Serial entrepreneurs often struggle to solve very complex financial problems. When they get a rich offer for their businesses, they typically want to upgrade their life styles, save for their own and their children’s futures, give money to charity—and fund their next ventures. Here’s how one hypothetical couple, drawn from client experience, put together their plan.

Many Goals

Eric and Eleanor are married and live in Los Angeles with their three young children. They have built a technology-related company from the ground up, for which they received a $34 million offer last year. If they sell, they are unlikely to retire. They are only 40, they loved creating their first business, and they are excited by the prospect of starting a new one.

The couple has several primary goals: They want to buy a new home for $4 million; set aside $1 million in seed capital for a new venture or two; cover family spending needs of $30,000 per month after taxes for the next five to seven years while they get the next venture started; fund their children’s college education, and build financial capital for their retirement.

They also have two secondary goals: They’d like to donate to their children’s school and charity, and transfer some wealth to their children.

Eric and Eleanor’s many goals have varying time horizons. Their key questions were how much to put aside for each goal, and how to invest it.

How Much Does Each Goal Require?

The unsolicited offer included an up-front cash payment of $25.4 million, one-year escrow of $2.8 million, and three-year earnouts totaling $6 million; they expect deferred payments if they sell. Their advisor suggested that they use the up-front cash to fund their primary goals and the deferred payments to fund their secondary goals. Hence, deferred payments are not included in this analysis.

Their accountant estimated that $25.4 million in up-front cash from a sale would result in about $9.3 million federal and state income tax payable next spring. Eric and Eleanor would need to keep this cash liquid and available to pay the tax bill.

What about their other immediate goals: a new home, new venture, college savings, near-term spending, and retirement spending? The Display below shows the breakdown of the proceeds.

The $16 million after-tax initial sale proceeds would pay for a $3 million down payment on a new home (assuming that they take out a $1 million mortgage) and a $1 million investment in their new venture, and leave $12 million for their other primary goals.

Eric and Eleanor want to maintain their current annual living expenses of $360,000 after taxes for up to seven years while they focus on their new venture. Our analysis suggested that they could be highly confident that $2.6 million invested in a balanced conservative portfolio (with about 30% in stocks and 70% in bonds) would support that spending for seven years, after inflation.

To pay for college for three children, Eric and Eleanor could each dedicate five years of annual exclusion gifts of $15,000 to front-load 529 education savings accounts for each child. That’s $450,000 in total. The 529 accounts would start with an equity-oriented asset mix and glide to a more conservative mix by the time the children go to college.

That leaves $9 million to fund their retirement and secondary goals. Eric and Eleanor both intend to continue working until age 65. They also expect that their combined after-tax salaries will cover their spending needs eight years after they start the new business.

What about their retirement spending needs? After accounting for all expenses that now run through the business and would continue post-sale, plus dwindling spending on the children after they finish college, Eric and Eleanor estimate that in retirement they’ll need $240,000 a year in today’s dollars.

Limited Appetite for (Investment) Risk

Like many people who take risk in their own businesses, Eric and Eleanor wanted to take less risk in their investments. So we assumed a conservative profile for their post-sale investments, and calculated that they’d need to invest $8.0 million to be highly confident they could spend $240,000 a year, inflation-adjusted, after retiring at 65. That would leave them with only $1.0 million for their secondary goals: gifts to children and charity.

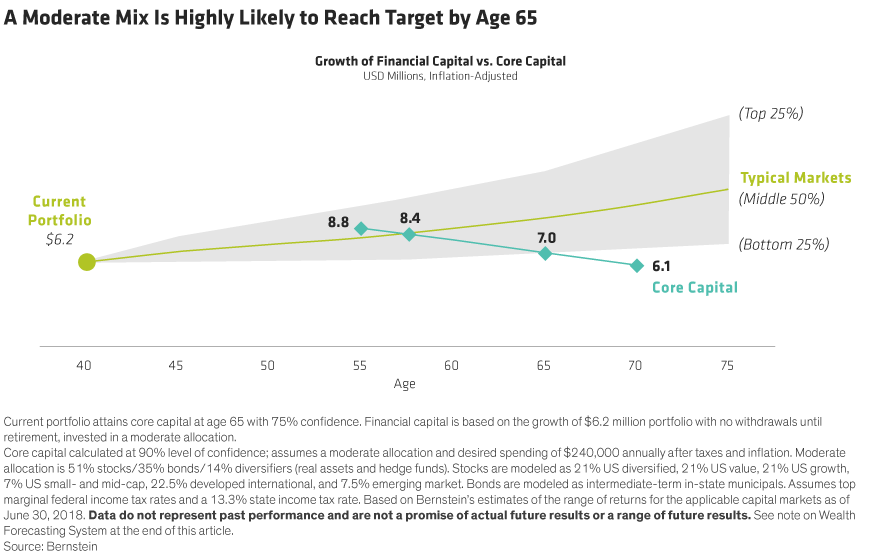

But we also calculated that if they opted instead for a moderate, balanced allocation, they could invest only $6.2 million now and be highly confident of having the $7 million they would need to retire at age 65, even in poor markets, as shown in the core capital line in the next Display. That would leave $2.8 million for their secondary goals.

Eric and Eleanor decided that the moderate allocation suited their risk tolerance and would best support their goals. If they end up getting deferred payments from the sale and their new venture is successful, they could make additional gifts in the years to come.

Business owners deserve a partner who will support them right from the start. For more thought leadership for entrepreneurs and business owners, check out the related blogs here.

The Bernstein Wealth Forecasting System uses a Monte Carlo model that simulates 10,000 plausible paths of return for each asset class and inflation and produces a probability distribution of outcomes. The model does not draw randomly from a set of historical returns to produce estimates for the future. Instead, the forecasts (1) are based on the building blocks of asset returns, such as inflation, yields, yield spreads, stock earnings, and price multiples; (2) incorporate the linkages that exist among the returns of various asset classes; (3) take into account current market conditions at the beginning of the analysis; and (4) factor in a reasonable degree of randomness and unpredictability.