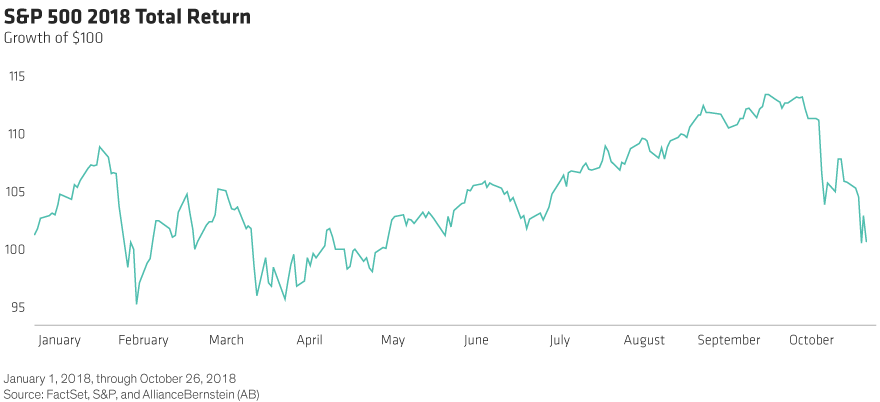

The US market fell 6.8% in October, giving back much of the positive performance from the first nine months of the year. Higher interest rates catalyzed the sell-off, but other worries around future profit growth and market leadership caused additional uncertainty. The confluence of these events disrupted the calm environment to which investors had become accustomed. Now the question is whether stocks are headed for a prolonged down market. While we believe this elevated volatility may be with us for some time, fundamentals are not weakening to the degree that would suggest markets will get meaningfully worse (Display 1).

GETTING HIT FROM MANY FRONTS

The recent rapid 40-basis point increase in interest rates—the 10-year Treasury went from 2.8% in August to 3.2% this month—caught investors unaware. The concern is that higher rates lead to greater borrowing costs, which can slow economic growth—particularly economic growth that has benefited from abnormally low interest rates for years. Now investors are dealing with the repercussions of the higher-rate environment and reassessing the path of rates in the coming year.

Falling US earnings growth expectations for 2019 are also impacting the market. Consensus estimates are for 10% earnings growth in 2019, which follows this year’s more than 20% growth—growth that largely benefited from tax reform. But now the market is considering whether we may need to assume a greater deceleration as there has been some cautious commentary from companies during the third-quarter earnings reporting season.

Specifically, weakening demand and higher raw material costs have begun to hurt earnings forecasts for some companies, and we wouldn’t be surprised to see more cautious comments over the coming quarters. Recent reports from US-based companies are showing the beginnings of trade-related issues. For example, companies in varied industries have called out slower China sales, while others noted raw material cost pressures because of tariffs. Still others remarked that inflationary pressures from wages, transportation, and other input costs were likely to weigh on current and future profit growth.

The last catalyst for the sell-off was a rotation away from the recent market winners. Over the last few years, large technology stocks led the US market higher—particularly the high-growth FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google). Yet, in October, the reverse occurred. There has been a rotation out of these names, into more value-oriented stocks. Much of the selling is a result of profit-taking from such strong winners, but we’d also highlight high valuations and earnings concerns.

WILL THE FED PAUSE?

This recent volatility has investors wondering if the Fed will stray from its stated rate-hiking course, so they don’t unnecessarily slow the economy when the stock market is under pressure. It’s our belief that they will remain on their current path. We expect one rate hike in December and four more next year. There are two main reasons: a solid economy and modestly rising inflation.

The US economy continues to be solid; the initial reading for third quarter GDP was 3.5%, which was stronger than consensus estimates, signaling strong growth, although slower than the 4.2% from the second quarter. At the same time, inflation, while still under control, has been increasing this year. The September consumer price index (CPI) reading indicated inflation of 2.3%, above the 2% Fed target (Display 2). Today, with little slack in the economy and inflation above the target, we believe the policymakers will remain on course by raising rates each quarter through the end of 2019, despite the current elevated market volatility.

STAY THE COURSE

Unfortunately, these crosscurrents lead to investor uncertainty, and that’s why we’re experiencing heightened market volatility. But in our opinion, as long as the underlying economy is sound, as it is today, we don’t believe this is the start of a sustained downward market.

As the market goes through this adjustment and volatility remains high, it’s understandable that investors are jittery. As we’ve said many times in the past, though, trying to time a market sell-off or bottom rarely works. Instead, we recommend sticking to the long-term plan and asset allocation agreed with your financial advisor. But staying the course does not mean doing nothing—we attempt to tactically adjust our positioning in anticipation of severe market moves as well as to take advantage of market shifts that are unwarranted or exaggerated.

For more on trends in the economy, markets and asset allocation for long term investors, explore The Pulse, a Bernstein podcast series, and for additional thought leadership, check out the related blogs here.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.