Small business optimism fell for the second month in a row in April, according to the National Federation of Independent Businesses. And a majority reported having less than four weeks of cash flow on hand in early May.1 That’s no surprise. Despite CARES Act funding through the Paycheck Protection Program (PPP) or Economic Injury Disaster Loans (EIDL), liquidity remains elusive. Almost one-quarter of those who have taken out one or both loans anticipate that they will need additional support.2 Yet a ready pool of capital—namely, retirement plans—could be hiding in plain sight. Should entrepreneurs tap their IRAs or 401(k) plans to keep their businesses afloat?

Path of Least Resistance?

At first glance, business owners who go this route appear to control their own destinies. Consider PPP, which has seen slowing applications after the first two rounds. While many borrowers have already received their funds, others have reduced their enthusiasm amid changing regulatory guidance or difficulties complying with the loan forgiveness terms and conditions. And some estimate that up to half of small businesses didn’t even apply because they didn’t think they qualified.3

In contrast, eligibility for the coronavirus-related hardship withdrawal created by the CARES Act is more straightforward: IRA owners and employer-plan participants may withdraw up to $100,000—without an early withdrawal penalty or mandatory withholding—and repay the funds within three years.4 The sole requirement? That the business owner certify that the withdrawal is coronavirus related.5 Importantly, anyone can take a hardship withdrawal from an IRA, whereas 401k plan sponsors need to opt-in to these provisions and plan administrators can help set specific guidelines.

What Do You Have to Lose?

On the surface, tapping your nest egg seems to provide welcome relief. After all, several options exist—all at your fingertips. Besides taking a hardship withdrawal from an IRA, a business owner could access her 401(k) plan6 by taking out a loan or skipping a contribution. Why opt for a hardship withdrawal versus a loan? The hardship withdrawal provides flexibility in the event you cannot repay.

Each of these choices offers liquidity, but draining your own coffers comes at a price—the loss of growth on foregone contributions or on the withdrawals taken from the account. Let’s explore how these costs stack up over time.

What’s the Impact of Forgoing a 401(k) Contribution?

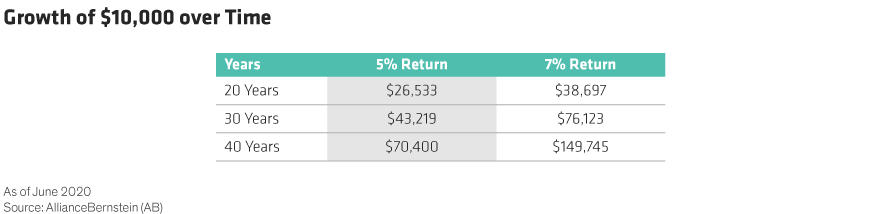

Assume an entrepreneur contributes $10,000 to her 401(k) each year, but this year, she needs the cash to sustain her tech businesses instead. What’s the impact of missing one year’s 401(k) contribution over a 20-, 30-, and 40-year period?

The future value of the $10,000 contribution will depend on how long it can grow and the return it would have earned otherwise (Display). For example, $10,000 contributed to a 401(k) today, growing by 5%, will have a future value of $43,219 in 30 years.

Digging into her own personal savings clearly generates a quick infusion of cash. But missing a single year’s contribution results in a material loss of growth over time—the higher the potential return, the bigger the hole. And that’s without capturing the lost tax deduction that a pretax contribution to a 401(k) would provide.

What’s the Long-Term Impact of Taking a Hardship Withdrawal from an IRA?

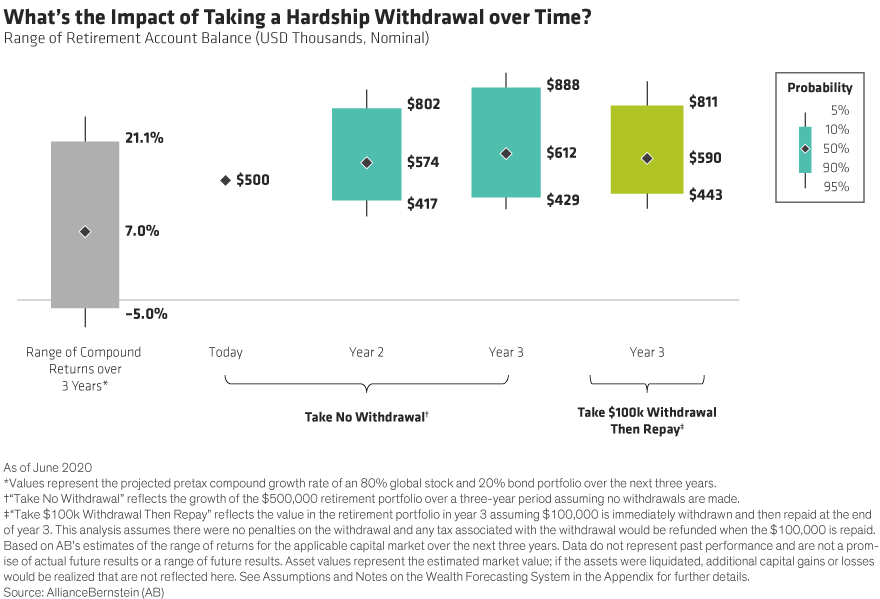

With his business struggling due to coronavirus, a restauranteur decides to take a $100,000 hardship withdrawal from his $500,000 IRA. We assume he will repay the $100,000 at the end of the third year whereupon the taxes he pays on the distribution will be refunded (given their offsetting nature, these transactions can be ignored). What is the loss on the growth of the $100,000 taken from the IRA over the three-year period?

As before, the impact generally depends on the returns of the account over the next three years. Using our Wealth Forecasting SystemSM, we project that over the next three years, the compound return of an 80% global stock and 20% bond portfolio could range from -5.0% (poor markets) to 7.0% (typical markets), to 21.1% (great markets). We also foresee a 77% chance that this allocation will deliver a positive return over the same period.

How does this impact his decision? In dollar terms, if we experience typical returns, the loss of growth on the $100,000 withdrawal after it has been repaid equates to about $22,000 over three years. While this may seem manageable, the loss continues to compound and results in nearly $100,000 less wealth after 25 years.

If returns over the next three years falter, taking $100,000 out now could seem like an easy win. But given the overwhelming odds of positive returns, our restauranteur will likely sacrifice long-term growth. The longer the time horizon, the greater the toll compounding will take. And if he can never repay the $100,000, he’d suffer an even bigger loss along with significant tax consequences.

Lender of Last Resort

It’s tempting to look at the CARES Act provision as an emergency exit, but most entrepreneurs would be better off viewing their retirement plans as lenders of last resort. When you’ve spent a lifetime building a successful business, it’s hard to watch it wither—especially given the exogenous nature of the shock. Small businesses also employ millions across the country and want to do their utmost to support their staff. But business owners who tap their own retirement plans should do so with eyes wide open. What may seem like a ready pool of capital may turn into a reminder of one of life’s fundamental lessons: there’s no free lunch.

1https://www.brookings.edu/blog/the-avenue/2020/05/29/how-the-paycheck-protection-program-is-coming-to-ground-in-the-nations-large-metro-areas/. Accessed June 1, 2020.

2https://www.nfib.com/content/analysis/coronavirus/nfib-survey-majority-of-small-business-have-received-ppp-loan-funding/. Accessed June 1, 2020.

3https://www.cnbc.com/2020/05/11/small-businesses-struggle-to-survive-despite-federal-loan-programs.html. Accessed June 1, 2020

4 Taxes owed on distributions can be spread over three years and refunded if the loan is repaid by the end of year three.

5 Here, the definition of “related“ seems fairly broad: either the participant, the participant’s spouse, or a dependent is diagnosed with the virus or the participant experiences adverse financial consequences due to quarantine, layoff, furlough, lack of childcare, reduced work hours, or closed business due to quarantine.

6 Under the CARES Act, the 401(k) loan limits have been increased to $100,000 or 100% of a participant’s vested plan balance, whichever is less.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.