The government shutdown and temporary displacement of some workers didn’t cause the strong US labor market to miss a beat. Today’s jobs report reinforces that gains have been accelerating. That’s good news for the economy and markets.

Big Job Gains in January’s Report

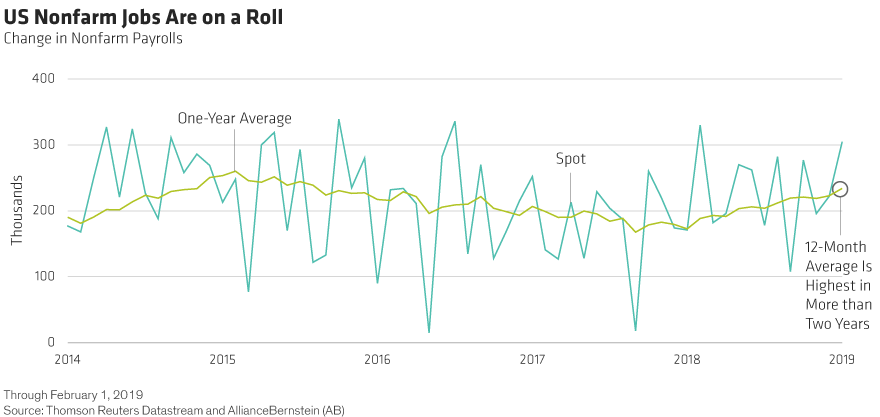

All told, the US economy picked up 304,000 jobs in January. That’s stronger than expected, even taking into account the big downward revision to December’s payroll numbers. The recent job gains remain impressive, even after nearly a decade of steady progress. The lofty numbers of the past few months aren’t likely to last, but even the trailing 12-month average change in nonfarm payrolls is the highest in more than two years (Display).

The government shutdown caused a few distortions to the latest data, but we expect the distortions to reverse next month…assuming the government doesn’t close its doors again. In any case, the shutdown clearly didn’t derail the broad strength in the labor market.

Wages Are Up, Bringing More Workers into the Labor Force

Given the robust job market and shrinking ranks of the unemployed (4%, the lowest in almost 20 years), it’s not surprising that wages have risen. As the pool of available workers shrinks, it takes higher pay to compete for them—and that higher pay is an incentive for more workers to look for jobs. The US economy is still close to a cycle high in wages, and our most reliable leading indicators suggest that increases will likely continue.

The best news in today’s report was another uptick in the participation rate. We didn’t expect December’s pace to carry over into January—but it did. The participation rate is now the highest it’s been since 2013. The higher the participation rate, the more likely the US economy can add jobs without heating up inflation. We’re still skeptical that this increase will continue, because demographic trends point in the other direction. But it’s definitely good news that higher wages are luring more workers to the labor force.

A Strong US Consumer: Good News for the Economy and Markets

The net effect of all of this: household paychecks continue to grow. In fact, they’re growing faster than at any point since the global financial crisis. Financial markets seem to have a lot of concern about a slowing economy, but the strong labor market suggests the opposite: the consumer is in really good shape. Consumption accounts for almost two-thirds of the US economy, and as long as consumer fundamentals remain this strong, a recession is highly improbable, to say the least.

If the Fed looked only at the labor market, the case for hiking rates would be pretty strong. Still, policymakers have made it clear that they will wait several months to see if inflation picks up before thinking about rate hikes. So, the latest jobs data should be positive factors for risk assets. Strong labor markets equal strong consumption, and with the Fed stepping aside for now, that’s good news for the near-term US economic outlook.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.