In recent weeks, the US yield curve has been making investors nervous again. The curve has inverted before each of the last seven recessions, and it did so again on March 22. But what does an inversion really mean for equity returns?

The yield curve simply tracks how long-term interest rates stack up to short-term rates, and it’s said to invert when short-term rates are higher than long-term ones. After three-month Treasury bill rates topped those of 10-year Treasury yields for the first time since 2006, we took a closer look at what happened to equity returns after the 11 other inversions that have occurred since the 1960s.

In the very short term, the effect of an inversion is negative. In recent years, that may be because the yield curve has gained incredible power in the minds of financial market participants as a foolproof signal of impending recession. In other words, the signal itself, rather than any fundamental conditions it signifies, might make investors nervous. In earlier years, when yield-curve inversions didn’t even warrant a mention in the New York Times, concern over how rising short-term interest rates would affect loan conditions seemed to be more top of mind.

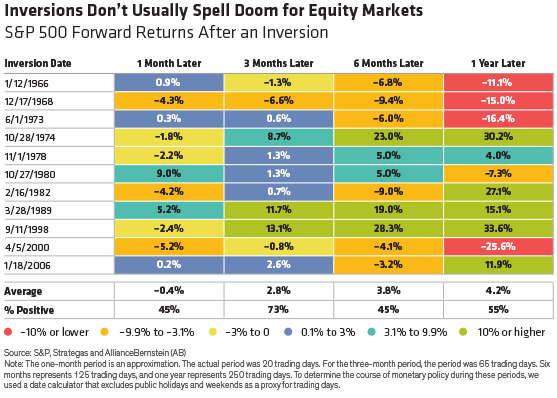

However, average stock returns were negative only in the first month after an inversion. Further out, average returns were positive. And the more time that elapsed since the inversion, the more positive the average returns were.

Looking more closely at long-term trends, however, the picture is more nuanced. Three months after an inversion, stock investors booked positive returns nearly three-quarters of the time. But by the time a year had passed, the results were usually much more extreme: either very positive or very negative.

What’s the Central Bank Got to Do with It?

The Federal Reserve may have contributed to those extreme results. During the three best yearlong periods of post-inversion returns, with gains ranging from 27.1% to 33.6%, the Fed was generally in loosening mode.

On the flip side, the Fed was generally in tightening mode during all but one of the five yearlong post-inversion periods in which investors experienced negative returns. And the one year of negative returns in which the Fed was not strictly tightening, having both raised and lowered interest rates between October 1980 and October 1981, turned out to be the “best of the worst.” The returns of –7.3% that year compare favorably to double-digit losses in other post-inversion periods.

At the moment, the Fed has put further rate hikes on ice, and some investors even believe cuts are in the offing. Historical data reinforce the idea that cutting would likely be better for markets, but the data also show that it’s possible for equity markets to keep going up even under tightening monetary conditions.

Zooming Out: The Bigger Economic Picture

Much depends on the broader economic context in which inversions occurred. For example, when the yield curve inverted in September 1988, the US economy was in its eighth year of expansion. The Asian financial crisis hit many global economies hard, but it failed to slow job creation, arrest the falling unemployment rate or nudge inflation higher in the US. The economy continued to expand into 1999, and US stock investors enjoyed the best returns of all 11 post-inversion periods.

The worst post-inversion returns, however, came soon after that period, with the April 5, 2000, inversion. The Fed had hiked interest rates five times since June 1999, unemployment began rising in May 2000 and technology stocks melted down. The disputed presidential election in November 2000 only added to the tumult. The US ended a 10-year run of economic growth with a recession that began in March 2001.

Investors can and will debate whether history will remember 2019 more like 1998 or 2000. And in the late stages of an economic cycle, it’s tempting to let events like a yield-curve inversion influence investment strategy. But we think investors should not be guided by these impulses.

The yield curve is a signal with no precision: though inversions have preceded recessions, they don’t pinpoint when they’re coming. We’ve also never seen an inversion in the post-QE age, and we’re skeptical that it’s a valid signal for equities this time around. Rates are still historically low, global central banks have paused any move toward tightening and some countries are even unleashing fiscal stimulus. This inversion was also quite brief, and the curve has since steepened, making this a faint signal at best.

Perhaps most importantly, however, inversions say very little about the fundamental ability of individual corporations to grow and prosper under a range of economic conditions. That’s why returns at any point after an inversion aren’t reliably positive or negative. Companies with high-quality growth, low leverage and high-rated credit are likely to fare well whenever the cycle finally turns. It’s best to stick with what works for now.

Scott Krauthamer is Global Head of Product Management and Strategy

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.