more acute because stimulus has pulled forward returns and racked up more debt. In this next chapter, which will start “the day after the virus,” investors will face lower returns and other possible side effects from secular trends—one of which could be longer-term structural inflation.

Low Returns and Ill-Timed Drawdowns: Threats to Income, Lifestyle and Legacy

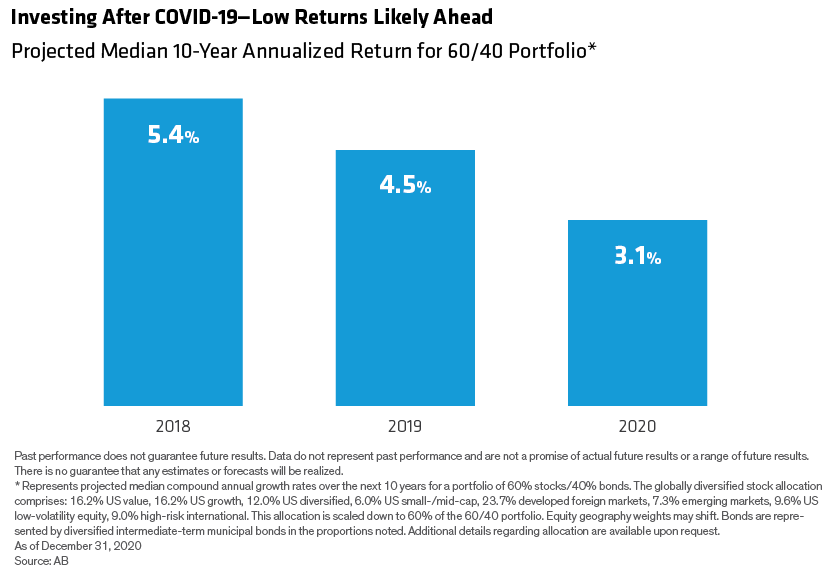

What could capital-market returns look like going forward? Take a classic 60/40 stock/bond portfolio, for example (Display): Forecasts at the end of 2018 called for roughly 5.4% annualized returns over the next 10 years. By late 2020, that number had shrunk to 3.1%, with a more than 40% chance of investors experiencing a 20% peak-to-trough loss.

In this environment, an ill-timed market downturn—magnified by inefficient portfolio design that may create vulnerabilities—could lead to running out of money or simply create a yawning “means gap,” with plans for philanthropy, legacy and other life goals taking a major hit.

Better downside protection in the years directly before and after retirement is a key to engineering a successful retirement. Designed effectively, such a portfolio will likely exhibit a lower probability of enduring big drawdowns. But in long-term wealth building, upside matters too. That’s the conundrum investors face today—the need to participate and defend.

The Keys to Designing a Better Return Path

In our view, the solution is to build a portfolio that has better up/down capture: the percentage of rising markets it captures versus the percentage of falling markets it captures. Getting that balance right is the challenge for every investor—and requires three main elements:

Better beta. Some markets—and approaches—have persistently delivered better up/down capture—quality equities, for example. Over the past 10 years, the MSCI World Quality Index captured 99% of the MSCI World Index’s upside but only 80% of its downside. That’s an up/down capture ratio of 1.24 versus the MSCI World (which, as the reference benchmark, is by definition 1.0).

Efficient structure. Combining different betas can create structures that also result in a smoother return path. For example, over the past decade, a combination of two fixed-income betas—50% US Treasury bonds and 50% US high-yield bonds—has produced a 1.49 up/down capture ratio versus US corporate high-yield bonds alone. Of course, the selection of the components, their assembly and interactions, and their ability to adapt to dynamic markets all come into play in determining portfolio success.

Targeted alpha. Passive investing has its benefits, with many options to choose from and cheap beta exposure. But broadly indexing market segments may create structural and definitional issues. Outperformance from skilled active management, by contrast, can navigate risks and uncover opportunities—an ability magnified when targeting less efficient markets.

Each element—better beta, efficient structure and targeted alpha—can create a favorable return sequence and be even more powerful in combination. But to what end? In our experience, three goals—two classic and one newer—seem front and center on investors’ minds. Improving the path of returns should be done through the lens of stable-growth, efficient-income and purpose-driven investing goals.

Want to learn more about post-pandemic portfolio construction? Download a copy of AB’s white paper, A Guide to Investing in the Time of COVID-19…and Beyond.

Richard Brink is a Market Strategist in the Client Group at AB, Walt Czaicki is a Senior Investment Strategist for Equities at AB, and Brian Resnick, CFA, is a Director and Senior Investment Strategist for Alternatives and Multi-Asset at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.