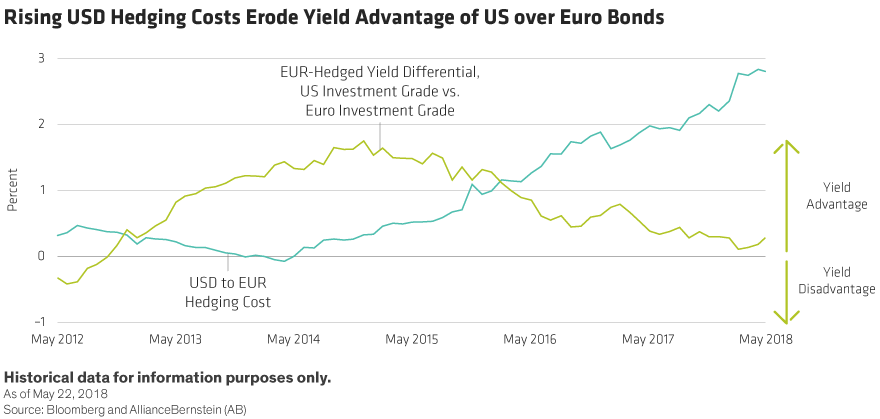

Recent moves in interest-rate differentials have increased the cost of hedging dollar-denominated bonds into euros. That means European fixed-income investors need to rethink their global diversification strategy—but not abandon it altogether.

Ever since Mario Draghi’s vow in 2012 to do “whatever it takes to preserve the euro”, European fixed-income investors have become used to abnormally low domestic bond yields. As yields dwindled on traditional European fixed-income assets, such as government bonds and investment-grade corporate bonds, euro investors started to globalize their portfolios to benefit from higher-yield opportunities outside Europe. By shifting allocations into USD-denominated bonds issued by US corporates and emerging-market names, European investors could tap returns that were unavailable from domestic assets.

But more recently, exuberant hedging costs have called this strategy into question. The annual cost of hedging a USD-denominated investment into euros was around 2.8% as of 22 May 2018, a 2.3% increase from 29 May 2015. So a bond yield in US-dollar terms may still look attractive, but if European investors hedge their currency risk, they may lose most of the yield advantage.

Should European investors start liquidating their global fixed-income allocations? We think that would be an overreaction. Instead, here are five guidelines that can help structure European fixed-income portfolios:

1) Expect high hedging costs to persist. The short-term interest-rate differential between the US and Europe is set to stay wide. In fact, the Fed is projected to hike the policy rate three more times this year, whereas the European Central Bank (ECB) probably won’t raise the deposit rate in 2018. As a result, hedging costs should remain high for investors this year.

2) Beware of leaving USD investments unhedged. High hedging costs can prompt investors to leave their bond exposures unhedged. This increases the volatility of the non-euro investment and creates uncertainty about the return stream of the whole portfolio. The US dollar has behaved unpredictably over the past year, as the fundamental outlook and government rhetoric have played ping-pong. Don’t assume the dollar will remain so strong.

3) Don’t discard all global exposures. Investing across different fixed-income sectors and regions can deliver portfolio diversification benefits. For instance, even if return expectations are lower, US mortgage-backed securities exhibit very low correlations with traditional fixed-income assets. Some of these mortgage bonds are issued in the form of floating rate notes and can offer protection in a rising interest rate environment. However, other USD-based bond exposures could be scaled down, now the balance of risk and reward has shifted.

4) Move fixed-income portfolios closer to home. High hedging costs from USD into EUR have shifted the relative value partly back to European fixed-income assets. However, euro-denominated markets may pose problems, too. Markets will anticipate that, as the ECB’s quantitative easing programme starts to wind down and abnormally low euro investment-grade yields start to reverse, corporate funding and profitability problems will arise for a range of issuers. In this scenario, it will require skill and flexibility to navigate a potentially volatile environment through dynamic duration and credit risk management. Even so, we believe a balanced mix of European bonds with an average investment-grade portfolio rating can still deliver an annual income of more than 2.3%.

5) Throw European financials into the portfolio mix. Credit spreads in Europe are currently supported by above-trend economic growth. Many European banks, in particular, are benefitting from today’s positive growth environment and a disciplined recapitalization over recent years. Subordinated debt from these banks still compares favourably with a wide range of emerging-market debt and US high-yield bonds, out-yielding, for instance, BB-rated US high-yield bonds by around 100 basis points on a euro-hedged basis (as of 22 May 2018). It’s a fixed-income sector that is close to home, provides for attractive income and, importantly, is accessible through bonds issued in euros.

High hedging costs have added challenges for European fixed-income investors. But knee-jerk reactions can also be costly. Investors should consider a thoughtful combination of global and domestic exposures that can generate a solid mix of returns in a changing environment.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.