Innovation is overtaking a broad swath of the investment industry, from portfolio design to the definition of alpha and from investment methodology to organizations themselves. Much of this evolution is driven by changes within the industry (such as lower fees on passive and quasi-passive products as well as the growth of alternatives) and exogenous factors in the broader policy and market outlook.

Rotation from Traditional Active to Passive/Alts Barbell

One area seeing transformation is the realm of asset allocation. We think the rotation from traditional active funds into a passive/alternatives barbell will continue, motivated by the view that traditional equity and fixed-income allocations will be unable to generate high returns and that alternatives may offer better diversification. Some investors also specifically seek inflation protection.

The macro outlook of high asset valuations, lower real returns and less diversification all point toward a continuing push into alternatives. At a more fundamental level, this migration is also supported by relatively fewer initial public offerings (excluding special purpose acquisition companies, at least) and companies choosing to wait longer before they list, depriving public markets of some early-stage growth opportunities.

Having said that, we also see a greater case for making distinctions within alternatives. For private equity in particular, the outlook may become less favorable. The amount of committed but uninvested capital (so-called dry powder) has nearly tripled over the past decade (Display), bidding up the entry price and forcing down future returns. Indeed, the average multiple for private equity deals has risen over this time frame as a consequence.

Also, the strong recent track record of private equity returns has benefited from an incredibly favorable period for businesses that rely on leverage, with both credit spreads and risk-free rates declining. That backdrop can’t be relied on to continue.

A further consideration for private equity is the question of the nature of diversification it offers—one should not conflate diversification with stale prices. Private equity also faces considerable risk from fund selection, given its much wider spread of outcomes between top and bottom quintile funds compared with active public equity.

If part of the rationale for private equity is that it can deliver higher returns than public equity, and if going public is the ultimate exit, the implication is that over multiple cycles the returns from private equity can’t escape the same constraints as public equity. That is, other than by using leverage, which investors can access separately. The bottom line: allocations to alternatives will likely expand, given a supportive macro environment, but the average private equity investment might disappoint.

A Blurring Line Between Passive and Active

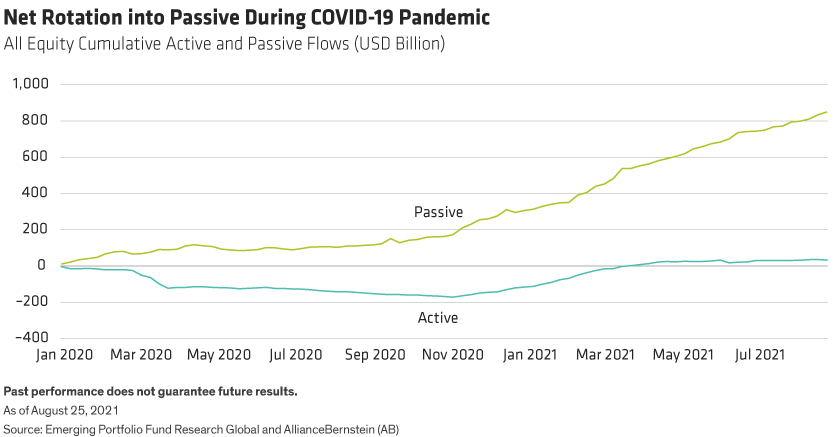

During the pandemic, we have witnessed a net rotation into passive and away from active. The passive share of assets under management (AUM) actually fell slightly in the early stages of the pandemic, but this decline stemmed from cuts in passive allocations as a quick way to reduce equity exposure. In the (belated) rotation back into equities that started a year ago, the rate of rotation from active to passive increased further (Display).

We expect the passive share of US equity AUM to increase further; passing the 50% threshold was not in any way a limit, merely a marker along the route. The realistic near-term limit to passive allocation comes not from the market but from asset owners who realize that passive allocations in a 60/40-like framework pose the risk of delivering negative real returns.

As the active/passive equity migration continues, the line between what counts as active and what counts as passive is not a fixed line marked in stone but a dynamic frontier.

This is most evident in the declining fee for equity factors from over 20 basis points to 4 basis points in the past decade. So, the cheap benchmark that funds are compared with is no longer simply the broad market index but the broad index and a set of cheap factor exposures that are almost free. In this way, the benchmark for active management is revealed to be multivariate—not univariate.

On one hand, this massively raises the bar for active management, but on the other hand it bolsters active management by revealing which kinds of funds genuinely add value through return streams that can’t be easily replicated. We think that this evolution shifts the key definition of alpha in the industry away from simple excess return and toward idiosyncratic alpha measurement versus a passive factor set.

From Excel to Python…and Then Machine Learning?

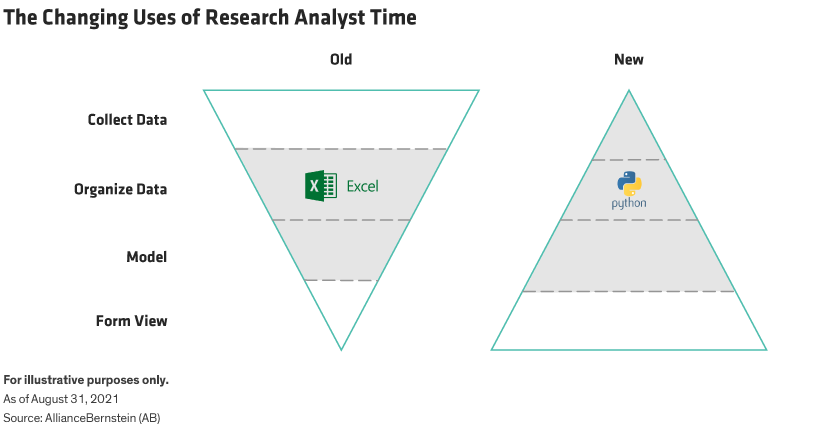

A very different kind of innovation in the industry is transforming the methodology of financial analysis. We would argue that the switch from paper spreadsheets to Excel 30 years ago did not materially change the nature of financial models—it merely made them more complicated and easier to update. But a switch from Excel to Python is likely to fuel a more profound change, with analysts spending their time very differently (Display).

Already, some data collection—such as web-scraping prices—is executed with Python. Python also seems likely to increasingly handle organizing that data. In time, this could extend to the actual modeling process. There’s always resistance to this type of change, but there are push and pull factors.

The pull factor: as “passive” strategies develop, the dividing line between passive and active will shift, requiring active approaches to tap a broader set of data in order to achieve idiosyncratic returns and stay ahead of the competition. The push factor is cost: it’s likely more efficient in time and personnel to manipulate data in Python, and inexorably declining fees and pressure on margins will force the transition.

This process has advanced the most in quantitative modeling. Modeling for truly systematic investment wasn’t taking place in Excel in the first place, but here the methodology is changing by adopting machine learning—and in some cases the claim of artificial intelligence. The push and pull factors are similar, but the jury remains out on how far the process will play out. Adoption of machine learning for manipulating and extracting data seems set to grow dramatically, but it’s unclear to what extent it can be applied to making actual investment decisions.

There are also open questions on how much complexity is acceptable in financial models, especially when they fail; preferences may develop for different kinds of machine learning models. So-called ensemble models like random forests can be constrained structurally so that they can be mapped onto the “real world,” while neural nets and support-vector machines lack that option.

Factors Could Become the New Asset Classes

The past four decades have been an extraordinary time, with prices on financial assets rising and diversification among them plentiful. Now, investors face a strategic valuation problem. This isn’t necessarily bearish, but it does imply low expected real returns on major asset classes. And if inflation rises, bond diversification may not be as effective, which could increase portfolio risk.

Set against this backdrop, valuation spreads within asset classes are very extreme. At the same time, we can demonstrate that the diversification benefits of factors tend to be more stable than those of asset classes. Perhaps at least part of the answer to the current risk/return dilemma is to consider asset classes and factors as interchangeable. After all, securities markets are ultimately merely composed of assets issued by companies and governments—who’s to say that a more “primal” way of dividing them up is by their legal structure (asset class) rather than financial characteristics (factors)?

One pushback on this notion is that it requires investors to deploy assets in a way that, for the past decade, would have been very suboptimal.

For 10 years, the cheap and accepted option of simply buying passive stocks and bonds has been a great trade. Meanwhile, the average return of factors has been below their longer-run average rate of return, with the case of apparent “failure” of the value factor prominent in that. However, we think that cyclical factors explain at least some of this. A factor approach would certainly not be a panacea, but we think it might be essential to achieving a given level of risk/return and will likely appeal more to investors who believe that the post-pandemic world will be fundamentally different.

Organizational Implications: Falling Silos?

What are some of the organizational ramifications of the innovations we’ve discussed? In an environment in which it’s harder to generate a given level of real return, it’s more likely that the industry will need to consider its output as a “return stream” rather than a certain kind of fund “product.”

This could lead to realigning organizations based on the nature or characteristics of return streams (alpha, factors, security-specific, macro) rather than asset class. Moreover, the switch from Excel to Python for financial models seems poised to blur the distinction between quantitative and “fundamental” models—and hence the historic partition between these modes of investing.

At the same time, to the extent that this modeling change enables the use of (expensive) new data sets, it implies that the new models that are needed, and the teams that develop them, become functions spread across organizations rather than limited to a specific asset class. That shift could make new modeling capabilities more cost-efficient. It might be necessary to break up long-established investment industry silos before these changes can be fully realized.

Inigo Fraser Jenkins is Co-Head of Institutional Solutions at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.