Rising global temperatures, record heatwaves and costly wildfires seen in recent months are events scientists have longed warned about. Still, most investors rank inflation, rising rates, geopolitical tensions and finding new economic drivers—not climate change—as top risks.

We believe that all those risks are important. But with global temperatures at life-altering highs, climate change needs to be incorporated into investment decisions right alongside them.

Climate change is measured by more than degrees. Its long-term economic impact is severe, with an energy crisis currently at its epicenter. For instance, gas and oil shortages from the Russia-Ukraine war led to soaring costs, threatening business continuity worldwide in the absence of alternative energy sources.

Climate risk challenges span all industries, leaving businesses striving to find effective solutions. However, through best practices, technology, proper funding and effective public policy, companies and countries alike can lower or prevent carbon-intensive consumption. In short, opportunities lie in fighting back. Government policymakers agree, especially in Europe and the US, where a wave of historic public programs and funding is unfolding (Display).

In addition to addressing climate change, these measures are clearing barriers and incentivizing more industries to reduce greenhouse gas (GHG) emissions. As companies of all stripes chart a greener course, we believe active low-carbon equity investors are well positioned to discern those most likely to succeed and prosper.

Governments Step Up as Low-Carbon Companies Step In

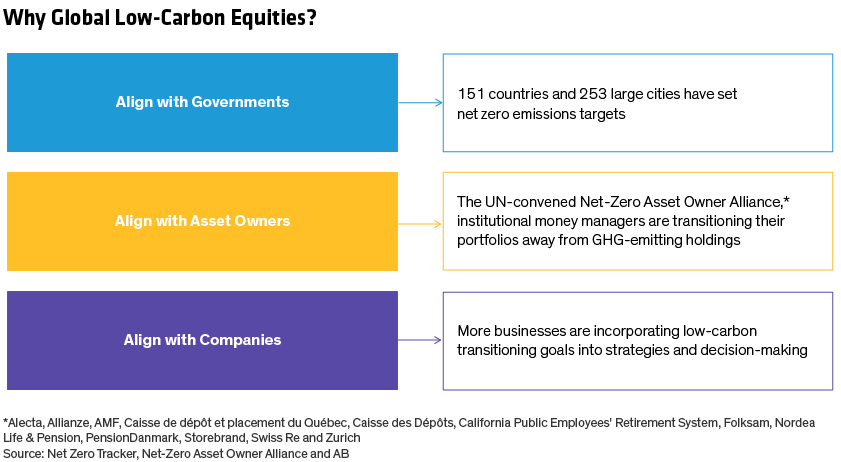

We believe intense government involvement is the year’s most important development in the prolonged global war on climate change, with lasting implications. It also ties to the first of three tenets supporting investing in low-carbon equities: aligning with governments in their pursuit of zero-emissions targets (Display).

The US Inflation Reduction Act includes a record $369 billion to lower carbon emissions by 40% over the next decade. Among its business incentives are generous tax credits for adopting wind and solar renewable energy into operations, so the math now makes solar more economical than traditional power sources.

A potential European Green Deal could include €375 billion to support the region’s own inflation reduction act. Among its goals: make Europe the first climate-neutral continent before midcentury and cut GHG output by 50%, while planting 3 billion new trees by 2030. A clean-energy component should boost wind and solar generation, which already has overtaken gas and coal across Europe, with solar production doubling in 2022 alone.

All 27 European Union (EU) member states are on board, but not all have committed to full funding. Still, companies are finding their own paths among the Green Deal’s many incentive road maps. For instance, the EU wants to cut permit-approval times for renewables projects in priority areas to 12 months (down from a range of three to 10 years), and to 24 months elsewhere. This alone should speed up projects for firms ready to start, eliminating costly delays.

We think both policy measures should steadily widen the low-carbon investment opportunity set. Encouraging greater use of clean fuels and energy storage, for example, is likely to be a game changer for companies for which it’s their lifeblood, such as California’s Enphase Energy and Israel-based SolarEdge Technologies.

Finding Industries at the Heart of the Low-Carbon Transition

Active stock selection is key when identifying companies that are best positioned to navigate the ongoing climate crisis without sacrificing returns. It takes commitment and hard work to get decarbonization right, and not all companies are up to the task.

Within European industrials, for example, clear decarbonization leaders have emerged in key categories at the intersection of climate change and equity selection:

Smart Grid Technology. Firms in this space help other companies build and manage energy-efficient facilities and resources that lower third-party GHGs, known as Scope 4 emissions. Schneider Electric is a good example, with a commitment of nearly 800 million tons of avoided or saved CO2 production for its clients by 2025, according to company reports.

Cable Solutions. Our research suggests exponential growth in demand for medium- and high-voltage cable, as strong renewable-installation demand combines with overdue upgrades to create a favorable pricing environment. Cable manufacturer Prysmian Group increased its waste recycling to 71% and recently signed on to connect submarine lines to new windfarms worldwide, among other milestones.

Design Engineering. These firms consult on ESG-friendly infrastructure, logistics and construction for transportation, facilities and water treatment plants. We believe AECOM Technology is one of the top competitors in the $80 billion market, which is expected to grow by double digits annually for decades. Its ESG action plan includes reducing carbon by at least 50% on major projects, or about 84 million tonnes of avoided CO2.

Climate-Resilient, but How Good and at What Cost?

We believe assessing climate resilience helps to identify companies likely to generate higher long-term return potential. But it shouldn’t be the sole consideration, even in a low-carbon equity strategy. Quality and price matter, too.

Quality companies, in our view, are durable businesses with well-defended competitive advantages and sustainable cash flows. They also tend to have an edge when inflation is high or rising, thanks to pricing power, industry leadership or both. Moreover, quality business models are well poised to tap the future drivers of economic growth, which increasingly include decarbonization.

Beyond focusing on high quality and climate resilience, vigilance on price is important too. It’s tempting to follow the herd, but even the strongest low-carbon companies can be overvalued when markets get hot, especially if they’re tied to the technology sector. Staying alert to valuations helps improve return potential and avoid expensive or vulnerable pockets of the market.

Unrelenting floods, wildfires, drought and heat have already made 2023 a record year on many levels. Global leaders are still waking up to the possibility of a bleak future without strong climate action. But we laud new comprehensive decarbonization policies from the US and Europe, while China, the world’s largest GHG producer, is also taking positive steps.

The climate war is far from over. But the front lines are constantly being fortified with innovative, high-quality companies destined to break through and win some battles. Over time, we believe they’ll add up to a greater good. That’s why we think climate change must be incorporated into active investment decisions, not just as a niche risk, but as a key contributor to long-term equity performance.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.