Generous dividends and relatively secure cash flows have been the hallmarks of real estate investment trusts (REITs) in recent years, but some investors fear that all REITs are too expensive. We think it’s time to take a closer look.

REITs have a new home in equity indices. The S&P Dow Jones and MSCI equity indices recently shifted REITs from the financials sector to the new real estate sector. As a result, real estate stocks’ weight in the indices, and in investor portfolios, has become much more transparent. This new placement also points to REITs’ growth and increasing importance over the past decade—and could help prompt fresh consideration of the asset class.

Breaking Down Investor Reluctance

Still, some investors are hesitant to jump into US REITs. Many investors are understandably wary because of the often indiscriminate hunt for yield in recent years. They worry that REITs have significantly outperformed the overall market, leaving them expensively priced.

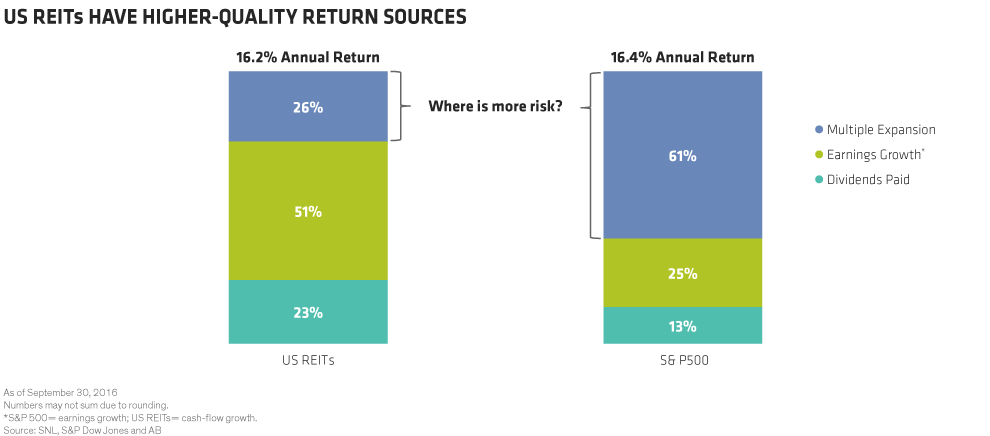

In reality, returns for US REITs and the S&P 500 have been fairly similar for the past three-, five- and 10-year periods. For example, the S&P 500 and US REITs delivered total annual returns of 16.4% and 16.2%, respectively, over the five years ended September 30, 2016 (Display).

The sources of these returns have been quite different, though. In the past five years, 61% of the S&P 500’s gains have been a result of an increased price/earnings multiple, versus only 26% for US REITs. In contrast, US REIT returns have been strong primarily because of dividends paid and cash-flow growth, generally considered higher-quality sources of returns.

What’s Next for REITs?

REIT fundamentals remain healthy, in our view, for most commercial real estate property sectors, including office, retail, residential and industrial. Supply growth has been restrained in the aftermath of the global financial crisis. Although new development has recently begun to increase, it is rising from very low levels. Even a continuation of modest US economic growth should lead to ongoing cash-flow growth, which analysts estimate will rise about 6% from 2016 to 2017.

A look at US REIT balance sheets shows they are stronger today than they were several years ago. Debt ratios are lower and debt maturities are longer. And when combined with a current dividend yield of about 3.7% and still-healthy cash-flow growth, we think this points to a favorable outlook for US REITs.

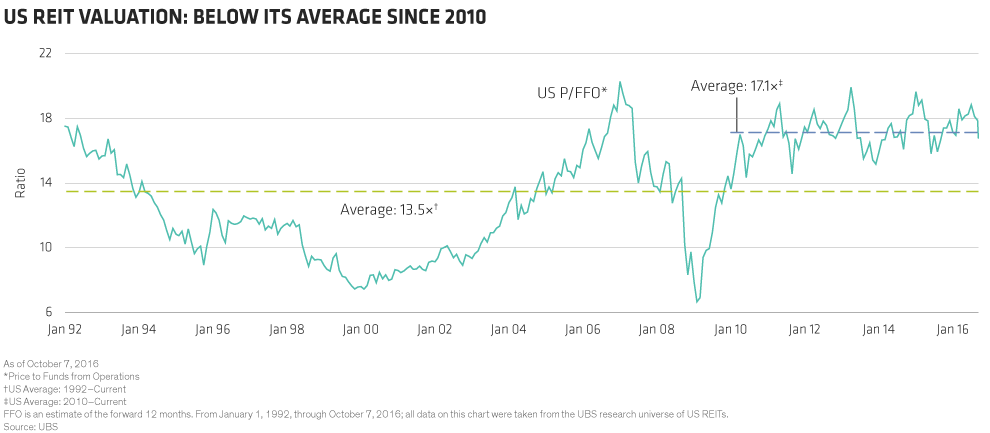

As illustrated above, total annual returns depend on dividends paid, cash-flow growth and the change in the valuation multiple that’s applied to current cash flow. In-place tenant rent agreements make dividend and cash-flow growth estimates reasonably reliable for REITs. The valuation multiple, then, is the final piece of the puzzle. Forecasting a future valuation multiple is an imprecise exercise, but history provides some guidance. Today’s price/cash flow (also known as P/FFO) multiple is above its long-term average but is slightly below its average since the beginning of 2010 (Display).

In our view, the more recent history may be a better guide for assessing the likely direction of valuation multiples. That’s because in the aftermath of the global financial crisis, low growth, low inflation and low interest rates have dominated the investing landscape—and could persist in the coming years.

Navigating Interest-Rate Moves

Of course, the rise and fall of interest rates could trigger share-price volatility over short periods. In our view, an allocation to a global real estate portfolio—either in addition to or instead of an allocation to US REITs—is one way to help mitigate the risk of rising US rates. A global real estate index such as the FTSE EPRA/NAREIT Developed Index offers investors a dividend yield and expected cash-flow growth similar to US REITs.

Global real estate portfolios, however, are exposed to a more diverse set of interest-rate environments. Today, in major markets like Japan, Europe and Australia, low rates are still embedded in the financial landscape and are unlikely to rise soon. Of course, after rallying in recent years, there are crowded trades among REITs, including some very high-yielding stocks with stretched balance sheets and unsustainable dividend payments. By taking an active approach to the sector, we believe that investors can avoid these trouble spots and capture the best of what real estate stocks have to offer.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.