There are currently 15 countries with interest rates lower than 1%, and more than half of those are negative. In the US, despite 10-year Treasury yields moving 40 bps higher since the beginning of September, rates are still historically low. And if the economy slows more than expected, they may move down again. What could these low interest rates mean for your investments?

Low Rates Affect Investments Differently

Low-interest rates hurt some asset classes, while others benefit. Bonds tend to have lower yields as rates fall, which detracts from their attractiveness. Cash, similarly, is less desirable in a declining rate environment. But that may be the point when some central banks adopt low rates—to encourage businesses to invest rather than hold cash.

Stocks, on the other hand, generally move higher. That’s because companies can grow their businesses by borrowing cheap money. Asset prices also increase because individuals tend to have more money to spend in a low-rate environment, increasing demand, which often pushes prices higher. Private market investments benefit from low rates, too—in some cases, more than public equities.

Private Markets Can Take Advantage of Low Rates…

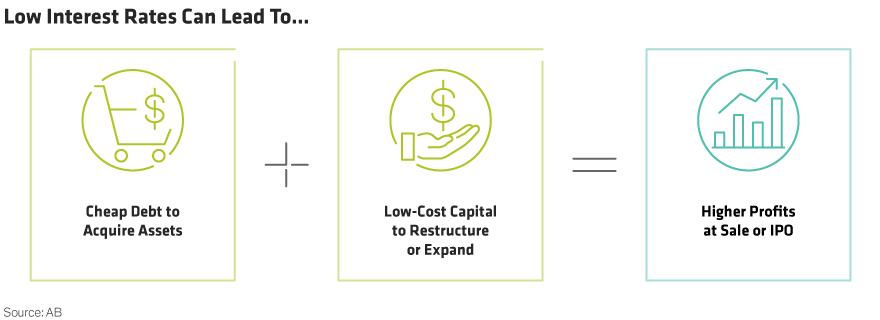

Private equity (PE) funds take ownership stakes in the companies in which they invest. So, just like public equity investors, they gain from a company’s ability to use low-cost capital to fund business growth. But private equity can also take advantage of low rates during an acquisition or to kick off an expansion strategy. If debt is used to finance an acquisition—either wholly or in part—then when rates are low, the overall cost of financing an acquisition will be less, and PE funds will benefit. However, funds cannot fall into the trap of paying up for an asset because they have cheap money at their disposal. Rather, they are challenged by maintaining price discipline and not being over reliant on low-cost debt financing to justify a higher overall purchase price. When a fund exits their position in a company—either through a sale or initial public offering—they may generate a stronger profit since they purchased the company cheaply, if they remained disciplined (Display).

Private real estate funds have a similar dynamic. They can buy existing or develop new properties using low-cost debt and finance improvements to the properties at the discounted rate. These improvements generally lead to increased occupancy and the ability to charge higher rents, driving more robust cash flow. When the property is disposed of, the high occupancy and history of stable rents generally drive up the sale price.

…But Don’t Need Them to Succeed

When rates do rise—as they inevitably will at some point—private markets, importantly, can still do well. At times, private market investors can offset the higher cost of borrowing in rising rate environments by obtaining assets at lower prices. That’s because sellers can become nervous that they won’t be able to dispose of their asset in a timely manner, so they may lower their asking price.

Additionally, private market funds do not rely singularly on debt leverage as their main source of generating above-market returns. Their primary source of returns comes from business growth, product or service transformations, or operational improvements, which are largely unaffected by the level of interest rates.

Lastly, because they are long-term in nature, and able to withhold making investments when the market is unfavorable, private funds can be disciplined and intentional in how they allocate capital to capture the greatest amount of upside over the fund’s life.

‘Chasing Capital’ Pushes Valuations

Low-interest rates can also be problematic. At times investors will swap investments that get hurt in low-rate environments with ones that do well. Especially if they have a similar risk profile. This substitution can flood certain asset classes with capital all at once. Today we see signs of this in the hunt for yield in public equity markets.

Large quantities of capital can also increase competition for assets in the private markets and cause prices to soar. ‘Chasing capital’ can result in expensive PE and real estate deals. If funds cannot find deals that are undervalued or rationally priced, they will end up overpaying for assets, which would likely cut into profits, or if the market turns down, result in losses.

But for funds looking to exit an investment, an oversupply of capital can be a positive. Since investors tend to bid up prices when there is a lot of money chasing a few opportunities, sellers have the advantage. Think of a home seller. If there are several buyers interested, the price of the home tends to get bid up. The value of the house did not change, but competition raised the price. This same phenomenon happens in ‘hot’ markets. So when interest rates are low or declining, private market sellers can often achieve a higher than anticipated return.

Discipline Is Key

Central banks use monetary policy to spur economic growth. The intended consequence of low rates is to encourage companies to borrow inexpensive money and invest in their business. Private market investments can take advantage of this cheap money as well. But the downside to discounted money is it often comes in droves, ratchets up competition, and can push asset prices to unreasonable levels. So private investors need to maintain a disciplined process to see the benefits of the low-interest rates. And while they don’t need low rates to be successful, they won’t complain about them either!

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.