Exiting the market usually triggers a tax bill—a fact that many market timers overlook.

When bad news seems to come in waves, it’s tempting to look elsewhere for a safe place to park your portfolio. Yet in the heat of the moment, few investors carefully think through the math. That’s unfortunate, because ignoring the tax impact of market timing can prove hazardous to your wealth.

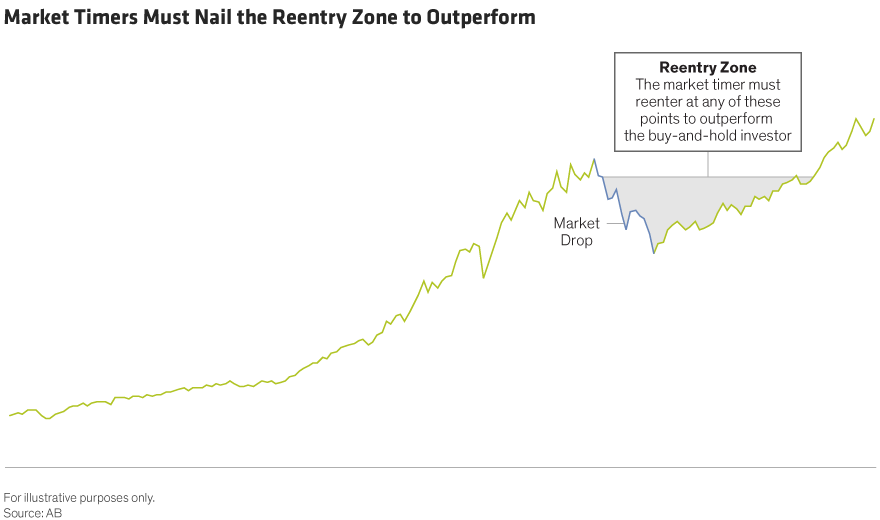

By now, most investors are familiar with the case against market timing. Too much hinges on knowing the unknowable, such as when and by how much the market will decline, and when prices have sufficiently dropped to warrant reentry. What’s more, few have the fortitude to reinvest once stocks have been battered and bruised.

But one compelling argument is rarely explored: the tax hit.

Taxes—One of Life’s Certainties

Taxable investors who retreat from the market essentially trade the potential to invest in an uncertain environment for the certainty of owing taxes. Think of the unrealized gains that come due as the inherent cost of selling. To recoup those costs, investors must earn higher returns than they otherwise would have—and that requires reentering the market below where they’ve exited.

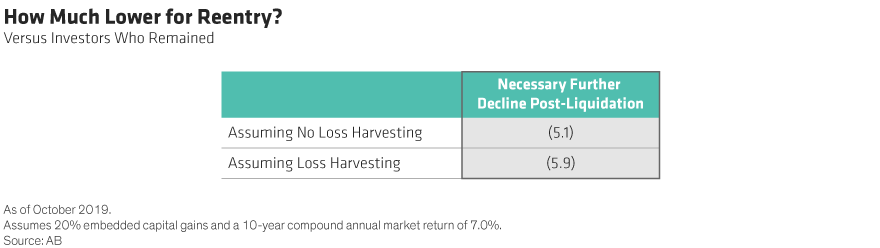

How much lower do you have to reenter after paying taxes upon exiting? The math gets a little tricky, but our recent white paper, The Hidden Cost of Market Timing, crunches the numbers. From those calculations we know that if the positions in your portfolio are up 20%, on average, from your purchase price—and equities deliver a 7% compound annual return over the next 10 years—you would need to reenter at a point 5.1% lower than where you exit for a market timing strategy to outperform. If you have greater gains, the reentry point would need to be lower still.

Loss Harvesting Changes Your Reentry Point

But accelerating unrealized gains aren’t the only drag on the market timer’s portfolio. There’s also a subtle opportunity cost: if the market drops after you’ve retreated, you forego loss harvesting opportunities enjoyed by other taxable investors.

How does loss harvesting change the equation?

In a starting portfolio with modest unrealized gains of 20%, a 20% market decline creates loss harvesting opportunities. To compensate for waiving this compelling opportunity, the minimum reentry point decline that the market timer requires increases from 5.1% to nearly 6%. In other words, we must raise the bar in terms of the magnitude of the decline required for the market timer to be made whole relative to staying invested and harvesting losses (Display).

Essentially, harvesting losses during a downturn adds tangible value. While not as great as the potential value from perfectly threading the market-timing needle, loss harvesting is infinitely more reliable. It represents the silver lining that those who stay invested can count on to boost after-tax returns should a market decline come to fruition.

Keep in mind that all of this remains guesswork. You cannot anticipate the extent of the decline—or the potential value that may be reaped from loss harvesting. If, for example, the market falls by more than 20%, then loss harvesting becomes even more valuable, and your minimum reentry point falls further. For this reason, you can only guess at your minimum reentry point.

In the end, “successful” market timing rests on variables that are ultimately unknowable. That means investors attempting it must acknowledge the inherent riskiness of their approach.

Planning Helps Resist the Timing Urge

Given the uncertainty of market timing, we’d suggest a different course of action: inaction. Instead of succumbing to emotion, develop an asset allocation that you’re confident can withstand a market downturn without seriously jeopardizing your long-term financial goals. Then stay put.

This article is an edited excerpt from The Hidden Cost of Market Timing, Bernstein, 2019.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.