Investors pursue alternative investments for both their attractive risk-adjusted returns and diversification principles. But for many wealthy families, there’s a hidden bonus: Alternatives provide an excellent source of wealth transfer opportunities. That’s why a growing number of investors are looking past the initial shortcomings and sourcing wealth transfer from their alternative portfolios.

Reframing Alts’ Drawbacks

While alternative investments—such as private equity, venture capital, and real estate—offer many benefits, they are not without drawbacks, especially if you’re counting on your portfolio to fund annual spending needs. Three obstacles stand out:

-

Illiquidity. Many alternatives do not generate steady cash flow. Instead, these long-dated strategies deliver profits upon exiting. They typically require investors to commit capital over several years and tend to have multiyear “lock-ups” that prohibit investors from selling or redeeming.

-

Income tax. Alternatives often generate significant income tax—and charge higher fees—relative to their traditional counterparts, detracting from overall returns.

-

Lack of control. Many alternatives use partnerships or limited liability company structures. With a minority interest, investors have little control, which is often magnified by a lack of transparency. Plus, these entities sometimes restrict transfers of interests to family or others.

Despite these concerns, many still find alternatives’ growth and diversification profile attractive. Why? Because potentially negative attributes can be viewed through another lens, one that makes them compelling opportunities for wealth transfer.

FIVE WAYS TO EXPAND WEALTH TRANSFER USING ALTERNATIVES

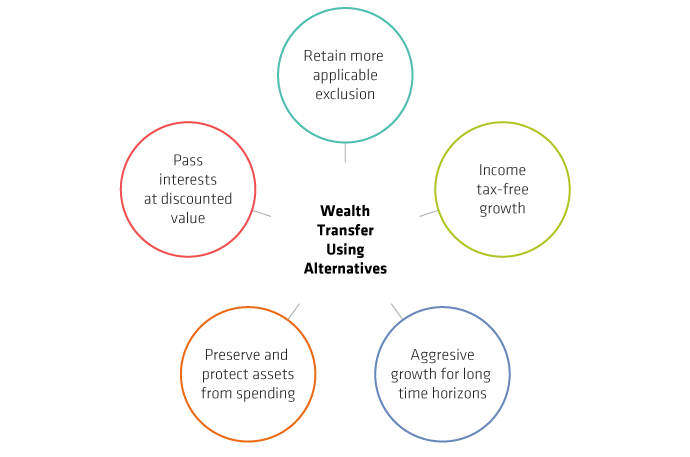

Beyond the obvious desire to gift assets, a well-structured wealth transfer strategy can accomplish several goals (Display).

- 1. Retain Applicable Exclusion: Alternatives’ relatively high growth potential makes them natural candidates for wealth transfer. That’s because moving assets while values are low or discounted ensures future growth occurs off your balance sheet and to your beneficiaries’ benefit. Think of it as clearing the way to keep more applicable exclusion amount—the amount you can pass to any person or entity without paying US gift or estate tax.1

- 2. Income-Tax-Free Growth: Some investors worry that transferring an asset with a high ongoing tax liability seems unwise, but savvy planning can overcome this challenge. Take hedge funds, which tend to generate considerable income tax. By moving the hedge fund to an irrevocable grantor trust, the grantor retains the tax liability, allowing the trust to grow income-tax free. Better yet, that tax settlement doesn’t use the grantor’s applicable exclusion amount.2 Another option? Investing through private placement life insurance, which allows the beneficiaries (or to a trust for their use) to receive the funds free of income tax following the insured’s death.

- 3. Aggressive Growth: Other hitches to alternatives—volatility and illiquidity—are surmountable for younger beneficiaries. An aggressive, growth-oriented allocation suits a younger beneficiary with a sufficiently long horizon to recover from market drawdowns. Shifting the grantors’ mindset opens the entire universe of alternative investments to younger generations.

-

4. Spending Constraints: Can illiquidity be attractive? It may be for parents and grandparents who wish to preserve and protect assets, since owners cannot readily sell due to illiquidity. Here, embracing illiquidity imposes spending discipline on future generations.

-

5. Discounted Value: Alternatives’ partnership and LLC structure also enhance wealth transfer. Lack of control and marketability—as well as illiquidity—allow minority interests to be moved to trusts at discounted values. Similar concessions apply to any interests that remain on an investor’s balance sheet following his or her death. These discounts can be amplified by transferring the interests to a family limited liability company (LLC) or family partnership and then giving interests to a grantor trust. The importance? Interests pass to heirs at up to 40% less than liquidation value.3

PRACTICAL CHALLENGES

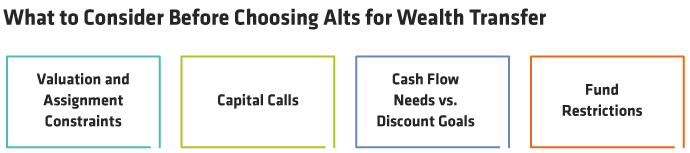

While the benefits of pairing alts with wealth transfer abound, so do the challenges (Display).

Most alts don’t undertake daily valuations, so investors must wait for monthly or quarterly pricing. Plus, alternatives commonly limit when owners can assign interests. This combination of constraints can create challenges for specific wealth transfer strategies—such as grantor retained annuity trusts (GRATs)—which require precision for the payment of annuities.

Capital calls may also come into play. Private equity, for example, often calls for investors’ capital over five-year periods. Investors must provide enough liquidity to satisfy these commitments when transferring private equity to a trust. With an irrevocable trust, that’s easily accomplished. An investor can make subsequent gifts as capital is due4 or lend assets to the trust to satisfy capital calls. But an investor using a GRAT must fund it to meet capital calls in advance. That additional capital will add to the calculation base of the GRAT annuity payment,5 making GRATs suboptimal for transferring private equity investments.

That doesn’t rule out private equity altogether. In fact, certain private equity strategies may prove ideal for grantors interested in taking advantage of the discount and moving potentially appreciating assets off their balance sheet. Strategies like secondary funds—which generally call capital faster than traditional private equity funds—neither burden the beneficiary nor require the grantor to make those calls.6 Likewise, funds that fully invest at inception—like hedge funds or alternative credit—may appeal. Keep in mind, more frequent liquidity windows may decrease discounts available for lack of liquidity. For that reason, carefully weigh cash flow needs versus discounting goals.

Transfer strategies should also factor in restrictions. Not all funds permit transfers, while others allow them with prior consent and/or to a restricted class (e.g., family members or trusts for family members’ benefit). Before earmarking an alternative investment for a wealth transfer strategy, determine whether a fund allows transfers and under what circumstances.

COMPLEX, BUT WORTH IT

The popularity of alternative investments will undoubtedly expand their use as wealth transfer tools. And that makes sense since gifts of alternatives can provide growth and income for subsequent generations. Still, wealth plans must manage these gifts carefully. Working with an estate, tax, and investment professional who is well versed in planning with alternatives is critical to maximize their benefits.

1 The applicable exclusion amount in 2021 is $11.7 million per person. See § 2010.

2 Revenue Ruling 2004-64.

3 See § 2010. The valuation of family entities, including applicable discounts, has been the subject of extensive Tax Court litigation. For example, in Grieve v. Commissioner (T.C. Memo 2020-28) published March 2, 2020, the Tax Court rejected IRS methodology limiting applicable discounts for non-voting membership interests. The valuation of business entities and determination of applicable discounts is beyond the scope of this paper. See Business Valuations for Estate and Gift Tax Purposes, AICPA (2015) for a comprehensive review of valuation approaches.

4 The investor may trigger gift tax on the transfer if the investor does not have sufficient applicable exclusion amount remaining to shield the gift.

5 § 2702.

6 A secondary fund focuses on buying interests from limited partners or general partners of existing private equity funds. See icapitalnetwork.com, “Secondary Private Equity Funds: Diversified Private Equity Exposure with an Attractive Risk Profile,” Kunal Shah and Tatiana Esipovich, April 27, 2020.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.