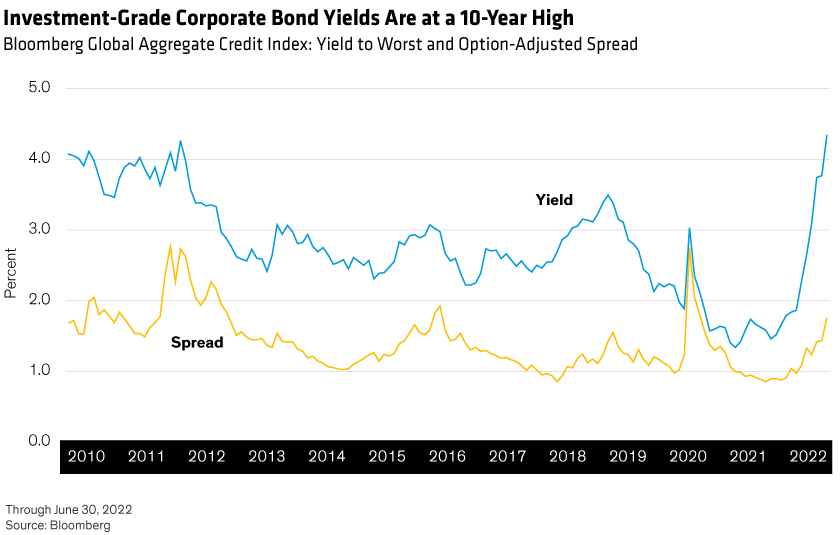

A higher rate regime has finally arrived: On June 30, prevailing yields for global investment-grade corporate bonds topped 4.3%. Credit investors have waited more than a decade for such attractive yield levels. Unfortunately, slowing growth and fears of a potential recession are making some investors leery of the sector. We think that’s a missed opportunity. Here’s why.

Valuations Look Compelling—by Many Measures

It’s hard to ignore that global investment-grade corporate yields are currently the highest they’ve been since the global financial crisis (Display). European corporate yields are more than 2% higher than one year ago, when half the index offered negative yields. Today, no European corporate yields are negative. And in just a few months, US corporate yields have risen from 13th percentile to 99th percentile compared with the past 10 years.

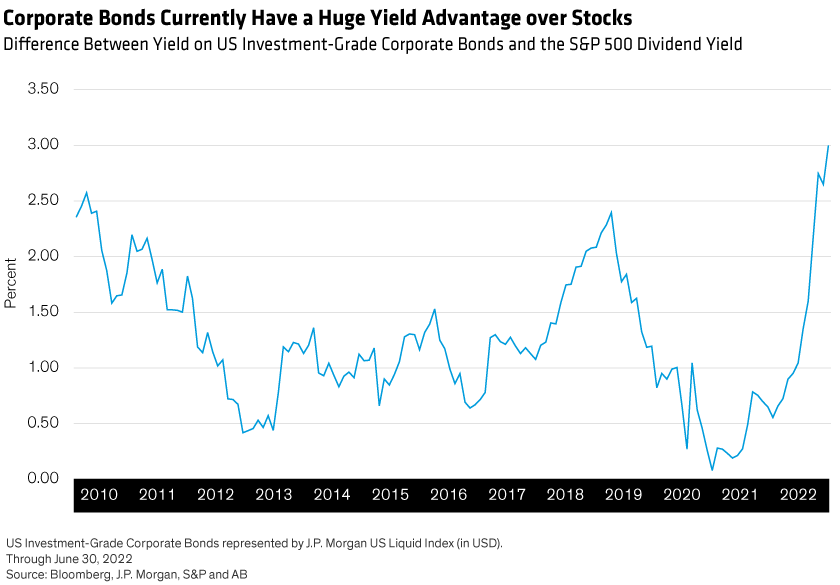

When bond yields were low, investors sometimes looked to high-dividend-paying equities as income-generating assets with growth upside potential. Today, the reverse is true: Investment-grade corporate bonds offer the biggest yield advantage over the S&P 500 dividend yield in a decade (Display), while mitigating risk assets’ downside.

Lastly, today’s generous credit spreads more than compensate investors for the risk of recession, especially given the sector’s starting point—exceptionally strong fundamentals.

Strong Fundamentals Provide a Cushion Against Downturn

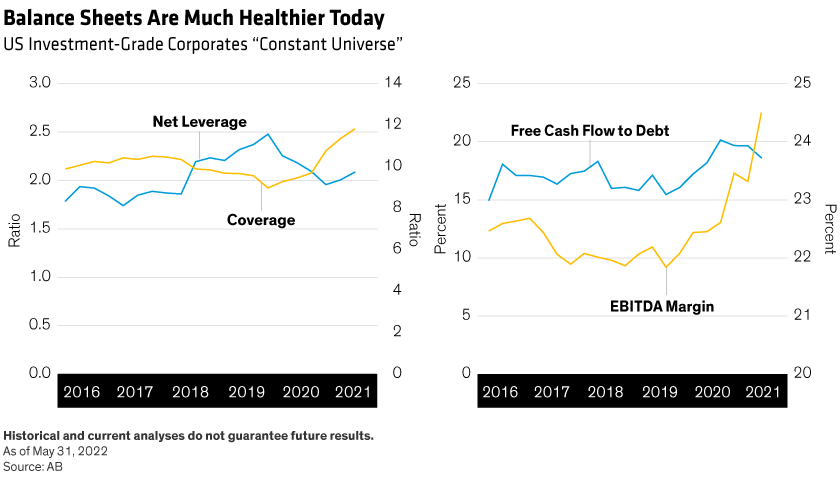

At the brink of most slowdowns, corporate fundamentals are already weak. But today’s issuers are in much better shape financially than issuers entering past recessions, thanks in part to an extended period of uncertainty surrounding the coronavirus pandemic. This uncertainty led companies to manage their balance sheets and liquidity conservatively over the past two years, even as profitability recovered. As a result, leverage and coverage ratios, margins, and free cash flow have improved.

To confirm these metrics, we conducted an in-depth historical “constant universe” analysis of the US investment-grade corporate market, adjusting our issuer universe to eliminate survivorship bias, changes in composition and other distortions. The result is a “constant universe” that shows just how much leverage has declined and coverage ratios have increased over the past 12 months, compared to the precipice of the COVID-19 pandemic in early 2020 (Display).

This relative strength in balance sheets means corporate issuers can withstand pressure and aren’t facing a pronounced downgrade cycle as growth and demand slow.

In addition to overall corporate well-being, business risk-taking is notably subdued. During expansionary periods, companies often take on more debt to fund mergers and acquisitions (M&A) or increase returns to shareholders. When the cycle turns down, companies might be left with too much debt or too little liquidity. But today, appetite for borrowing to fund M&A activity is low.

In fact, there’s scope for their appetite to grow without impinging on ratings. Even though companies’ collective financial policy is likely to become more aggressive over the next 12 months, we expect improvements in credit profiles to outnumber deteriorations in nearly every investment-grade industry. That represents the continuation of a recent trend: in the first half of 2022, ratings upgrades outnumbered downgrades by more than two to one.

Technical Conditions Are Poised to Improve

Today, supply-and-demand dynamics are a less obvious piece of the outlook puzzle. But in our analysis, heightened concerns about central bank asset sales may be unfounded. For example, the Federal Reserve hasn’t been a major player in the US investment-grade corporate market, so its sales aren’t likely to have an effect on markets as it unwinds quantitative easing.

By contrast, the European Central Bank (ECB) could swamp the European credit market if it liquidates its sizable investment-grade corporate bond portfolio. But will it? We don’t think so. In 2018, central banks prematurely ended their government bond purchase programs, only to have to resume purchases in short order. The ECB won’t want to repeat this scenario, which would threaten market stability amid a growth slowdown. Instead, the ECB is likely to hold onto its investment-grade corporate bonds and even reinvest the cash flow back into the investment-grade credit market, providing further stability for Europe’s credit sector.

But what about demand? Many investors remain on the sidelines, having underweighted fixed income in their asset allocations for years because of exceptionally low yields. We expect that investment-grade corporate bonds will be investors’ natural first step into the market as today’s much more compelling yields lure them back. That positions the corporate sector for a rally. In fact, corporate bond flows have already stabilized and could be on the brink of a reversal.

All the Bells and Whistles

In short, even in the face of a possible recession, signs are highly favorable for global investment-grade corporates. Valuations are attractive. Balance sheets are healthy, free cash flow is expanding, profitability is up, and companies are maintaining relatively conservative financial policies. Indeed, fundamentals have never been stronger heading into an economic slowdown. Even supply-and-demand dynamics are likely to be supportive.

In our view, credit investors should heed the signals and jump on board. Rarely have we seen a better time to invest in investment-grade corporate bonds.

Tiffanie Wong is Director of Fixed Income Responsible Investing Portfolio Management and Director of US Investment-Grade Credit, and Vivek Bommi is Head of European Fixed Income and Director of European and Global Credit at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.