Russia’s invasion of Ukraine has shocked the global economy, in particular by fueling further spikes in energy and commodity prices. The new inflationary catalysts will have differing effects on monetary policy moves because regional economies are starting from different places, which will determine their ability to withstand higher commodity prices.

The crisis in Ukraine is inflicting tragic consequences on the local population, while its macroeconomic effects are being felt around the world. Russia and Ukraine’s combined share of world GDP totals less than 2%, according to World Bank data. But that small number belies their outsize impact as exporters of essential commodities, which will likely hurt the global economy in two ways. First, conflict within Ukraine will reduce agricultural and industrial shipments. Second, western sanctions will impede exports of Russian commodities. In both cases, limitations on supply are likely to push prices higher.

Food Prices Face Wheat and Fertilizer Shock

Taken together, Russia and Ukraine account for over 25% of global wheat exports. Russia alone accounts for around 13% of global nitrogenous fertilizer exports. As a result, the conflict will inevitably push food prices higher around the world. Our research suggests that the impact will be felt disproportionately in emerging market countries that are more reliant on imports from Ukraine and Russia, including Egypt, Indonesia, Brazil and Turkey.

Neon gas is another commodity where an impact is all-but-certain. Odessa-based Iceblick supplies about 65% of the world’s neon gas, used in the laser lithography process which is fundamental to producing computer chips. Here, the repercussions will likely impact developed countries most.

But Russia’s role as an energy exporter is potentially the most important variable of all. Russia is the world’s third-largest oil producer behind the US and Saudi Arabia, and the world’s largest exporter of oil to global markets, according to the International Energy Agency. In particular, Russia supplies around 40% of Europe’s energy needs.

Surging Oil Prices Spell Trouble

Even before Russia’s invasion, oil prices were surging. Now, as of March 7, prices are approaching the 2008 peak of around $140 per barrel and if they move higher, we may face a global crunch (Display, below).

Energy efficiency has consistently improved since the 1970’s oil shock, making it easier for businesses and consumers to absorb price fluctuations. But a price breakout to new records will challenge countries that rely on imports. And in Europe, several economies are highly dependent on Russian supplies and vulnerable to the spike in regional gas prices that are currently more than ten times pre-COVID-19 levels.

Growth Prospects Under Threat

How do policymakers think about energy or commodity shocks? In the near-term, rising energy prices are stagflationary: boosting prices in the near term but hurting growth in the long term as higher energy prices force consumers to scale back spending on other goods and services.

In recent decades, policymakers have generally treated commodity price shocks as temporary. Usually, they’ve been right to refrain from tightening policy in response. But now, with inflationary pressures already high, it could be dangerous to assume that inflation expectations are stable. Today, the right response depends on the underlying balance between inflation and growth, which differs by region.

Gauging Regional Differences

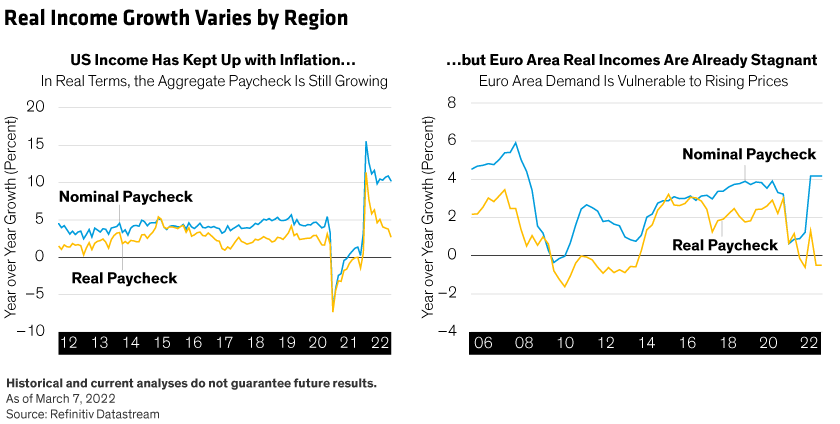

To assess this balance, we looked at nominal and real income growth in Europe versus the US. Our research shows that US consumers are in a much better position to cope with current price pressures, because real income growth—depicted by our paycheck proxy—is positive. That gives US consumers a cushion to absorb higher energy costs (Display, below).

In the euro area by contrast, while the nominal paycheck is growing at a healthy rate of 4%—the strongest pace since the Global Financial Crisis—real paycheck growth is stagnant or even slightly down. As a result, rising prices erode consumers’ purchasing power. And that doesn’t yet account for the 60% increase in natural gas prices in recent weeks or prospective increases in prices of soft commodities and food.

If European inflation rises further, we believe the region risks a negative demand shock this year. The European Central Bank is treading dangerously by signalling recently that it may raise interest rates, because real incomes are precarious. In 2011, the ECB bucked policy norms by raising rates when real incomes were negative, but quickly realized its error and reversed course.

In the UK, the story is somewhat similar because real incomes are negative. However, unlike the ECB, the Bank of England has already started a rate hike cycle. Raising rates might not be a great idea right now, but if the BoE continues, we think it is likely to stop sooner than it otherwise would, given the economic shock.

Dynamics in the US are different. While US inflation is higher than in Europe, incomes are also healthier. The nominal paycheck is growing rapidly at about 10% year over year and the real paycheck is growing at 2.7%, in line with its long-term average. This might not reflect every household, but in aggregate the economy is keeping pace with inflation and a little bit more. From the Federal Reserve’s perspective, this means the US economy can handle rate increases. Since higher inflation is unlikely to prompt a dramatic slowdown, we don’t think the pressures emanating from the Russia-Ukraine conflict should dissuade the Fed from raising rates.

That said, caution is warranted. Potential unpredictable outcomes could affect consumer expectations or weaken corporate investment. Some banks may have hidden exposures to the region. Given uncertainties created by the Russian invasion, we think the Fed is likely to be cautious, starting its tightening cycle with a 25 b.p. increase later this month.

In emerging markets, some central banks are in a particularly difficult position. Across Latin America and Eastern Europe, inflation pressures have been more acute and typically policymakers have already increased interest rates.

Investors never like uncertainty and tend to prefer a narrow range of outcomes. We don’t have that luxury today. But amid the gloom of war, remember that not all possible macroeconomic outcomes end in recession. For example, if the conflict ends in the near-term, commodity prices could move lower before demand destruction sets in. Policymakers around the world will need to engage in a delicate balancing act while on a fast-moving train, given the fluidity of the situation.

Eric Winograd is Director of Developed Market Research and Markus Schneider is Senior Economist—EEMEA at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.