With the post-pandemic US economy on the mend, a new threat has emerged: inflation. A confluence of pent-up consumer demand, record household savings, low inventories and global shortages has ignited the sharpest near-term price hikes in decades.

Price appreciation during recoveries is normal, but this economic snapback is reinvigorating inflation much more than in prior rebounds. US core inflation is at a 25-year high. In May alone, the Consumer Price Index (CPI), not including food and energy, rose 0.7%. We believe some elevation may continue for several months, but will likely be transitory as COVID-19 dislocations gradually dissipate toward year end.

Just the thought of inflation, however, gives muni investors the jitters, and who can blame them? Market reaction to inflation has been historically destructive to muni bond returns, often driving them into negative territory (Display).

Expectation Alone Can Drive Results

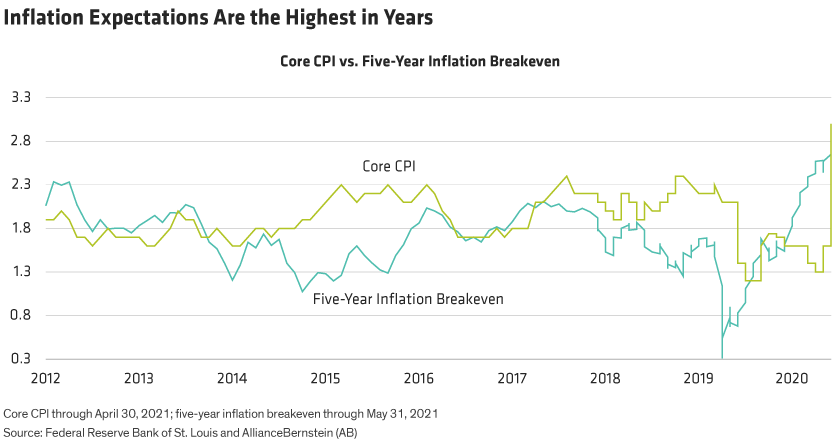

After bottoming in March of 2020 due to COVID-19 economic fears, break-even inflation rates have been rising ever since. The break-even inflation rate is the difference between yields on Treasury Inflation-Protected Securities (TIPS) and those of comparable-maturity Treasuries. Breakevens effectively measure broad inflation expectations among market participants. And the break-even inflation rate on five-year securities rose from 0.49% to 2.57% in the 14 months between March 31, 2020, and May 31, 2021 (Display).

During the same period, inflation protection outperformed, as it has in the past when expectations, not just inflation itself, were rising. For example, five-year Treasury securities posted returns of (0.07)%, while comparable-maturity TIPS delivered 11.30%. Clearly, expectations can have as much influence on market direction as actual inflation itself.

As Inflation Rises, Seek Shelter

All this adds up to why muni investors should be ready and able to protect their interests in a rising-inflation environment. But how exactly?

First off, avoid the sidelines. Just waiting for inflation to settle down can lead to missed opportunities. Idle cash is no match for inflation’s erosion power either. Be strategic instead and diversify into investments designed to navigate inflationary environments.

TIPS are popular inflation-protection tools. TIPS adjust their face value in step with the Consumer Price Index (CPI), then pay interest based on the revised face value. TIPS worth $1,000 with a 1.5% coupon, for example, pay $15 in annual interest. If inflation is 2%, then their face value ratchets up to $1,020, which raises the interest payment to $15.30.

For tax-aware investors, however, TIPS’ notorious tax inefficiencies can be a disadvantage in two ways. First, their interest and the inflation adjustment are taxed at ordinary income rates, not the lower capital gains rates. Second, investors must wait until the TIPS mature to receive the inflation adjustment to the bond’s principal value, but they are taxed in the year the adjustment is generated—an inconvenience known as “phantom income.”

Choose Tax-Efficient Inflation Protection Carefully

A vehicle similar to TIPS provides inflation protection but with tax efficiency too: municipal inflation-linked debt. Like conventional muni bonds, muni inflation-linked debt is issued by state and local governments to fund operations and projects, and interest paid is tax-exempt to certain investors. As with TIPS, the bond’s face amount and interest payments are adjusted based on inflation.

But muni inflation-linked debt is hard to find. And because the market is comparatively small—just over $1 billion—it’s very illiquid. As a result, inflation-linked munis often trade at higher prices relative to TIPS than the typical municipal/Treasury relationship suggests.

We believe a more accessible approach combines conventional tax-exempt municipal bonds with CPI swaps—two very large, highly liquid markets. CPI swaps are agreements between two investors who arrange to “swap” fixed-interest payments in exchange for floating-rate payments tied to inflation rates over a specified time period. While one party pays the other an agreed-upon fixed rate, the other party agrees to pay the first party an amount equal to the CPI. The swap thus offsets a portion of the bond’s potential losses from rising inflation.

Moreover, investors benefit from tax efficiencies because muni bonds are tax exempt and the swaps are taxed at capital gains—not ordinary income—rates. The scenario-forecast data in the Display below illustrates how the tax efficiencies of a muni bond and CPI swap combo can really add up, compared with TIPS alone.

Effective inflation-protection strategies should shield municipal portfolios from surges in actual inflation and outperform ordinary municipals if expectations rise further. Despite truly unique challenges in this recovery, munis have held up very well, but investors should be ready for anything. And whatever direction inflation moves, girding against it takes attentiveness and speed. Because actual or expected, inflation has real impact potential.

Daryl Clements is Portfolio Manager of Municipal Bonds at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.