Is the rising tide of US companies touting adjusted (or non-GAAP) earnings in recent quarters a danger for equity investors? Not necessarily. You’ve got to dive deeper into the details.

Accounting Wars

Recently a number of market watchers have been sounding the alarm about the widening chasm between GAAP and non-GAAP earnings—that is, earnings reported according to Generally Accepted Accounting Principles versus pro forma or “adjusted” earnings measures.

Adjusted earnings typically exclude certain expenses, charges or gains that are required under GAAP standards (the most common being stock-based compensation, amortization of intangible assets, and charges related to asset impairment or restructuring). Company managements argue that adjusted earnings can give investors a more accurate snapshot of underlying operating performance. But as adjusted earnings are almost always higher than GAAP earnings, critics worry that managements may be massaging the numbers to create a rosier picture than the fundamentals warrant.

This long-simmering debate has reached a boiling point in recent months, as the gulf between GAAP and non-GAAP earnings has gotten too big to ignore. In 2015, about 87% of companies in the S&P 500 reported adjusted earnings, up from 73% in 2010. And the median size of the adjustment increased from 8% in 2010 to 25% in 2015. In aggregate, reported GAAP earnings were almost 22% below adjusted earnings last year. Overall, there has been a sizeable increase in both the frequency and the magnitude of the adjustments.

There have been two typical responses to this state of affairs. One has been to see this as a signal that stocks may be overpriced, since “true” GAAP earnings are so much lower than the flattering numbers managements would rather have investors focus on. Another is to treat it as an early sign of a possible recession, on the theory that deteriorating conditions at the end of a business cycle might prompt companies to do more window-dressing.

It’s All About the Writedowns

We see it differently. In our view, the spread between GAAP and adjusted earnings is a symptom of the dearth of investment opportunities in a world awash in capital.

Why do we say that? Let’s look more closely at what’s behind most of the growth in adjustments. The lion’s share is due to larger and more frequent write-offs of goodwill and asset values. So it’s not that companies are becoming more cavalier about accounting standards; it’s that they are getting more aggressive about writing off impaired assets.

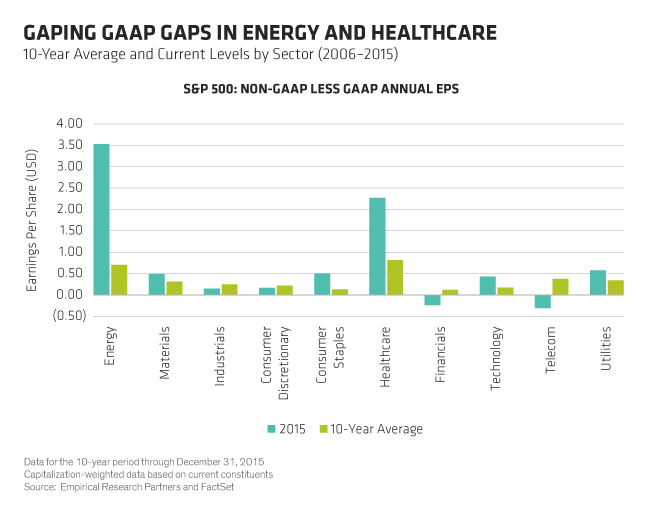

It also helps to distinguish between different industry sectors. Although earnings adjustments in 2015 were higher than the 10-year average in six out of ten sectors studied, the bulk of the increase was driven by energy and healthcare (Display). Energy companies have been writing down investments made when oil prices were a lot higher than they are now. In healthcare, a spate of deals and consolidation among the largest companies has led to steady growth in amortization of intangible assets, generally excluded from adjusted earnings.

While the causes of the write-offs in these two sectors may seem different on the surface, they share a common root. In each case, managements were striving to grow earnings in a low-growth world—and, to put it bluntly, they overreached. Energy companies paid too much for drilling rights and development crews, banking on the idea that oil prices would remain at their historical highs or rise even higher. In the case of healthcare, high valuations for target acquisitions drove companies to make overly optimistic projections about their ability to raise prices, expand distribution and commercialize drug pipelines.

In other words, we see the current discrepancies between GAAP and adjusted earnings as signaling that managements invested too much and were unable to earn an acceptable return. This would be more worrying if these write-offs presaged a sharp and broad drop in capital and consumption spending, as was the case when overinvestment in residential real estate sparked the Great Recession.

But we see two mitigating factors. First, the drop in energy prices (and the attendant plunge in investment) has already been working through the economy. Second, write-offs of healthcare company goodwill (an intangible asset) are unlikely to have any appreciable impact on economic growth.

Ignore the Noise, Focus on Cash

Still, the wrangling about the proper measures of profitability can be confusing. So what’s an investor to do? We believe equity investors should keep an eye out for companies with a couple of key attributes. First, a strong cash-flow yield (that is, cash flow divided by price). This is partly because cash flow can provide a valuable gauge of a company’s financial health. Second, a history of prudent capital stewardship. After all, one of management’s most critical tasks is capital allocation. If the investment landscape is too barren, we think the better course is to give money back to shareholders and let them figure out what to do with it.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.