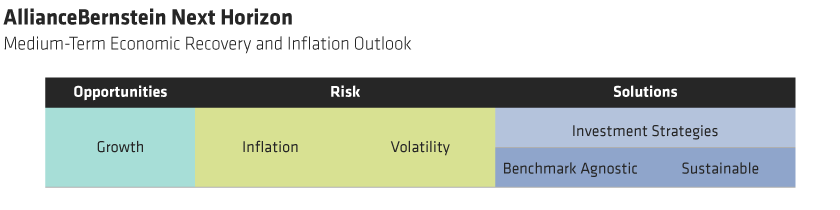

In investment, as in life, it helps to know where you’re going and how to get there. But how do you, as an adviser, help your clients move forward in today’s uncertain environment, when the positive prospects of global economic recovery are tempered by the risks of inflation and market volatility?

You need a map and a means a means of transportation, which is why we’ve launched the AllianceBernstein Next Horizon initiative.

Next Horizon aligns our investment research and portfolio-management capabilities to help you and you clients see a way forward—and to move forward, too. Think of our research as a map and our investment strategies as potentially (depending on your clients’ risk profiles) a vehicle.

Your starting point is our outlook for inflation.

Inflation: a Medium-Term Planning Horizon

Of all the trends now emerging that could significantly affect your clients’ medium-to-long-term investment strategies, inflation is arguably the most important. Recent high CPI high numbers, reflecting the economic recovery from the first wave of COVID-19, have generated many headlines.

But the real inflation risk, in our view, lies further down the track, in the form of a move to a higher structural inflation regime in the next few years.

Two of our global economists have intensively researched the trend and published their insights in a white paper, Inflation—Joining the Dots: Shifting Priorities Open the Door to Higher Inflation.

When you read it, we think you’ll understand why we consider the inflation outlook to be an important horizon for your clients’ medium-term investment planning.

The paper is part of our research which, taken as a whole, can help you steer your clients through these challenging times. As well as inflation and related policy issues, we research the investment opportunities and risks—such as market volatility—that you’ll need to help them navigate.

Investment Strategies for an Uncertain World

Our research insights drive our investment strategies which, in different ways, are well suited to capturing the growth opportunities of economic recovery and managing the associated risks (see table).

Many are benchmark-agnostic—that is, their portfolio construction is determined by security selection rather than by the weighting of holdings relative to a market index. When, as now, markets are driven by sentiment rather than fundamentals, this approach can lead to less volatile returns.

So, they can make the ride less bumpy—but will they go the distance?

Our sustainable and ESG-aware strategies, which reflect our own and our clients’ desire for responsible and ethical investment solutions, are designed with medium- and long-term investment objectives in mind. But that’s not all….

As the white paper referenced above makes clear, one of the factors leading the world towards higher structural inflation is policymakers’ acceptance of the need to address inequality and climate change. So, sustainable investing is not just ethically attractive, it’s timely, too.

For more information about how our Next Horizon initiative can help you and your clients, please get in touch.