Investing can be overwhelming. The wide array of choices and technical jargon paralyze some investors, while the market’s gyrations scare others off. It’s easy to avoid spending time learning how to invest, but doing nothing can be harmful. This holds especially true for women, 95% of whom will eventually become their family’s primary financial decision-maker at some point in their lives.

Where should you start? Tackle the building blocks.

Stocks (ownership interest in companies) have grown most in value over the past 90 years—but fluctuated most along the way. High-quality bonds (US government and company debt) and short-term cash instruments grew much less with fewer ups and downs. This means stocks pose more market risk, but bonds and cash pose more shortfall risk: not earning enough to fund your goals. Bonds and cash also carry more risk of losing value relative to inflation.

With those basics behind you, here’s a quick guide to creating an investment plan:

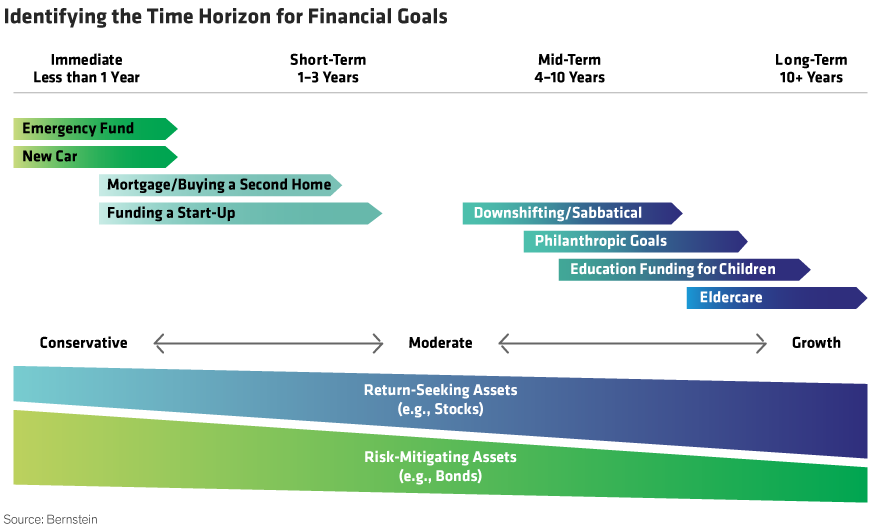

- Align your time horizon and asset allocation (Display).

-

For emergency cash and spending within one year, set up a bank savings account or a money market fund. Cash instruments like these are best when you need the money soon. How much emergency cash should you have? Enough to cover 3-6 months of expenses if you’re in a dual-earner family; 6-12 months if you rely on one income.

-

To fund spending in one to five years, invest mostly in risk-mitigating assets, such as high-quality bonds. Include some return-seeking assets, such as stocks, to add upside potential. Stocks also diversify your exposure to a potential rise in inflation or interest rates, which hurts bonds more.

-

For longer-term goals, invest more in stocks. You’ll likely experience short-term losses, but try to remain focused on your long-term objectives. In the long run, stocks have historically been the higher-returns asset class. Also maintain some exposure to bonds for income, stability, and diversification.

- Diversify your investments by issuer, economic sector, country, and company size. Diversification reduces risk, because different types of investments rise and fall at different times (they are weakly correlated).

- Avoid frequent and unnecessary changes to your strategic asset allocation. It can lead to unnecessary transaction fees, lower returns, and higher income tax due.

- Consider active management strategies for your longer-horizon investments. They can add returns and avoid the concentrated risks that passive index strategies can be prone to. Another way to diversify? Try a combination of both active and passive strategies.

Remember, time is on your side. The sooner you get started, the more time your portfolio will have to benefit from compounding—a key lesson you won’t want to skip.

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.