Recent volatility in equity markets has added appeal to US REITs, with their generous dividends and cash flows. But could a US rate hike upset the picture? Probably not as much as you think.

US REITs, specialized stocks that invest in real estate, held up well during the volatile third quarter. While the S&P 500 Index dropped by 6.4%, the MSCI US REIT Index ended the quarter up about 2%. As fears about China’s troubles and global economic growth mounted, the US real estate market was a relatively safe place to be.

But investors aren’t at ease. Even though the US Federal Reserve delayed its widely anticipated interest-rate hike, investors know that it’s just a matter of time before monetary policy changes direction.

What Really Matters?

It’s widely believed that US REITs returns are tied to interest rates. And it’s true that the correlation of daily returns of the MSCI US REIT Index with the daily change in the US 10-Year Treasury rate this year through September 30 was –0.75. In other words, the US REIT market usually fell when the interest rate rose. But we think the relationship between the two is more complex.

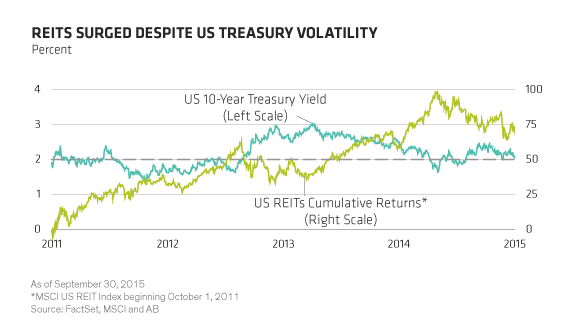

Take the last four years as an example. Back in 2011, the US 10-Year Treasury rate was 1.91% at the end of September. After four years of volatility, the rate ended up at 2.04%—almost exactly where it started. And what happened to real estate stocks? US REITs surged by almost 74%, or 14.8% annually over the same period (Display).

During these four years, REITS and rates weren’t dancing together. The correlation between REITs and the Treasury rate was just 0.21, which we think suggests a very weak relationship over longer time periods. So while REITs returns are indeed tied to interest-rate trends in the short term, we found that over longer time periods, this correlation is weak. What really matters, in our view, is dividends paid and the growth of cash flow.

Dividends and Cash Flows Drive Returns

Despite the strong returns for REITs since 2011, valuations increased only modestly. For example, the REITs market price/cash flow ratio (also known as P/FFO) rose only 12% to 16.6x during the four year period. This means that the vast majority of the market’s 74% return was sourced from dividends paid and cash-flow growth.

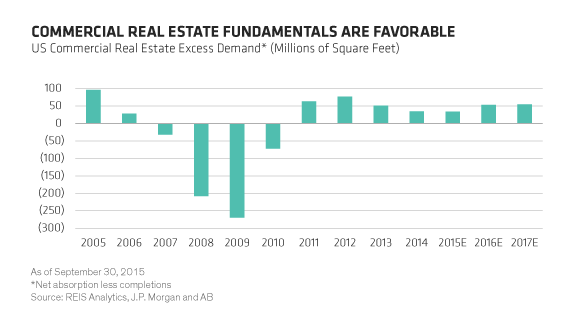

So what’s the outlook for cash flow today? We think it’s pretty good for most US commercial real estate sectors, including retail, residential and industrial property. Supply growth has been restrained since the aftermath of the global financial crisis. While development has started to increase, this new supply is rising from very low levels. Modest US economic growth should lead to demand growth outpacing supply growth for the next few years, in our view (Display).

Occupancy and rent levels are vital indicators. We expect both to continue to rise, spurring further cash-flow growth, which analysts estimate will increase by about 6% from 2015 to 2016. US REITs also boast a dividend yield of about 4% and stronger balance sheets than several years ago, characterized by lower debt ratios and longer debt maturities.

Of course, interest rates can’t be ignored. Rates movements will likely continue to affect market returns in the short term. But even this risk seems less threatening given that interest rates are likely to rise only gradually. Based on US Treasury market prices, investors expect the 10-year Treasury yield to be just 2.28% on September 30, 2016—about 36% lower than they expected two years ago.

Global Cushion for Volatility

Investors can also cushion some volatility by going global. Global real estate offers similar dividend yields, cash flows and return potential to US REITs, with the added advantage of exposure to diverse interest-rate environments, which can help offset short-term turbulence. In markets like Japan, the euro area and Australia, low rates are still embedded in the financial landscape and are unlikely to rise soon.

In a low-growth and unpredictable world, investors crave resilient sources of returns. By taking a long-term view, we think US real estate stocks can live up to the promise of generating income via dividends and cash flows—even if interest rates begin to climb.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.