Few assets have as much polarized debate and disagreement on their role as an investment than gold. “Gold bugs” tout its reliability as a store of value, while skeptics view gold as a “barbarous relic” whose value is driven primarily by sentiment and occasional mania. Two factors underpin the argument—the limited intrinsic value of gold and a poor understanding of its long-term drivers of price and return—which make it hard to evaluate gold in an absolute sense, unlike other asset classes.

The debate resurfaced this year as falling yields, geopolitical uncertainty, and the possibility of currency wars have reignited investor interest. So how do we evaluate if an allocation to gold makes sense?

It’s About the Return Pattern

Our research shows that returns from gold pale in comparison to other assets, providing an uncompelling case in its favor. Over the last several decades, gold’s performance has been no better than bonds, with much higher volatility. But while its overall return is nothing to write home about, gold can still make sense as a diversifier due to its pattern of returns.

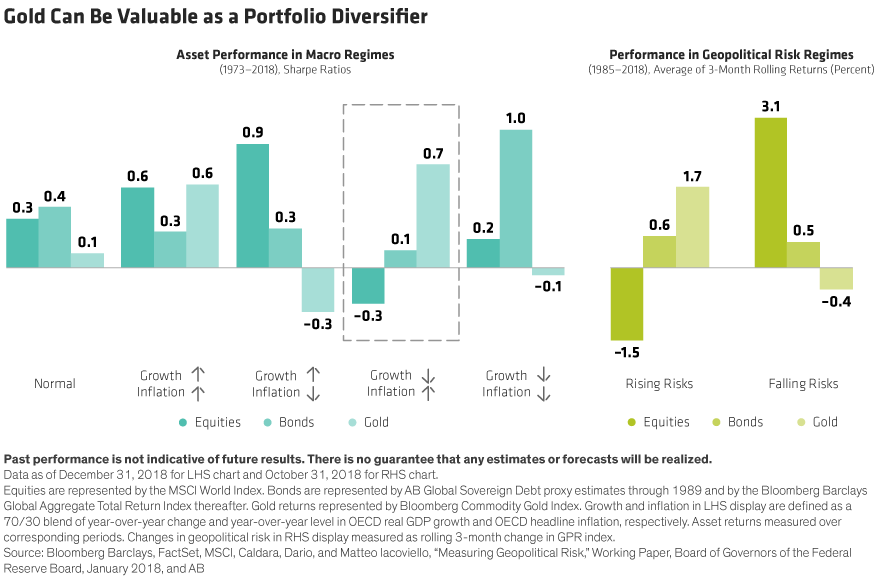

In “normal” environments when risks and uncertainty are low, gold has been a relative underperformer to stocks and bonds. During periods of rising geopolitical or macro uncertainty, however, gold not only delivered positive performance, but also outperformed both equities and bonds. Specifically, in low-probability but highly impactful events—such as high inflation or stagnation, elevated geopolitical risk, and low confidence in monetary policy—when bonds may provide limited diversification, gold tends to be a good diversifier (Display).

Long-Term Drivers Beyond Sentiment

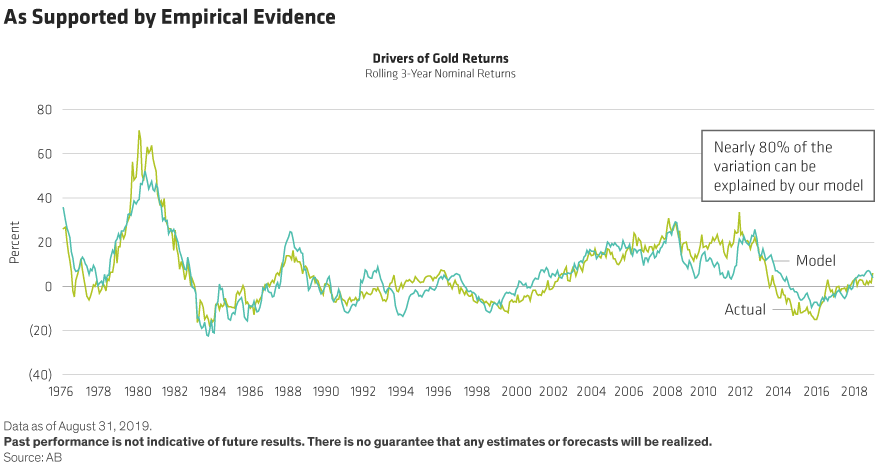

While the price of gold is driven by sentiment in the near term, there are intuitive economic and risk drivers that explain most of the variation in gold prices. These factors explain nearly 80% of the variation in 3-year rolling gold prices (Display).

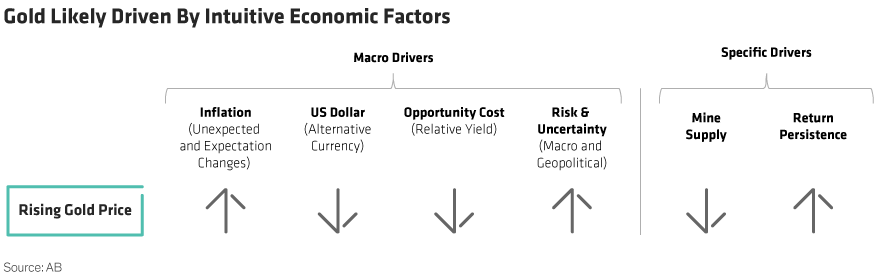

The first is how gold’s price reacts to currency and yields. When the US dollar rises, gold’s value falls, and vice versa. At the same time, when interest rates fall, the cost of holding dollars rises, while the opportunity cost of holding gold, which does not yield an income, falls (Display).

The second is the behavior of gold during periods of high and rising inflation. Gold has historically been a good hedge when the value of money is being eroded and inflation is rising sharply.

The final is idiosyncratic drivers related to supply and demand. Although most of the world’s gold has already been mined, any increase in the supply is negatively related to returns. Gold also exhibits return persistency—as the return on gold increases, market or mining demand tend to also go up. The combination of factors that drive gold prices tend to be persistent, pushing prices even higher.

What About Bonds and Digital Currencies?

Bonds have been an effective portfolio diversifier to equities for the last 40 years. But with $12 trillion* of global bonds with negative yields and active debate about the incremental impact of monetary stimulus, the diversification benefits of bonds cannot be taken for granted in the future. Further, secular forces such as globalization, demographics, and debt, which have put continual downward pressure on inflation, may be abating. So, low inflation for the foreseeable future, which is the expectation embedded in most asset forecasts, might prove to be too complacent as well. If a rising-inflation, lower-growth environment emerges, an allocation to gold can improve overall returns since in this situation, it has historically outperformed both stocks and bonds.

Also, it is worth comparing gold to cryptocurrencies which are designed to be alternatives to fiat currency—a role gold has traditionally played. To put it simply, for anything to qualify as a credible store of value, it needs to have limited supply, be part of an accounting system, and be a good medium of exchange. While cryptocurrencies may exhibit some of these characteristics, current implementations are far too volatile, lack necessary scale, and importantly, unlike gold, lack a long history of being a reliable store of value. Thus, they’re missing the key criteria to be credible alternatives to gold for serious investors.

Worth a Look

Although gold’s expected return on a standalone basis is muted, its efficacy as a hedge in low-probability but high-impact environments—such as rising geopolitical risks, stagflation, or an erosion of trust in monetary systems—would mean that a small allocation to gold in a portfolio of financial assets may make sense for some investors. Trying to time the market, by moving in and out of gold, is difficult to do because the environments where gold provides an effective hedge are hard to predict, so a small strategic allocation would be more effective.

*Through November 29, 2019.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.