With a new Chairman, a retiring Vice Chairman, and at least three open seats on the Board of Governors, the Federal Reserve is in a period of transition. Clearly, this is an uncertain time for the financial body that governs US monetary policy and regulates the banking system. These changes at the Fed, which is designated as the voice of reason and stability for the US financial system, inject a degree of ambiguity. But should investors worry?

NEAR-TERM CONTINUITY

Last month, President Trump nominated Jerome Powell to take over as Chairman of the Federal Reserve from Janet Yellen, whose term expires in February. “Jay” Powell’s nomination was well anticipated by the market and brings continuity to the Fed’s near-term objectives. Working alongside current Chair Yellen on the Federal Open Market Committee (FOMC) over the past five years, Powell helped design and implement many of the programs the Fed installed since the 2008 Global Financial Crisis to right the economy. More recently, he’s been instrumental in crafting the Fed’s current policy framework, a path he will likely follow over the near term, which should promote continued economic stability. In other words, it’s business as usual for the Fed, for now.

A MARKET DISRUPTION WOULD BE REVEALING

But how will the Fed react if an unexpected economic event demands a change of direction? No one is certain. When difficulty arises, the market generally gets a glimpse into the long-held beliefs of a new Chair. With Powell though, his leanings are a bit less clear since he has an unusual background compared to more recent, academically trained Chairs. Powell has been a Fed Governor since 2012, but he’s also a lawyer who has worked in private equity and the Treasury department. He lacks the depth of monetary policy academic credentials that distinguished most Chairs before him. For this reason, we assume Powell will rely heavily on other Fed Governors and District Bank Presidents to bridge the knowledge gap. The recent Board nomination of Marvin Goodfriend is a good example of an academic monetary theorist Powell could tap. But at the moment, other vacancies on the Board of Governors and at the top of the NY Federal Reserve Bank breed further uncertainty.

WHO’S THE SUPPORTING CAST?

The Chairman is not the only new face at the Federal Reserve. By next year, at least five of the seven Governors will likely be new. The District Banks have seen a similar level of high turnover. The recently announced retirement of New York Fed President Bill Dudley means that by the end of next year, only three of the 12 District Presidents will have been in their roles during the Financial Crisis, and only about half will have been in office for more than three years. This uncertainty surrounding Powell is also making investors nervous, but is it really cause for concern?

KNOWN UNKNOWNS

The Chair of the FOMC drives policy. Historically, there has been virtually no dissent on policy decisions among FOMC members, especially among the Board. This reality that Powell will dictate policy makes the uncertainty surrounding him more pronounced. And the lack of insight into how he might alter policy when the cycle turns or at times of stress may feel unsettling. But it is also normal. The high degree of unanimity among Board members suggests that there is often little foresight into how a Chairman might react under difficult conditions. In other words, we never know how a new Chairman will respond to economic disturbances until it happens. This is nothing new.

WHAT WE DO KNOW

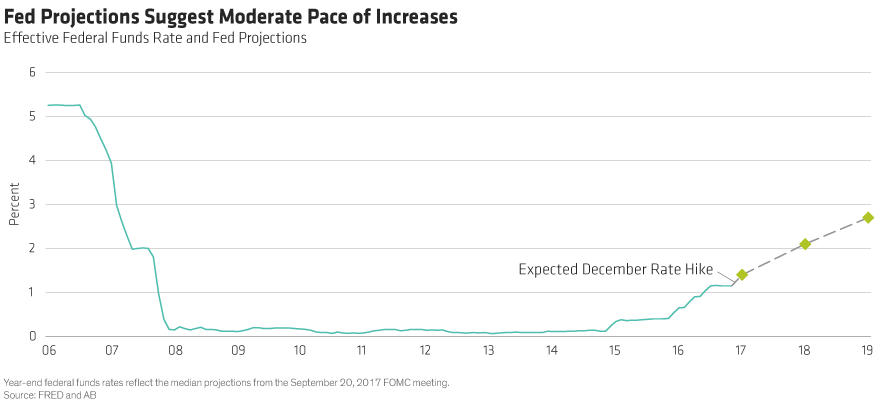

The Fed’s direction over the next six months is generally accepted—a balance sheet reduction program along with measured, well-telegraphed rate increases (Display 1). Beyond that, we don’t know for certain what the economic environment will look like or how Powell will react. Then again, we never do. So, while this leadership transition may cause apprehension, investors can feel assured by the surefootedness of the current plan, which allows time for the Powell Fed to settle comfortably into their new roles.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.