Asset allocation, effective portfolio design and dynamic management have always been powerful tools for battling volatile markets, but risk has come into even sharper focus lately. Economic growth is slowing, yields are low and stocks have taken several tumbles. Investors are looking for new ways to tackle risk.

The discussion generally revolves around equities—they’re among the riskier asset classes and the biggest allocation in many portfolios. The challenge seems well understood, leading many institutions to look for risk reduction by allocating to illiquid return sources that carry less beta and mark-to-market risk. But investors also want to make traditional portfolio asset allocations more robust.

Many of our clients have asked probing questions as they seek to gain insight into this important issue: What can we learn about risk management from past market dislocations? How should we measure the effectiveness of risk-management tools? How can we tell which tools might work better in certain environments—and the best ways to deploy them?

Answering these questions requires a broader perspective on both strategic and tactical asset allocation. It also involves investors’ time horizons: how important is managing the risk of severe short-term shocks versus managing the risk associated with meeting funding gaps over the long run? In any case, the risk-management tool kit should be expansive, because no single tool works all the time. The tool kit’s contents will grow over time as new strategies emerge, but specific selections will vary as market conditions evolve.

Surveying the Portfolio Risk-Management Tool Kit

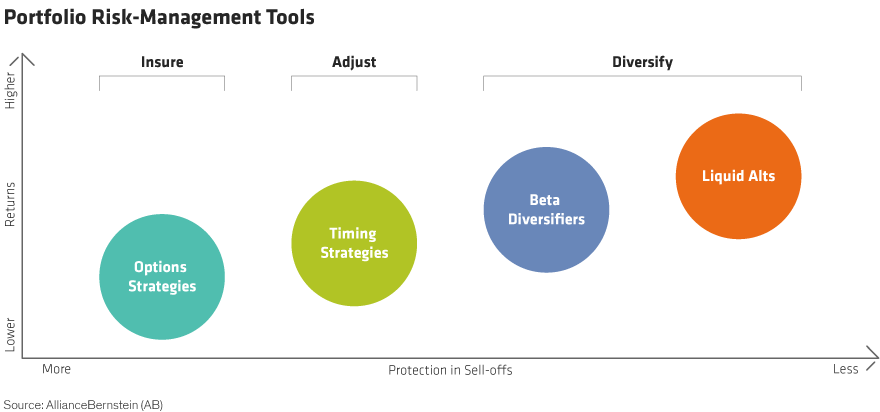

Let’s start by organizing what is a very diverse set of risk-management tools that portfolio managers have at their disposal in managing downside risk. There’s no shortage of asset classes and strategies that can be integrated in multi-asset portfolios. For practical purposes, though, we can group them into four broad categories (Display).

1) Beta diversifiers: Diversifiers, including duration exposure (in the form of sovereign bonds) and commodity investments, provide return sources that don’t track equity performance patterns. Because they’re not perfectly correlated, beta diversifiers can improve a portfolio’s risk-adjusted returns. And because they’re liquid, it’s easy for investors to add or reduce exposure.

2) Liquid alternatives: Similar to beta diversifiers, liquid alternatives, including long/short and market-neutral strategies, are designed to produce return streams that don’t track equity returns. In fact, they’re largely uncorrelated with stock returns. Liquid alternatives can be designed to harvest specific risk premiums including style, momentum and value. These strategies generally require leverage to magnify their impact.

3) Timing strategies: Timing tools, including momentum and volatility, are designed to identify entry and exit points for broad market exposures. Timing strategies can be return oriented, emphasizing upside capture and overall returns, or risk oriented, focusing on risk reduction and protection in severe drawdowns. Given the nature of timing strategies, the investing process needs to be nimble and dynamic to capitalize on them.

4) Options: These are the most reliable tools for managing extreme downside events, but they’re also among the most expensive. Investors must pay a premium for options—in the form of carry cost. They provide the most certain and consistent level of protection, because they’re structured to pay off when equities sell off.

Institutional investors have continued to add illiquid alternatives, including private equity and private credit strategies, to their tool kits since the Global Financial Crisis. Providing that these tools align with investors’ risk/return profiles, they offer another source of diversification and alpha potential in exchange for longer required holding periods.

With this broad tool kit, investors are empowered to manage risk flexibly. They can diversify risk using investments such as bonds or liquid alternatives. They can use timing strategies, such as volatility, to allocate away from downside risk. Or they can insure against risk events using options.

Investors’ time horizons also influence the categories and types of risk-management tools they select. Beta diversifiers and liquid alternatives, for instance, are more effective as long-term diversifiers than in protecting against short-term shocks. That role is better played by tactical asset allocation strategies, which tilt away from equity risk, and options, which automatically cut equity beta.

The Road Test: A Historical Comparison to Equity Returns

To quantify the effectiveness of risk-management tools, we first need to understand how they’ve stacked up versus stock returns. To answer that question, we move from theory to hard data—analyzing historical daily returns. Over the full time frame of the analysis, we isolated 22 major equity sell-offs and recoveries. Past behavior is a good starting point—not because it can predict what will happen, but because it offers insight.

Below, we highlight a few of these tools and show how their returns have fared in different levels of equity performance (Display). If we group equity returns by deciles from worst to best, an effective risk-management tool should perform well when equity markets struggle.

Let’s pick a few examples. Volatility is a timing strategy that signals changes in equity exposure: When volatility is higher, stock exposure should be reduced. When volatility is lower, the reverse is true. The full-period data indicates that volatility timing strategies have been effective protectors—when equity returns have been at their worst—the left-most decile—this strategy delivers strong positive returns.

On the other hand, there are commodities, from the beta diversifiers category. Owning commodities in the worst equity markets hasn’t done much good. Commodities’ return patterns are similar to those of equities; commodities fall when stocks fall and rise when stocks rise. The yen, another beta diversifier, is an interesting case: it has produced strong returns in the worst equity periods but posted losses in most other periods.

We should note that much of the last 30 years has been disinflationary. It’s not surprising that commodities were more effective during inflationary periods such as the 1970s and 1980s. That’s why it’s very important to analyze shorter periods with distinct environments, as we’ll do later in the article.

Quantifying Risk-Management Effectiveness: A Three-Dimensional Framework

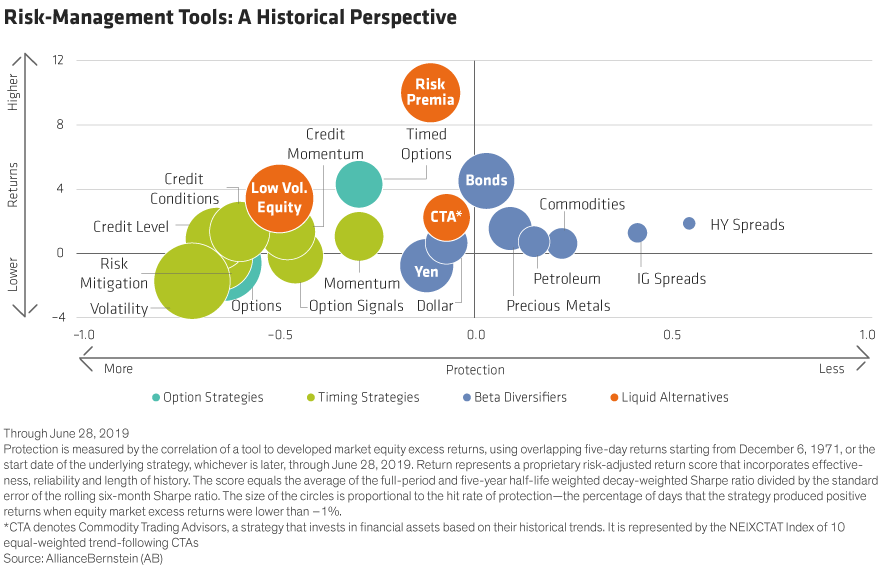

Using their return histories, we can build out a broader, multidimensional framework to compare the effectiveness of risk-management tools across all four categories on a level playing field.

We looked at three dimensions for each tool. Correlation to equity returns reflects the level of protection a tool provides in equity downturns. Risk-adjusted performance—measured using Sharpe ratio as an input—indicates a tool’s return contribution or cost. Consistency of downside protection is true, too: we can measure that by the percentage of times a tool finished in the black when equities declined.

Bringing all three of these dimensions together gives a robust picture of risk-management effectiveness over time (Display).

Timing strategies have been highly protective as a group. And given the large size of the circles, they’ve also been highly consistent in providing that protection. But they don’t deliver much return, and some are costly—volatility in particular.

Beta diversifiers, including the yen and sovereign bonds, are less protective as a group than timing strategies. The yen comes with a steep cost: because Japan’s interest rates are the lowest in the world, there’s a negative carry from investing in the yen.

Bonds, on the other hand, have delivered solid risk-adjusted returns and only slightly less protection than the yen. Option strategies are highly protective and very consistent, given their structural negative correlation to equities. However, they are relatively costly.

Effectiveness at Downside Protection Varies with the Environment

The story changes as we zoom in to shorter time periods that featured very diverse macro and market conditions. Let’s look at a couple of examples from the timing strategies as a case in point (Display).

Timing strategies generally worked well in the 2000s, when stocks outperformed over a long period with two extended sell-offs. But timing has struggled since 2010, because the market hasn’t seen lasting trends in either direction. In terms of the cost/protection framework, timing strategies were less costly and protected better from 2000 to 2009; they were costlier and less protective from 2010 to 2019.

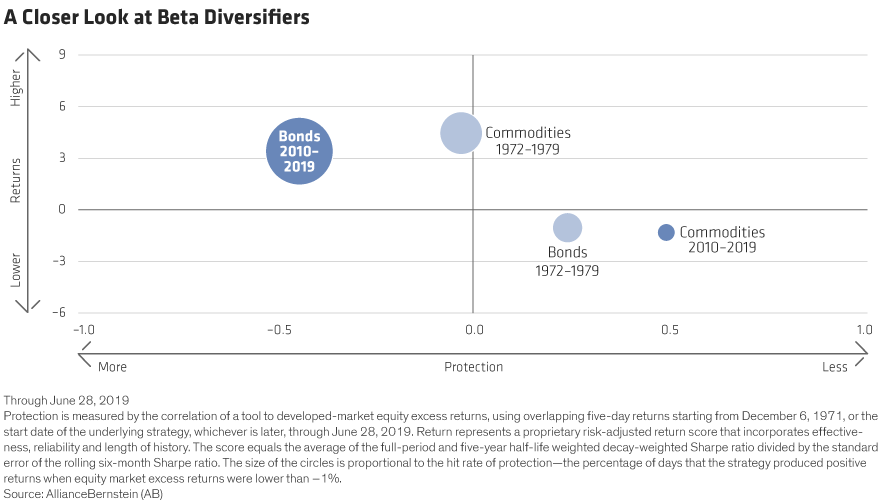

Bonds and commodities—two members of the beta diversifiers category—are another example of how risk-management effectiveness varies across periods (Display). In the 1970s, bonds were positively correlated to equities and posted poor risk-adjusted returns. But since 2010, duration has been much more effective, with a negative correlation to stocks and solid risk-adjusted returns. Commodities have been a mirror image: very effective in the high-inflation 1970s, but much less so when disinflation reigned, as it did from 2000 through 2010.

Past to Present: Incorporating Other Key Factors

A historical assessment provides good information, but it’s really just a starting point. As we’ve said, history is informative, not predictive. It can highlight a group of tools that may be effective in specific environments, but investors also need to understand how tools’ behavior evolves over time, which ones might be effective based on an in-house market view, and what each tool looks like today.

Real estate is a good example of how the behaviors of risk-management tools can change. At the time of the Global Financial Crisis, real estate companies were highly levered, and the market worried that they would face financing challenges—as a result, real estate performance ended up being very equity sensitive. More recently, interest rates and nominal growth have been low, leading many investors to view real estate as a source of steady income. As a result, real estate has been much more interest-rate sensitive.

Inflation provides another insightful case study. If an investor believes that populism and other structural factors will push inflation higher, commodities would be worth considering, given their effectiveness in earlier inflationary environments. They’re out of favor today in a low-inflation environment, so it would take some conviction to add them to a portfolio. But unless your belief is that inflation will never rebound, it would make sense to consider commodities. In managing portfolio risk, nothing is always in style or always out of style.

The Risk-Management Framework in Practice

Operating a risk-management framework like this—constantly evaluating, deploying and revising risk management tools—isn’t easy.

Deploying tools dynamically requires investors to be nimble, and governance protocols may make it harder to quickly adjust positions and exposures in rapidly evolving conditions. This is one reason some investors are looking at strategies with built-in flexibility, such as alternative risk premia and tactical asset allocation factors.

Managing risk through evolving conditions also requires an expansive tool kit to choose from, and investment restrictions might constrain the available universe, effectively eliminating some tools. Diverse tools also require wide-ranging capabilities, infrastructure and management expertise. Options are a good example of a strategy that requires either specific in-house expertise or the willingness to outsource.

And lastly, investors need to be committed to—and willing to justify—integrating a tool that may be unpopular or costly now but will be necessary for the portfolio. It’s next to impossible to incorporate a risk-management tool precisely before it becomes effective—but it must be in place when the time is right. This conundrum can create challenges when traditional performance-measurement systems make benchmarking a key focus of day-to-day assessment, rather than the delivering of outcomes.

To sum things up, let’s revisit the three client questions we posed earlier and offer some answers based on the insights drawn from this research and the three-dimensional framework:

What can we learn about risk from past equity market dislocations?

Examining the historical behavior of risk-management tools can provide insights into the environments when they were effective and those when they were ineffective. It provides a good starting point for a deeper dive into certain tools that could protect well in the expected environment—and that are favorably priced.

How should we measure the effectiveness of various risk-management tools?

We think three dimensions are critical in measuring effectiveness: risk-adjusted returns, specifically Sharpe ratios; the amount of protection in equity downturns, measured by correlation to equities; and the consistency of that protection, measured by the percentage of time a tool posts positive returns when equites lose ground.

How can we tell which tools might be better suited for certain environments and how to deploy them?

Narrowing the tool kit based on past performance allows a deeper dive to understand their current attributes and forward expectations for each tool, which may impact the decision to use it or put it aside. But investors’ risk priorities also define choices. If an institution is truly a long-term investor that’s less concerned with short-term shock protection than with managing long-term funding gaps, it wouldn’t buy options to protect against short-term tail risk—in fact, it might even sell them.

Deploying risk-management tools effectively requires a market view, a perspective on risk priorities, broad investment capabilities, the ability to be nimble and the conviction to deploy out-of-favor or costly tools that may be needed in the future.

Daniel Loewy is Chief Investment Officer and Head of Multi-Asset Solutions at AB. Sharat Kotikalpudi is Director of Quantitative Research in the Multi-Asset Solutions Group at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.