The long-anticipated rate hike by the US Fed has intensified concerns that the move will be a drag on the ongoing housing recovery. We think that’s unlikely.

But it’s worth digging a bit deeper into what investors are really worried about. Many of the fears focus on reduced housing affordability—that higher rates mean more expensive loans, which in turn would cause the housing market to suffer. It’s a valid concern, but we think it’s overblown.

What’s more, other factors—such as improvements in labor markets and easing credit standards—can help counter a decline in affordability. In fact, history shows several periods in which the housing market thrived even as interest rates rose.

A Closer Look at Housing Affordability

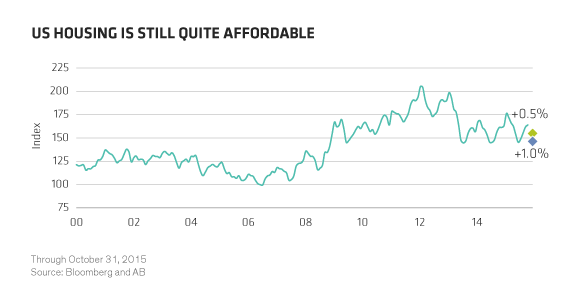

By the numbers, housing affordability tells us whether the typical family has enough income to afford a median-priced home at the prevailing mortgage rate. A widely used index (developed by the National Association of Realtors) that measures affordability indicates that housing is still quite affordable. The index is well over 100, a level at which the typical family has just enough income to afford a home (Display). Even if mortgage rates were to rise by one full percentage point, housing affordability would likely remain high by historical standards.

Help from Improving Labor Markets

Because income is a key element in housing affordability, changes in household income bear watching. And the news is positive: growth in US median income has gradually picked up pace after declining during the financial crisis. With the unemployment rate at 5% and falling, it seems very likely that wage increases will continue to accelerate, helping counter rising rates when it comes to affordability.

Improving labor markets have a positive impact beyond rising wages—they help move younger workers out of the house to start the search for their own homes. As the dismal post-crisis employment picture fades further into history, we’re seeing an increase in younger household formations. That’s stoking housing demand and contributing to the US economic recovery.

More Credit Means More Access to Housing

Continuing economic expansion has also helped encourage greater availability of credit, which is vital in helping consumers finance home purchases. Credit standards had understandably tightened after the crisis, but they’ve been easing gradually ever since—allowing more borrowers access to home loans. What’s driving the improvement? One key element is better transparency with respect to policy changes. Higher employment and rising wages help, too.

So even though some investors fret about rising rates, the US housing market appears to be on solid footing. And because rising rates are accompanied by improving labor markets and easing credit, we think there’s enough information for investors to stop focusing on the risks to the housing market and start thinking about the opportunities being created.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.