There's a strong case to be made for quality of stocks, not quantity, in portfolio construction

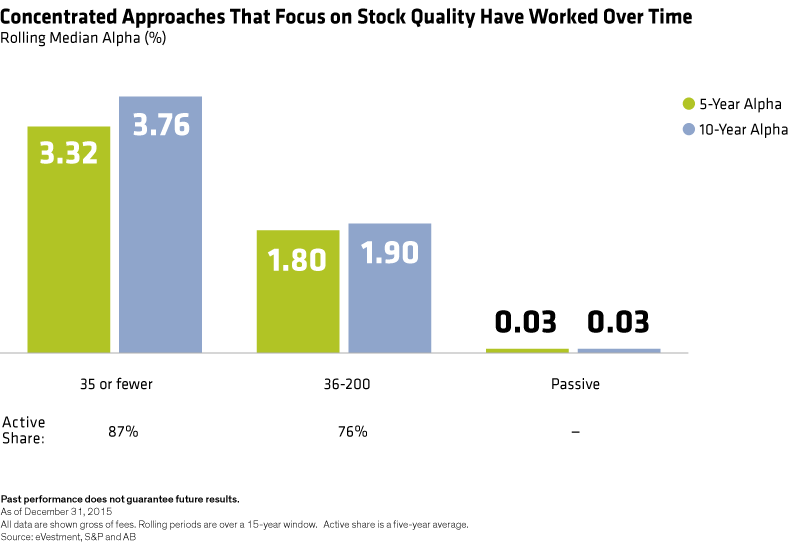

To put numbers to this concept, we categorized US equity managers based on the number of positions they hold. We'll call managers with 35 or fewer stocks “concentrated” active managers. These managers tend to have very high "active share".

Managers with 36 to 200 stocks can be referred to as "traditional" active managers. As a group, they have a fairly high active share, but it varies greatly within the category. Managers with more than 200 stocks are effectively "passive" investors with low active share.

Historically, concentrated managers have been very successful. The median concentrated manager has delivered 3.32% annualized rolling excess returns over the last five years and 3.76% over 10 years, gross of fees (Display below). Traditional managers have also produced excess returns, though lower than those of concen¬trated managers (1.80% over five years and 1.90% over 10 years). Passive managers have posted relatively flat excess returns over both time periods. Sometimes, there’s power in fewer stock holdings.