Target-date funds are the only big pool of assets overseen by fiduciaries that typically rely on single-manager solutions. Best practices—and our research—suggest a multi-manager approach is better.

Why has the target-date landscape been slow to innovate for US defined contribution (DC) plans? One factor may be that the top three target-date fund providers account for roughly three-quarters of the assets in the market. This is largely due to their strong, historically bundled recordkeeping operations. But no other large asset pool is so heavily concentrated in so few providers—not retail mutual funds, high-net-worth investors, defined benefit (DB) plans, sovereign funds or endowments.

In sharp contrast to what’s typical among target-date funds today, many of the largest DC plans have taken note of institutional best practices and gravitated toward customizing their target-date funds, tailoring the asset allocation to participant demographics. In doing so, DC plan sponsors have found that customization provides greater benefits, such as control over underlying managers and a more diverse mix of asset classes.

Beyond this control and greater diversification of asset classes, our research indicates that glide paths benefit from using a multi-manager structure rather than a traditional single-manager structure. It’s a prudent risk-management strategy that’s commonly employed by most of the investment-management industry.

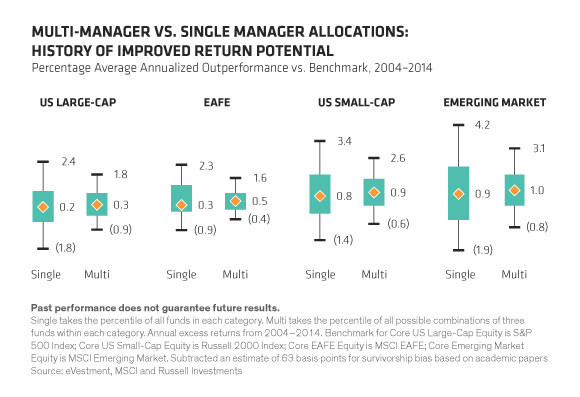

We calculated the performance of multi-manager portfolios by using funds from multiple combinations of three managers and compared these with the performance of individual managers’ funds. To do this, we looked at all possible three-manager combinations that had performance figures available from 2004 through 2014 in four basic equity asset classes: US large-cap, international, US small-cap and emerging-market stocks. Our research shows that using multi-manager funds has historically produced more stable returns with improved median alpha (outperformance over the benchmark) compared with single-manager actively managed funds (Display). Also, the range of returns for the multi-manager results is tighter, which could provide greater consistency—and better contain loss potential.

The status quo of single-manager target-date funds may soon change now that the Department of Labor has encouraged plan sponsors to consider customized and nonproprietary offerings. Not only would that be more in line with industry-wide best practices and fiduciary prudence, but it may help mute any adverse economic impact on participants arising from a single-manager structure.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.